Wear and Tear

Wear and Tear

The tires on your car will wear out. Your house will eventually need a new roof. Wear and tear is a common exclusion on insurance.

How does that apply to jewelry? It's crucial for insurers to recognize when jewelry damage is not the outcome of a sudden, unpredictable event, like fire or theft, but is the result of wear and tear over time.

Claim: Lost center stone

The insured suddenly realized the center diamond was missing from her ring. She had no idea when or how it happened. She figured a lost stone was a covered peril.

The insurer had the jewelry inspected by a gemologist. Magnification revealed that five of the six prongs meant to hold the stone in its setting had broken tips. The single remaining functional prong was not sufficient to hang onto the diamond.

The prongs, which look so sturdy in these magnified views, are actually quite delicate. They are just small wires bent over to hold the stone. It is not that uncommon for a prong tip to break, perhaps from putting hands in pockets, wearing gloves, or digging into a purse. If one or more prongs break, the gem could become loose in its setting, and movement of the loose gem could begin to stress the remaining prongs.

Jewelry features like prongs are too small to be seen by the unaided eye. For proper care, jewelers encourage their customers to come in for regular jewelry inspections. Something like a tune-up for your car. During a jewelry inspection, the jeweler might spot potential problems, such as a loose prong or faulty clasp, and correct them. Because such things are common wear and tear issues, a warrantee from the retailer may even require regular inspections. Often jewelers offer inspections as a free service to their customers.

In this case, regular inspections would have caught the problem early on and prevented the diamond from falling out. Instead, the gem was lost. The loss was not due to an unpredictable event, like a theft, but because the insured did not take appropriate care of her jewelry.

Claim: Damaged ring

Claim: Damaged ring

The ring was severely misshapen, a distorted oval rather than a circle. One wonders about the finger that was wearing the ring when it took on this shape!

The gemologist examining the ring for the insurance company had a good idea how the damage was caused. He said such an altered shape would come from squeezing something very hard. In fact, there was even a break in the platinum ring from the pressure.

He also found that the facet edges on almost all the side diamonds were abraded.This usually happens when a person wears a ring next to another ring with diamonds, because the diamonds rub against each other. In this case, he reported, the insured was most likely repeatedly lifting weights with this ring on. Squeezing a knurled weight bar would cause both the deformed shape and the diamond damage.

He also found that the facet edges on almost all the side diamonds were abraded.This usually happens when a person wears a ring next to another ring with diamonds, because the diamonds rub against each other. In this case, he reported, the insured was most likely repeatedly lifting weights with this ring on. Squeezing a knurled weight bar would cause both the deformed shape and the diamond damage.

This was a case of severe wear and tear. The jewelry had been repeatedly subjected to inappropriate stress in a situation that jewelry is not made to withstand. It was not damage for which the insurer was liable.

Claim: Chipped diamond

A lab examined the ring's center diamond, which was princess cut. The gemologist reported that the corners were indeed nicked. This is a common occurrence for this shape, since the gem's four corners are cut to have sharp points, which are very vulnerable to chipping. Some manufacturers chamfer the corners to make them less vulnerable to damage but that was not the case here.

Other diamond shapes also have vulnerable points. For any such shapes, unless the points are protected by the setting, they are likely to chip even under normal wear. That is, the chipping is a result of normal wear and tear, which is not a covered peril.

Other diamond shapes also have vulnerable points. For any such shapes, unless the points are protected by the setting, they are likely to chip even under normal wear. That is, the chipping is a result of normal wear and tear, which is not a covered peril.

Claim: Cracked emerald

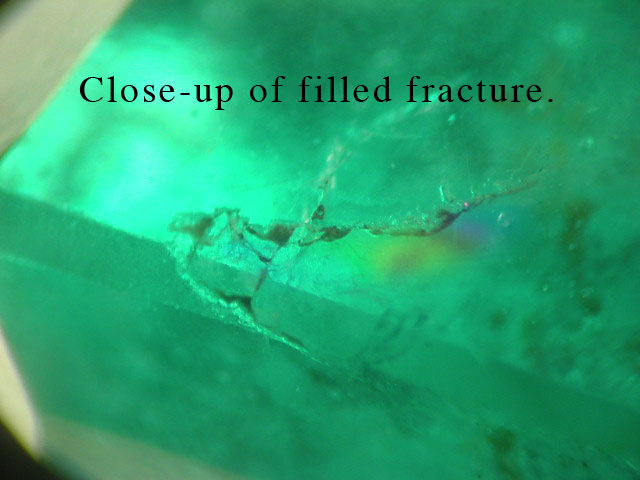

The insured brought in an emerald purchased some time earlier which now appeared to be damaged. Examination in a gem lab revealed that the emerald had been fractured to begin with, and the fractures had been filled with a foreign material to make the gem look better. After a while the fill material started breaking down and the fractures again became apparent.

Fracture-filling is a very common treatment, especially for emeralds, and it should always be disclosed by the seller and on the appraisal. Even under normal wear, the fill material can simply break down and the gem will look damaged because the original fractures reappear. Some insurers, aware that this treatment is not permanent, decline coverage for fracture-filled gems.

In this case, the insurer refused to pay the claim, and in turn sued the retailer, arguing that the policyholder should have been informed that the stone was filled with some foreign material and that such a treatment might not be permanent. Ultimately, the plaintiff won a quarter-million-dollar judgment and the retailer went bankrupt.

Proper jewelry care

As with any property, maintenance is important. Regular inspection of jewelry is similar in purpose to regular servicing of a vehicle. It's the insured's responsibility to know how to care for their property. For example, it's a good idea to remove jewelry when playing sports, working in the garden, using power tools, working on the car, or doing any activity where the jewelry could be bumped, chipped, broken or otherwise damaged.

It's the insurer's business responsibility to recognize when damage is not the result of a covered peril but is caused by wear and tear or inherent vice. A wise insurer will have contact with a reliable gemologist who can often help in making such determinations about jewelry.

Fracture filling, clarity enhancement, and Yehuda treatment are all terms for clarity treatments. Any of these terms on the appraisal or other documents signifies that the gem has fractures that have been filled with a non-gem material to make the gem more attractive.

Flaws in the gem become less visible but they are still present. If the fill material breaks down, the fractures once again become visible, but this change is not damage for which the insurer is liable.

Other qualities being equal, an "enhanced" stone is worth far less than an untreated gem.

Always have damaged jewelry examined by your own expert. Use a gem lab staffed by qualified gemologists who understand the kind of information insurers need. It should be a lab with which you have an ongoing relationship.

Normal wear and tear and inherent defects may look like "damage." Be sure the lab understands that the distinction is crucial for insurers.

The lab should report to you not only existing damage but also characteristics of the stone, gem treatments, or any other conditions that would have made the gem vulnerable to that damage. The lab's report should include photos of any damage, with notations.

If you cannot locate a suitable lab, you can also submit a gem to the GIA and ask for a damage assessment. The cost of using a lab should be regarded simply as part of the loss adjustment expense and will significantly improve loss ratios.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com