Jewelry appraisals — watches vs. jewels

Appraisals for watches are usually very detailed. We know manufacturers, style numbers, and serial numbers for the many parts that make up the whole.

Appraisals for rings, bracelets, necklaces, have much less information. Why is that? Why not give all the info?

A customer pays $10,000 for a watch and finds its every bell and whistle specified and accounted for. But for a $20,000 ring the description usually is much skimpier.

We’re not talking about truly bad appraisals, carelessly done. We’ve seen worthless appraisals that use idiosyncratic grading language, or don’t mention that there are side stones on the ring, or even fail to identify the stone. No, this is about the vast majority of reasonable appraisals that leave off identifying information that should be included.

What’s missing?

Jewelry appraisals often omit mentioning workmanship, though there can be huge valuation differences depending on whether jewelry is cast, stamped, machine made, etc. Consumers who are not up on these distinctions may not even know to ask.

Similarly important is the weight of the gold—which, according to one survey, is left off 70% of appraisals insurers receive. Though the consumer may not be thinking about it, jewelers and appraisers know that a karated solid gold tennis bracelet is worth more than one that is hollow, and karated solid gold jewelry is more durable, so that info should be recorded.

Even the setting of the gemstone is often skipped over, though an inappropriate setting can lead to future damage. The appraisal should also note if there are any problems, such as faulty prongs or an inappropriate setting style for the gem, which could result in damage to stone or even loss of a stone.

Cut — the most important of diamond’s 4 Cs, because it accounts for as much as 50% of the stone’s value — hardly ever appears in appraisals. Cut is often (deliberately?) confused with shape.

What’s required is a description of the diamond’s proportions. Diamonds are often poorly cut to retain carat weight but, all other things considered, a well cut stone is more attractive and has a higher value.

Jewelry appraisals rarely mention the manufacturer, even though the National Gold and Silver Marking Act requires that any jewelry marked as karat gold (e.g. 14K) or silver be also stamped with the manufacturer's trademark. The trademark itself may be just a symbol, but it identifies the maker and the maker should be named on the appraisal.

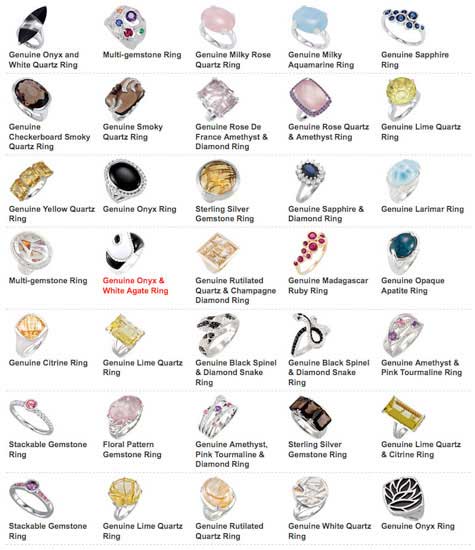

Consumers probably imagine their ring was specifically designed and crafted by a goldsmith at his workbench just behind that curtain at the back of the store. Actually, a large variety of ring blanks, semi-mounts and finished rings are available to retailers from manufacturers’ catalogues. The seller of the jeweler can simply give the name of the manufacturer on the appraisal.

For non-selling appraisers, it’s not so easy. There are a few websites with search functions for identifying jewelry makers by their trademarks, but the databases are far from complete. But with the rapid advances in AI technology, it should soon be possible to search for a jewelry maker by just supplying a clear photo of the trademark.

WHY are so many jewelry appraisals incomplete?

Do appraisers overlook things accidentally?

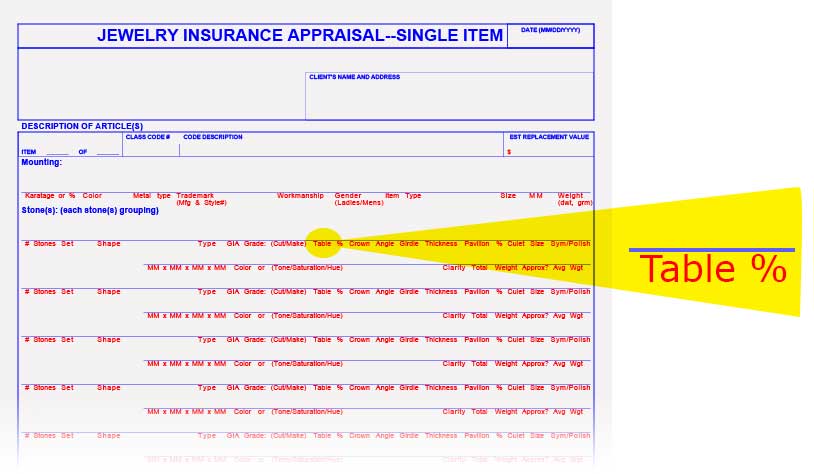

The insurance industry established standardized JISO appraisal forms to avoid such mishaps. These forms, which are available at no charge on the JISO site, prompt appraisers for information important for insuring jewelry and gems.

Gemological data and terminology can befuddle non-gemologists, especially when found in a narrative appraisal. JISO forms have labels for each detail, which helps insurers understand what’s being described and allows them to readily see if important details are missing.

Some appraisers include JISO forms in their appraisals. Others use the JISO 18 worksheet to gather necessary details, then incorporate that data into their own appraisal presentation; however, this approach loses the advantage of JISO’s standardized layout, with its identifying terms needed by non-gemologist readers (like underwriters).

Unfortunately, most appraisers resist making use of the JISO forms.

Do appraisers not know how to determine jewelry qualities?

Anyone can call themself a jewelry appraiser, but many people writing appraisals don’t have thorough gemological training or sufficient experience to gather the necessary information. Insurers often see appraisals with illegible signatures and no credentials listed, or bogus titles and credentials.

Do appraisers not have the necessary gem lab equipment?

A gem lab is not a room but rather an area with the equipment necessary to determine jewelry’s quality and valuation. Many jewelry retailers do not examine the merchandise they sell to verify its quality, but just take the word of the manufacturer or supplier. Some appraisers grade a diamond’s color using CZ stones rather than diamonds, which is proscribed by GIA and can result in inaccurate grading.

Does it take too much time to be thorough and precise?

It does take time, and expertise, to describe a sapphire’s color not just as blue but to give its saturation, tone and hue in proper gemological language, and to inspect for and report on any treatments.

It does take time to determine precise color grades and clarity grades. Insurers see appraisals with diamond clarity grades such as VS1-SI1. A difference of one, two or three grades can mean a serious difference in value. Such “flexible grading” is a disservice to the consumer and to the insurer.

Do appraisers deliberately conceal info?

Some do, yes. Retail jewelers writing appraisals on their merchandise (or appraisers dependent on retail jewelers) may leave off information to prevent customers from comparison shopping. This certainly accounts for the absence of manufacturer names and style names or numbers.

This secrecy encourages consumers’ impression that their jewelry is unique. It promotes the idea that replacement is difficult and, should a claim arise, the insurer would have to turn to the retailer for a suitable replacement (not true in reality).

Even appraisers independent of retailers may leave off information that they know will not please the customer or the referring seller. They may give a valuation that matches the “suggested retail price,” even if they know a realistic valuation would be much lower. They may not mention a gem treatment because it would lower the valuation of the jewelry.

Do appraisers think the customer doesn’t know enough to care?

Indeed, many jewelry purchasers do not understand how value is determined. They may not appreciate how one color grade, for example, can mean a huge price difference for diamond. They might not know what to make of terms like crown angle and pavilion depth, because they’re only shopping price. Nevertheless, it is a disservice to the customer (and the insurer) to leave off information or to approximate grades.

Do they think the insurer doesn’t care anyway?

Unfortunately, many insurers do not care. Due to underwriting economics, if they see a recent appraisal date and valuation, they may not look beyond that.

But if the grading is unreliable, if the valuation is inflated, they will be overcharging on premiums. And if a claim arises, an incomplete appraisal means the replacement will be based on partial info and guesswork.

Do appraisers not know what information insurers need and why?

If so, then let’s be clear: A jewelry appraisal for insurance should have sufficient information that an accurate replacement could be made from the description. Period.

FOR AGENTS & UNDERWRITERS

You will seldom encounter one-of-a-kind items. The vast majority of jewelry, while represented as unique, is not unique and does not depend on rarity for its value.

It is a disservice to the insured for insurers to accept appraisals with inadequate information and to base premiums on inflated valuations, knowing that in the event of a claim, the settlement will be based on the insurer’s cost to replace. And if information is incomplete, determining like kind and quality is difficult

The best appraisal includes the JISO 78/79 appraisal form and is written by a qualified gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

If a GG or FGA+ is not available, request JISO 805, Jewelry Sales Receipt for Insurance Purposes, which can be prepared by the selling jeweler, or JISO 806, Jewelry Document for Insurance Purposes, which can be completed by any appraiser.

FOR ADJUSTERS

You will seldom encounter one-of-a-kind items.

Check for manufacturer and style number, as this information will greatly facilitate pricing a replacement and will guarantee a like-kind replacement.

Never assume a lost piece cannot be duplicated or a damaged piece cannot be repaired, even if the jewelry looks complicated or the appraisal description is inadequate.

If information on the jewelry is incomplete, or details from different sources are conflicting, hire your own trusted appraiser to examine all available info and use their expertise to fill in any blanks. Ask that appraiser for a full description of the jewelry on JISO 18 form, as well as a valuation.

Then use the JISO 18 description to get replacement bids. As always, solicit bids based only on the jewelry’s description, not on its valuation! And get it in writing!

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com