When you need a jewelry appraisal, what do you do?

In an ideal world, you advise the insured to get an appraisal, and the insured goes to their local gemologist appraiser. The result is a reliable document that satisfies the needs of both the client and the insurer.

But. . . this is not an ideal world.

In the real world, qualified independent appraisers can be difficult to find. And a reliable appraisal is hard to come by.

What’s wrong with most jewelry appraisals?

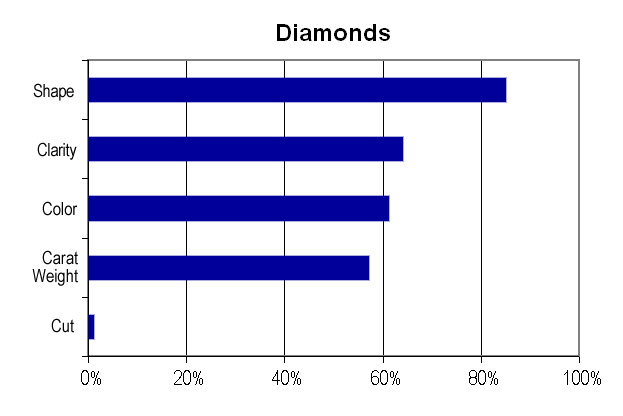

We’ve covered this many times, with many examples. Some important info may be missing (how about color and clarity treatments?); or grading is “flexible” (how about the made-up clarity grade “SI 3”—for Slightly Included 3—instead of the true grade I1, meaning inclusions are visible to the unaided eye); or valuations are grossly inflated (say, double the purchase price) to please the customer.

Some documents passed off as appraisals even overlook something so basic as carat weight. Some are mass produced for sale to retail jewelers, describing stones that have never been examined by a gemologist. Some have no appraiser named; or the signature is illegible; or there is no contact information for the appraising person or entity, as though the appraisal simply wrote itself.

Where are the reliable appraisers?

Appraisers today find that the public is unwilling to pay what their services are worth. Many turn to specializing in estate appraisals. Others try for government contracts appraising seized jewelry property. Still others may end up working for a jeweler, with the understanding that their descriptions and valuations match what the seller decides.

One prominent appraiser located in New York’s diamond district says it’s hard to make a living as an independent jewelry appraiser. He chooses to deal only with high-end clients and sends walk-in traffic to colleagues.

Still, finding an “appraiser” is not difficult, because literally anyone can call themself a jewelry appraiser. The words are available. There is no regulating body, no degree requirement to legally hang up that shingle.

The problem is that many people currently producing appraisals — or appraisal documents, or documents for insurance, jewelry descriptions, or any number of other such papers — have little or no gemological training. Though they may list bogus credentials, they probably have no understanding of how an appraisal for insurance is used, and they may even be lacking basic scruples. They will produce the kind of problematic appraisals and inflated valuations mentioned above.

The average consumer or insurer looking for a qualified and independent appraiser can have a tough time.

Qualified, in our estimation, means having a degree as a GG (Graduate Gemologist of the GIA) or FGA+ (Fellow of the Gemmological Association of Great Britain ) or similar qualifications. Additional training as a CIA (Certified Insurance Appraiser™) is a big plus.

Appraisers with a GG or FGA+ credential will usually have these letters after their name, but there is not, for example, an online list to consult for finding one in your area. Unfortunately, appraiser organizations are not eager to help insurers in this regard.

The best thing right now: JISO for every appraisal

If your client needs an appraisal:

If your client needs an appraisal:

Recommend they find a CIA or GG or FGA+ appraiser, and have the appraiser use the JISO 78/79 for the appraisal, or incorporate the JISO form into the appraiser’s usual presentation.

JCRS can facilitate finding a CIA in your vicinity, though many areas do not yet have an appraiser with this credential.

If no CIA or GG or FGA+ is available, print out JISO 806 and suggest the client have their appraiser fill it out. This form prompts the appraiser for all details of the jewelry, so no information is overlooked. While this does not guarantee there are no errors or misjudgments, it does mean that details cannot be accidentally overlooked.

JISO 805, Jewelry Sales Receipt for Insurance Purposes, to be filled out by the selling jeweler, is also a useful document. It specifies that the valuation is the actual price paid by the buyer in that store. Given the prevalence of inflated jewelry appraisals, this is an important feature.

Some insurers offer premium discounts when a JISO document is part of the appraisal, and this can motivate the insured to take this extra step. The reward for the insurer is getting as detailed an appraisal as possible, which is a definite plus for the policyholder in the event of a claim.

FOR AGENTS & UNDERWRITERS

Beware of appraisals supplied by the seller. These are basically sales tools that often have inflated valuations as well as exaggerated quality descriptions.

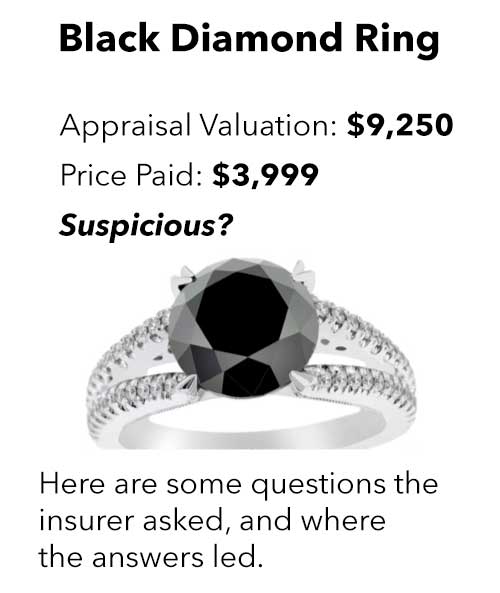

Because many appraisals have inflated valuations, which create moral hazard, always ask for the sales receipt.

All jewelry details on the appraisal, and details left off an appraisal, affect valuation. Without essential information on the appraisal, an adjuster would have to guess at the jewelry's quality. And the wrong guess could result in a very dissatisfied customer.

Organization and completeness are ongoing problems with appraisals. It’s best to follow insurance industry standards and include JISO 78/79/805/ or 806 form. The forms use a standard format, which assists the appraiser in presenting all necessary details. (Some appraisers include a JISO appraisal along with an appraisal in their preferred format.)

FOR ADJUSTERS

Use the appraisal's descriptive data, rather than its valuation, to price a replacement.

Jewelry retailers are known for raising prices in advance of a sale, so they can offer bogus discounts from their “regular selling price.” The purchase price is a truer indication of value.

Appraisals supplied by the seller are sales tools meant to impress the buyer. Their valuations may have little real-world basis. This is especially true with vacation jewelry, purchased on cruises and in popular tourist locations.

Be aware that if you are dealing with an unreliable or questionable appraisal, not only may the valuation be inflated but also the jewelry’s qualities.

If a JISO 78/79/805 or 806 is not available, use JISO 18 to analyze data from the documents you do have. This is especially helpful if you're faced with a "narrative" appraisal. JISO 18 allows you to order the information from other documents in a useful way and see what details may be missing.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com

If your client needs an appraisal:

If your client needs an appraisal: If no CIA or GG or FGA+ is available, print out JISO 806 and suggest the client have their appraiser fill it out. This form prompts the appraiser for all details of the jewelry, so no information is overlooked. While this does not guarantee there are no errors or misjudgments, it does mean that details cannot be accidentally overlooked.