What to look for – on the jewelry appraisal, on the cert, and on other documents

Valuation isn't the only important thing for insuring jewelry.

This is a brief overview & reminder of what insurers should look for, with links to more extensive discussions of the topics.

THE APPRAISAL

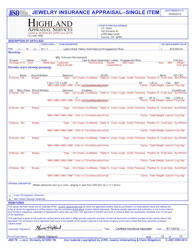

Detailed Description Unlike other property claims, where the item is usually damaged, most jewelry losses are total. When a claim is made, there's nothing to inspect. Without a detailed description, the adjuster is at the jeweler's mercy, and even the most honest jeweler will have to rely on guesswork. Some appraisers include JISO 78/79 as part of their appraisals. The standardized JISO forms are extremely helpful because they prompt the appraiser for all necessary information. (A study of non-JISO appraisals submitted to 21 insurance companies found that only 1% of the appraisals had listed even all 4 Cs of diamonds!) Keys to required info are in red below the data. Although an underwriter may not understand the values or terminology, he can see whether the appropriate blanks are filled in. If a claim is made, the adjuster can give very precise details when pricing a replacement, and the policyholder is assured of a replacement of like kind and quality. |

|

Date A date on the appraisal is important, since jewelry can rise or fall in value over time. Particularly with expensive jewelry, the valuation should be updated every few years so premiums are appropriate. (Some insurers can independently verify gem values, making appraisal updates unnecessary.) |

|

Client's name Check to be sure the appraisal was prepared for your client. If the appraisal came with the purchase of the jewelry, especially second-hand jewelry, the buyer (and insurer) cannot know whether the appraisal in hand was written for the jewelry in question. The buyer should get a new appraisal. An appraisal with no client named suggests a boiler-plate document created without an appraiser ever having inspected the jewelry. It is not uncommon for sellers to order a number of identical documents for a type of jewelry they sell, often with inflated valuations. |

|

Appraiser's Credentials Literally anyone can legally call himself an appraiser. A trained and qualified jewelry appraiser is proud of his credentials and usually appends the appropriate abbreviations to his name. An appraiser with no credentials listed is likely to lack professional training, and the appraisal may not be reliable. |

Best appraiser credentials: GG (Graduate Gemologist of the Gemological Institute of America) |

THE LAB REPORT

Which Lab? All diamond grading labs are not equal. Some are notoriously unreliable in grading, some produce reports that include inflated valuations, and some labs are completely bogus (a name on the paper, but no physical address, no phone number, no website). Unless a lab is recognized as reliable, you cannot trust anything the lab report says. |

The major trustworthy labs: You can follow these links to verify lab reports you receive. |

OTHER DOCS TO ASK FOR

Photos Pictures of the jewelry are invaluable if a replacement is ever needed. The agent can take clear jewelry photos with most modern smart phones and can submit the photos to the insurer in jpg format. It's best to have photos as jpg files, because much information is lost if photos are printed on the appraisal (and much more is lost if the appraisal is then copied for the insurer). |

Agent or insured can supply pictures of jewelry for the insurer. |

Sales receipt In the face of "buy now" sales, bogus "discounts," and rampant inflated valuations on appraisals and reports, seeing the sales receipt can bring things down to earth. Valuation should reflect market value, and the selling price is the best evidence of what the jewelry actually sells for in the marketplace. |

True valuation usually does not exceed the "sale price." |

Watch warrantee Watches are the most common counterfeit merchandise seized by U.S. customs officials. For any expensive name-brand watch, be sure to keep on file all documents that testify to the watch's value and authenticity, including the sales receipt and any guarantees and warrantees from the manufacturer. |

10:1 Annual production of fake Rolexes to authentic Rolexes. |

FOR AGENTS & UNDERWRITERS

This page is just an OVERVIEW of some essentials. Please follow links in each section for more detailed discussions.

A JCRS survey revealed that 78% of jewelry appraisals submitted to insurers are written by jewelers with NO gemological training. For high-priced jewelry, be sure you have an appraisal from a GG or FGA+, preferably one who is also a Certified Insurance Appraiser™.

Appraisals and lab reports supplied by the seller are sales tools, and they often exaggerate the quality of the jewelry and carry inflated valuations. If you suspect an inflated valuation, recommend getting an additional appraisal from an independent appraiser with the credentials listed above, and a gem report from one of the labs listed above.

Remind clients that an inflated valuation does not change the actual value of the jewelry, and it may result in higher premiums than necessary.

Any luxury watch from an unauthorized source should be thoroughly inspected to be sure that all its parts are genuine. This requires opening the watch case and examining the entire watch in detail. The inspection should be done by an authorized dealer in that brand or a Certified Master Watchmaker for the 21st Century. You don't want to have to replace a knockoff with a genuine item down the line.

FOR ADJUSTERS

Your job is easier if you are dealing with a JISO 78/79 Jewelry Appraisal, or JISO 806 Jewelry Document for Insurance Purposes, or JISO 805 Sales Receipt. They all prompt the appraiser for complete information in a standardized format.

If one of the above is not available, use JISO 18 to analyze data from the documents you have. This is especially helpful if you're faced with a "narrative" (paragraph style) appraisal. JISO 18 allows you to order the information from other documents in a useful way and see what details may be missing.

When pricing a replacement, use descriptive data from the appraisal and lab report, rather than the jewelry's valuation.

Do not blindly accept the bid of the selling jeweler. Get competitive bids, or rely on your own jewelry expert to estimate cost of repair or replacement.

Keep in mind that often appraisals supplied by the seller are sales tools meant to impress the buyer. Their valuations may have little real-world basis. If the appraisal shows a valuation considerably higher than the sales receipt, suspect an inflated valuation.

For damaged brand-name watches, be sure to have the piece examined by an authorized dealer of that brand, or a Certified Master Watchmaker for the 21st Century, to ensure all parts are authentic.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com