A new switcheroo

Jewelry insurance fraud through substitution comes in many varieties: a high-quality gem may be swapped out for one of lower quality, an imitation diamond might be passed off as genuine, the lab report submitted may describe a diamond other than the one being insured.

Jewelry insurance fraud through substitution comes in many varieties: a high-quality gem may be swapped out for one of lower quality, an imitation diamond might be passed off as genuine, the lab report submitted may describe a diamond other than the one being insured.

One insurer recently confronted a new variation of substitution. It involved ordering replacements.

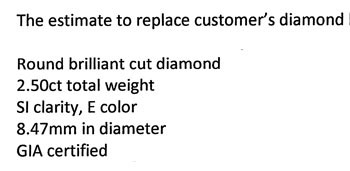

A ring lost its mined diamond. The insured wanted her original jeweler to do the replacement, and the insurer agreed to consider the jeweler's estimate. The jeweler sent an estimate that specified the qualities of the proposed replacement.

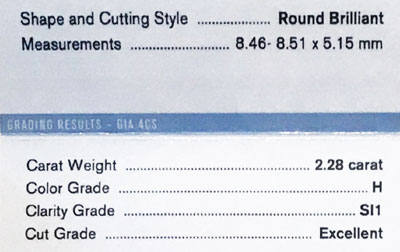

Using the GIA report on file for the lost diamond, the insurer compared the description of the original diamond with the replacement's description.

Is the proposed replacement of like kind and quality?

It is not! The jeweler is proposing a gem of higher quality than the original!

Lost Proposed

diamond replacement

Carat weight 2.28 2.50

Color grade H E

Clarity grade SI1 SI

Carat weight

The replacement is significantly larger than the original. A bump-up from 2.28 carats to 2.50 carats means a serious increase in valuation.

A little background on how the pricing of mined diamonds works: Diamonds are priced per carat, but it's not a matter of simple multiplication. That is, a 5-carat diamond is not simply 5 times the price of a 1-carat diamond of similar quality. The per-carat price is stepped up at intervals as size increases. Because it is more difficult to find larger diamonds than smaller ones, larger diamonds are worth considerably more.

In the case of this replacement, diamonds from 2.0 to 2.49 carats have the same price/carat, but a 2.5 carat diamond is a step up in price/carat. So not only is the proposed replacement bigger than the original, it also comes at a higher per-carat price.

In the case of this replacement, diamonds from 2.0 to 2.49 carats have the same price/carat, but a 2.5 carat diamond is a step up in price/carat. So not only is the proposed replacement bigger than the original, it also comes at a higher per-carat price.

Most insurers may not be aware of this, but a jeweler certainly is!

Color

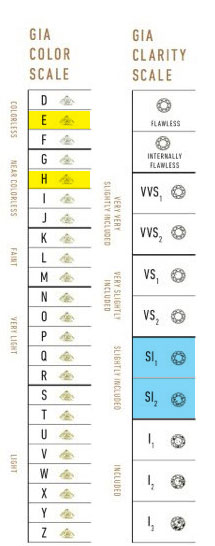

The color for the proposed replacement is three grades higher than for the lost diamond, as shown in the GIA color grading scale. An E color grade is almost the highest grade for a colorless diamond, whereas the lost diamond's H grade indicates that some color was perceptible under magnification.

So the proposedvreplacement is of a higher value than the original in color as well as in size.

Clarity

The clarity grade of the lost diamond is SI1; the replacement's grade is SI. GIA's clarity scale does not have a grade that is simply "SI", so we don't know whether the replacement proposed is SI1 or SI2.

Like color and carat weight, clarity also affects valuation, so the ambiguous grade is not acceptable.

Was this a deliberate attempt at fraud?

Did the jeweler hope the insurer would not notice the discrepancies and simply pay for the better stone? That could have happened, because many insurers might not bother to check the details, or might not realize how important the details are to valuation.

Another trickiness here is that the jeweler's price for the replacement diamond was just slightly under the valuation given on that jeweler's appraisal from several years earlier. However, that earlier appraisal was not for the lost diamond but for a two-ring set that included the lost diamond. The jeweler may have expected the insurer would just compare the valuations and say OK.

Why didn't the jeweler simply supply a replacement of like kind and quality?

Perhaps such a gem wasn't available? Nope, that's not the case. While waiting for the jeweler's estimate, the insurer was able to locate a diamond that was a perfect match in color and clarity grade, and just a couple of points higher in carat weight. (It was also of better cut proportions, though that discussion is beyond the scope of this article.)

By offering a stone of higher value the jeweler would, of course, be getting a higher payment from the insurer. In addition, the jeweler could brag to the customer about getting a real deal for her, a bigger and better diamond than she had before. And insurance paid for it!

So both jeweler and insured would benefit. But what about the insurer?

A replacement of the same quality as the lost diamond would cost the insurer less. If an insurer did, through inattention or ignorance, accept the bumped-up gem and pay the higher price, that insurer would be cheated.

Insurers are required to replace a lost item with like kind and quality. An insured should be made whole, not profit from a claim. Supplying a replacement of greater value may constitute fraud on the part of the jeweler and the insured.

FOR AGENTS & UNDERWRITERS

A loss always highlights the importance of having reliable appraisals and lab reports.

Read the docs is always good advice. In the case of replacements, also compare the docs to be sure the replacement matches the original in quality.

The growing popularity of lab-made diamonds, which are so much lower in market price, has also put the price of mined diamonds in flux. It is important to keep valuations up to date, so premiums are appropriate and values reflect the current market if a claim is made.

For diamond grading reports we recommend the following labs, and you can use these links to verify reports you receive.

GIA Report Check

AGS Report Verification

GCAL Certificate Search

FOR ADJUSTERS

The vast majority of jewelry is not unique and irreplaceable. This applies to both gems and mountings. These days, online research can give you an idea of current gem pricing.

Since settlements are based on value at time of loss, a replacement's valuation won't necessarily match the original price or the insured valuation. This is especially true in today's market, as the low prices of lab-made diamonds continue to disrupt the pricing of mined diamonds as well.

In seeking replacements, use competitive bidding to get the best price available.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com