When it comes to damaged jewelry,

Never Assume!

Never assume it’s a total loss. Never assume it can’t be repaired. Never assume the insurer is liable. Don’t even assume there’s actually damage! Whenever a policyholder makes a claim on damaged jewelry, it’s always worth some investigation. Here’s an unusual case to prove that rule.

A Mysteriously Chipped Diamond

The SSEF Swiss Gemological Institute received a pendant with a yellow diamond that had a small chip on the crown. Not unusual so far. Although diamonds are the hardest known mineral, and therefore not susceptible to scratches (they can be scratched only by another diamond), they are not especially tough. Their toughness rating is merely "fair-good," meaning they can chip, crack or break under impact, as when knocked or dropped.

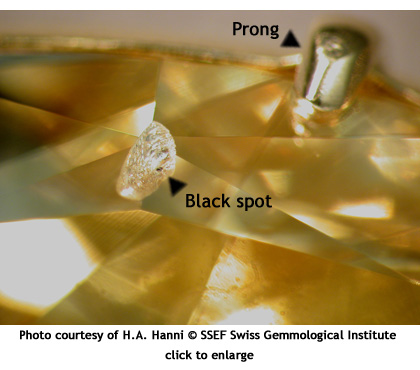

Diamonds do chip. This chip, however, had the odd appearance of a stepped crater. At the bottom of the chip’s depression was a black spot. Since the gem’s grading report did not mention the quite noticeable spot as an inclusion, the spot must have appeared after the stone was graded. Chemical analysis revealed that the black spot was graphite. Graphite is chemically identical to diamond, but it has a different crystalline structure, resulting in its different properties — black rather than clear, soft rather than hard.

As gemologists puzzled over the stone, they noticed that one of the prongs showed evidence of having been recently repaired by laser soldering. A pinpoint source of intense heat, as from a laser, would account for both the distinctive crater-like shape of the chip and the surprising transformation from diamond to graphite at the bottom of the depression.

The lab concluded that the chip was caused by an accidental shot from the laser soldering gun when the pendant was being repaired.

Any Damaged Gem or Jewelry

The above story illustrates the Sherlockian talents of trained gemologists! Taking advantage of those talents can save you money.

For damage claims on all items of substantial value, have the damaged jewelry examined by a graduate gemologist, preferably a Certified Insurance Appraiser™, in a gem lab. This is useful because:

- Damage may be due to inherent vice, for which the insurer is not liable.

- What appears to be damage may actually be a pre-existing flaw in the gem.

- Damage may be due to a treatment that weakened the stone, such as fracture-filling.

- "Damage" may just be an apparent change because the stone underwent a treatment that was temporary. Often such treatments are not disclosed on the appraisal, as they should be.

- Damage may have resulted from poor workmanship or from accident or carelessness during cleaning or repair of the jewelry.

- An independent jeweler/gemologist may find that the jewelry can be repaired. (The selling jeweler is more likely to recommend replacement, a much more costly option.)

- The gemologist can describe the jewelry’s qualities and give a valuation on JISO 18, Jewelry Appraisal and Claim Evaluation form. You can then compare this information with data in the appraisal on file before settling the claim. After all, the carrier is responsible for repair or replacement of the actual stone, not the stone described on an exaggerated appraisal with an inflated valuation.

- If you decide to replace the stone, you can use the gemologist’s JISO 18 description to price the replacement.

Our records show that all too often insurers overpay damage claims by thousands of dollars. Frequently, they automatically pay the full limit of liability, without consulting a disinterested gemologist to help determine whether it is necessary to do so. The potential savings are well worth the comparatively small gem lab inspection fee.

FOR AGENTS AND UNDERWRITERS

For jewelry of valued at more that $1,000, recommend that policyholders submit JISO 78/79 appraisals, written by Certified Insurance Appraisers™. The description is guaranteed to be accurate because it is based on a gem lab inspection by a trained gemologist who takes full responsibility for his work.

The JISO appraisal also guards against inflated valuations, since the valuation is based on what the jewelry sells for at that jeweler/ appraiser's store.

As an alternative for items of lesser value, when insurers would not require an appraisal, we recommend the JISO 806, Jewelry Document for Insurance Purposes, preferably completed by a Graduate Gemologist. With descriptive content the same as in JISO 78/79, it is intended to be used by jewelers who do not meet the higher education and training requirements set forth in the JISO 78/79 appraisal standards.

FOR ADJUSTERS

With any damaged item that could lead to a claim payment exceeding $1,000, it is best to have the piece examined by a professional gemologist in a gem lab.

For a lab inspection, give the entire item to the lab. Do not tell the lab any details about the policyholder or give out any documents on file, or discuss how the damage occurred. Ask for a complete description of the gem on a JISO 18 form. Ask the lab to estimate the cost of repair, to help you determine whether to repair the item or replace it. Do not commit to hiring this lab to do the repair.

Also ask for an estimate of the salvage value of the damaged stone. Then get competitive bids on the salvage.

You can use information from the lab's JISO 18 report to determine the accuracy of the appraisal on file.

If the cost of repair is so high that you choose to replace the item, use the information on the JISO 18 form to price a replacement. Shop around for the lowest bid.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com