Moral Hazard, Documents

and the Bottom Line

Say a submission arrives with two appraisals. Or with an appraisal and a lab report. Or an appraisal and a sales receipt. Two or more docs can help verify the jewelry's quality and valuation, and one document may fill in details that the other is missing.

Say a submission arrives with two appraisals. Or with an appraisal and a lab report. Or an appraisal and a sales receipt. Two or more docs can help verify the jewelry's quality and valuation, and one document may fill in details that the other is missing.

It's also possible that information on one doc may contradict or undermine what is on another doc—and that's also useful.

To take advantage of having multiple documents, it's important to closely examine them. Here's how a careful look saved one insurer from a costly error.

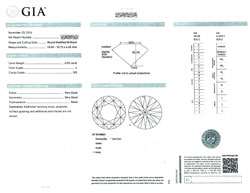

Coverage was requested for a ring set consisting of a lady's diamond engagement ring with a wedding band of channel-set diamonds soldered to each side. The submission arrived with 2 appraisals, a GIA lab report, an "appraisal report," and 3 sales receipts. The insurer checked them all. [Note: Identifying information on the submission has been blocked out for privacy.]

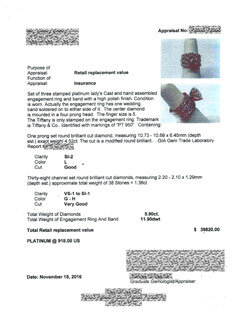

Two appraisals for the ring set

One appraisal valued the ring set at $39,820. The other, from a different appraiser, valued it at $56,150.

Big valuation difference — 41% !

The appraisals were written only 3 weeks apart, and the later appraisal had the higher valuation.

Was the insured unhappy with the earlier valuation? Did he decide to try for a higher figure?

Both appraisals mentioned a Tiffany & Co. logo on the ring. But the Tiffany logo was only on the engagement ring.

If the attached wedding bands with their channel-set diamonds had been by Tiffany, they also would have carried the Tiffany logo.

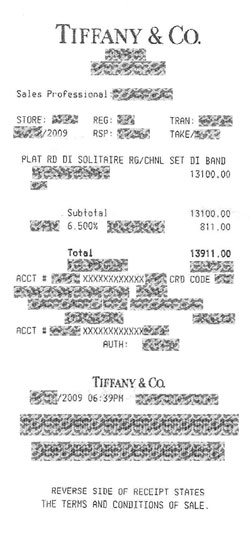

Receipt and record of original engagement ring

Tiffany records showed that the insured had indeed bought from Tiffany, some years earlier, a platinum ring containing a 1.3 carat round brilliant diamond of I color and VS1 clarity.

This description does not match the stone in the ring at issue here. Neither of the two appraisals mentions a Tiffany inscription on the diamond.

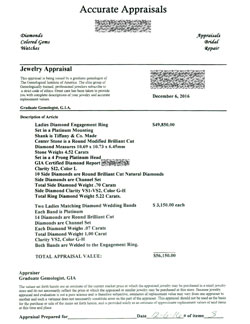

Sales receipt and appraisal for the wedding bands

The sales receipt, from the online retailer Blue Nile, showed that the insured had purchased the two bands with channel-set diamonds for $1350 each. The appraisal, also from Blue Nile, valued each band at $2,200.

Even though this Internet seller works on lower margins than a brick-and-mortar store would, this is a generous valuation.

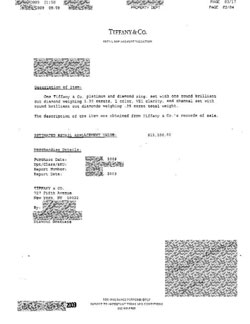

Receipt for a loose diamond

This sales receipt shows the purchase of a loose diamond for $36,000 plus a diamond traded in. Neither diamond is described as to size or quality.

It appears that the client traded in the original 1.3 carat diamond from Tiffany for a larger one, presumably the 4.52-carat diamond described on the appraisals. The insurer assumes that the retailer mounted the new diamond into the ring and adjusted the setting to accommodate the larger stone.

The receipt also showed that the client, a resident of the lower 48, had purchased the loose diamond in Alaska, from Blue Diamond [not related to Blue Nile, where the side rings were purchased].

Blue Diamond has outlets in tourist areas in Alaska and Puerto Rico, at ports where cruise lines make regular stopovers for shopping. As we've detailed in our earlier article on cruise jewelry, stores in such heavily trafficked tourist sites are likely to exaggerate quality and inflate prices, knowing that their customers will soon leave port. In fact, vacation jewelry bought in any tourist area is likely to be overpriced. The seller knows that dissatisfied customers have little recourse once they return home.

The evidence indicates:

The insured had a Tiffany engagement ring from an earlier purchase. Tiffany round brilliant diamonds are cut to ideal proportions. That 1.3 carat Tiffany diamond, of I color and VS1 clarity, would have had a value of about $10,000.

As described on the GIA report, the 4.52 carat replacement stone from Blue Diamond was three grades lower in color and three grades lower in clarity than the original.

In addition, the replacement diamond was not an ideal cut round brilliant (like Tiffany's) but a modified round brilliant. The GIA report diagram suggests a branded diamond, though no brand name is given. Modified round brilliants generally sell for 20% less than well cut round brilliants, because changing the angles of the facets and their proportions affects the play of light and makes the stone less attractive.

So, what's wrong with the submission?

- Appraisals from Blue Nile for the wedding bands were inflated by about 30%.

- For the new center stone the client had paid $36,000 plus the Tiffany round brilliant, with its value of about $7,000, coming to $43,000.The insurer determined, through its ITV (insurance to value) underwriting software, that the price of the center stone was inflated. The insured probably could have gotten this ring set for $25,000 to $30,000.

- There were two appraisals, with very different valuations: $39,820 v. $56,150. The lower valuation was close to a reasonable one, but the insured wanted coverage based on the higher valuation.

Underwriters have a responsibility to reduce moral hazard. If the higher valuation were used, it's possible that in the future the insured would discover that he bought an inferior diamond and would have a convenient "loss."

Since the insured wanted coverage based on the inflated valuation, the application was declined.

FOR AGENTS & UNDERWRITERS

The level of documentation in this submission made it easy to determine cut quality and value.

Always ask for the sales receipt. If there is a great discrepancy between the purchase price and the appraised valuation, the purchase price is usually a more realistic indication of retail market value.

The sales receipt also gives information about the seller—which, in this case, turned out to be a popular shopping port for tourist cruises. Be cautious about insuring cruise jewelry, or any jewelry bought on holiday, as vacationers caught up in the adventure of travel can make expensive purchases on impulse, without proper knowledge and without comparison shopping.

Don't be thrown off your guard by brand names. In this case, the jewelry was so adulterated that the Tiffany logo meant little. Also, fake brand-name merchandise is rampant at tourist sites—and on internet sites!

Large retailers often supply with the purchase a boilerplate "appraisal" document that carries an inflated valuation, well in excess of the purchase price. The quality description on such a doc is also likely to be exaggerated, and it may fail to include crucial information, such as cut geometry (one of the 4Cs), color treatments and clarity treatments.

The best appraisals include the JISO 78/79 appraisal form, and are written by a qualified gemologist (GG, FGA+, or equivalent) who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

For jewelry of substantial size and value, ask for a gem report from a reliable lab.

These are the major trustworthy labs, and you can use these links to verify gem reports you receive.

GIA Report Check

AGS Report Verifcation

GCAL Certificate Search

AGL

Gübelin Report Verification

New technology by Sarine is making its way to major labs and the better-equipped retailers and appraisers. The new machines can do color grading, plot the geometry of a stone, measure its light performance, locate inclusions, and the like.

FOR ADJUSTERS

Compare the appraised value with the sales slip. Jewelers are required to hold sales receipts for at least three years, so if the insured doesn't have the receipt, they can contact the jeweler/seller.

If there is a large discrepancy between valuation and selling price, the selling price is likely to be a truer indication of value. When in doubt, adjusters should get a second opinion from their in-house jewelry insurance expert.

Always have damaged jewelry examined by a qualified gemologist (GG, FGA+, or equivalent, preferably one who has additional insurance appraisal training) to verify the quality of the jewelry. This cannot be stressed enough! Just as most auto insurance companies have DRP appraisers for auto claims, insurers should consider using the same kind of procedure by getting their own expert for jewelry claims.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com