Protect Your Homeowners Market–

Keep Jewelry OFF HO Policies!

Perhaps you’ve been including scheduled jewelry on the homeowners policy as a convenient way of providing coverage. But there are good reasons NOT TO—reasons that impact both agents and their clients.

Insurance losses related to jewelry are huge — much more than most insurers realize. According to Department of Justice statistics, 70% of all personal property (contents) theft losses are jewelry.

Insurance companies process billions of dollars in jewelry losses each year. Some of these jewelry losses are hidden, because they’re reported as “contents” losses under a homeowners policy, rather than as jewelry.

So what? Jewelry claims usually fall below the radar of concern, for both insurers and agents, because the cost of the settlement is comparatively small. But . . .

If jewelry is on HO, the IMPACT of a jewelry claim is serious!

- Jewelry loss counts as HO loss.

- 70% of all personal property theft losses are jewelry.

- Jewelry losses hit CLUE and PILR reports.

- Client loses homeowner’s “claim free” rating.

- HO policy is difficult to remarket after a loss.

- “Mysterious disappearance” claims, in particular, are red flags.

Other disadvantages

- HO policies have capacity limitations.

- Many HO carriers will not cover higher-value jewelry.

- HO policies will not list non-family members with “insurable interest.”

Unlike most house contents covered in a homeowners policy, jewelry is small, valuable and very vulnerable. Jewelry is not only stored in the home, it also travels. It’s put on and usually forgotten as we go about our business, taken off and left on dresser or sink, regularly exposed to damage and loss. At home or out on the town, jewelry is a magnet for theft, and it’s particularly prone to “mysterious disappearance.”

Homeowner policies with losses are much harder to place with another carrier. Many agents already face shrinking sources and rising rates for HO policies, as insurers seek to protect themselves from disasters such as hurricanes, tornadoes, forest fires, earthquakes, hail storms and ice storms.

Prior losses make placing a homeowner policy all the more difficult. “Mysterious disappearance” claims in particular can kill remarketing the HO policy. These unexplained losses are major red flags.

In addition, homeowner carriers usually have restrictions and capacity limitations for jewelry. Many carriers are not willing to write higher-value jewelry. It can be difficult to find a policy that adequately covers jewelry and also offers the client a competitive price.

A stand-alone jewelry policy (personal articles floater—PAF) addresses the jewelry need without impacting the homeowners policy. You can offer your client the best HO policy at the best price, then offer a standalone policy for jewelry—either from the same carrier or though a company specializing in personal jewelry coverage.

Standalone policy is better for the INSURED:

- Larger schedules

- Higher item values—expensive jewelry not excluded.

- Significant premium discounts (alarm, safe, appraisals, etc.)

- Jewelry claims do not impact homeowner coverage.

Standalone policy is better for the AGENT:

- Emotional importance of jewelry for client means you have an extra opportunity to impress client with your care and expertise.

- Cross-selling opportunities

Jewelry can be the toe-in-the-door for other coverage. It can be the cornerstone of all your business with the client, both personal and commercial. - You retain control of account and enhance client’s reliance on you.

|

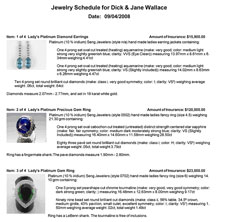

Illustrated jewelry schedule |

Far from being more costly, this solution generally means savings to the client. Standalone jewelry policies are quite competitive in price, and often they are the least expensive choice. Some insurers offer premium discounts not available on homeowner coverage. In the event of a jewelry loss, the homeowner policy—and the client’s claim-free status—are not affected.

While jewelry is usually a low-premium item, it has great emotional value to the client. Jewelry can be the cornerstone to all your business with that client, both personal and commercial. Rather than simply referring a client to a direct jewelry insurer, it is better to seek an agency appointment and place coverage yourself. That way you retain control of the account, earn a commission, and also enhance the client’s trust and reliance on you.

A word of caution:

Not all standalone jewelry policies offer a cash settlement option. This could have devastating consequences for the agent, even if the agent had only recommended the insurer. Not informing the client that a carrier offers only repair-or-replace settlements (no cash) could leave the agent open to an errors and omissions (E&O) problem. Even short of such an extreme consequence, a client who is dissatisfied at claim time can retaliate by taking all his business elsewhere.

Be sure the standalone policy you offer includes an option for cash settlement.

FOR AGENTS & UNDERWRITERS

Insure scheduled jewelry under a standalone policy, rather than including it in the homeowners policy. This is especially important for larger schedules, which may exceed HO capacity or per-item limits.

Point out to your clients the advantages of the separate policy:

- broader coverage at lower cost

- higher item and schedule values

- jewelry claim will not affect HO rates and availability

Being aware of the emotional importance people attach to their jewelry, emphasize how the standalone PAF offers extra protection. Use jewelry to increase your connection with the client.

Be sure the jewelry policy includes a cash settlement option.

FOR ADJUSTERS

A standalone jewelry policy benefits the adjuster because the separate application usually requires more information specific to the jewelry, as well as better documentation.

Be sure to ask the underwriter for appraisals, sales receipts, gem reports, photographs, and any other information on file.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com