What's up with diamonds? Prices!

If you google "diamond" these days, the search engine is likely to help you along by showing questions users are typically asking:

• Are diamonds worth more now than 10 years ago?

• Are diamonds increasing in price?

• Do diamonds hold their value over time?

Insurers, too, should consider these questions.

About 25% of rough diamond is suitable for jewelry. The rest is for industrial use.

About 25% of rough diamond is suitable for jewelry. The rest is for industrial use. Right now, diamond prices are indeed going up.

Market prices of gems and metals, and thus jewelry valuations, are determined by many disparate factors, such as world politics, weather, and supply chain interruptions. The current picture for diamonds is partly due to a health crisis—the pandemic.

With a spike in Covid-19 cases, India, where 90% of the world's diamonds are cut and polished, imposed severe quarantine restrictions. This caused a 30-50% drop in factory utilization, an outflow of migrant workers, and a decrease in the volume of diamond cutting and polishing operations. Jewelry manufacturers and retailers now face higher prices due to a limited supply of finished diamond.

Meanwhile, Australia's Argyle mine has closed, and other mines have decreased or suspended activity, so diamond rough is also in shorter supply and prices have gone up. The price escalation is most extreme for larger diamonds, since large diamond deposits are increasingly rare.

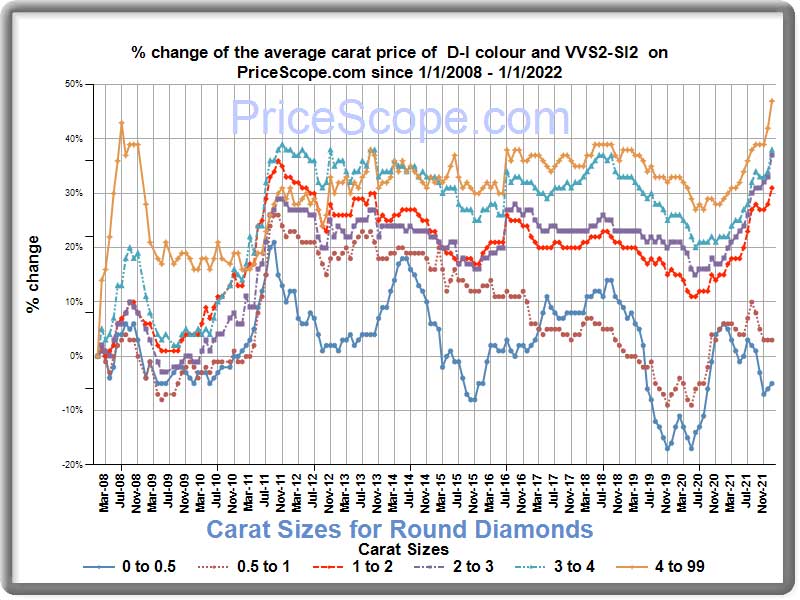

As the graph indicates, the recent price rise has been steep, and it's likely to continue for a while. But there's no guarantee!

Contrary to what many consumers would like to believe, the value of diamond does not inevitably increase. The graph shows some historic ups and downs. And other forces can come into play to dramatically alter pricing.

As we discussed in Lab-grown diamonds are coming your way, the tables may soon be turned. Lab-made diamonds sell for less that mined diamonds, and mined diamond prices may wind up dipping considerably just to be competitive.

Only 1% of all polished diamonds traded annually in the world is larger than 0.30 carat.

Only 1% of all polished diamonds traded annually in the world is larger than 0.30 carat.What does all this mean for insurers?

Be sure jewelry valuations are up to date!

First, pay attention to the date of the appraisal. An appraisal may have acceptable descriptive information, but if it's years-old, the valuation may no longer be accurate. Gem and metal prices can rise or fall, jewelry styles can go in or out of fashion, and other conditions may affect jewelry pricing. So you want the valuation to be current.

Then, "keep" valuations up to date, to keep premiums appropriate and to reflect the current market if a claim is made. Some insurers determine insurance-to-value annually for their clients. If this is not possible, suggest the client get a current valuation from an appraiser at regular intervals.

Be careful, as some jewelers change the date on the appraisal but do not re-value the jewelry, retaining the prior valuation. This is done so that the insured can get a jewelry policy with lower premiums. Just as with Homeowners policy, it's important not to under-insure.

FOR AGENTS & UNDERWRITERS

The value of jewelry is subject to many variables, so valuations can change over time. An up-to-date appraisal valuation is crucial.

The best appraisal includes the JISO 78/79 appraisal form and is written by a qualified gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

A number of retailers have started supplying their own appraisals and lab reports. Needless to say, such docs will mimic the claims of the retailer, and they also may omit or spin information that would negatively affect valuation. Request an appraisal from an appraiser who is independent of the seller and who has inspected the item and assigned a current valuation.

All diamonds of one carat or more should have a report from a nationally respected independent lab. Labs can afford the instruments needed to distinguish mined diamonds from their less-valuable counterparts that are lab-grown, and they have gemologists with the expertise to recognize gem treatments. We recommend the following labs and suggest that you use these links to verify reports you receive.

GIA Report Check

AGS Report Verification

GCAL Certificate

FOR ADJUSTERS

Customers usually assume that if they're buying a prestige brand they are getting high quality, but they may just be paying luxury prices.

Base the settlement on descriptive information from the appraisal and lab report, not on the valuation.

On a damage claim, ALWAYS have the jewelry examined in a gem lab that has reasonable equipment for the job and is operated by a trained gemologist (GG, FGA+ or equivalent), preferably one who has additional insurance appraisal training, such as a Certified Insurance Appraiser™.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com