Fakes, fakes, and more fakes

“Who knows what a real diamond looks like? All you can go on is what the salesperson tells you.”

That’s what one cop said, in sympathizing with a number of consumers who’d purchased jewelry with fake gems. That’s what he believed, and apparently the jewelry purchasers saw it the same way.

Is the word of the jewelry seller really “all you can go on”? We don’t think so. We think you—the insurer and the consumer—have a number of ways to spot jewelry fraud and avoid being taken in.

Prevalence of jewelry fraud

A quick glance at the variety of outright scams and subtle deceptions shows the importance of being vigilant:

- A consumer’s eye was caught by a full-page color ad for a 1-carat solitaire ring at a remarkable price. There was an eye-popping picture of what appeared to be a sparkling diamond engagement ring. Nowhere in the ad did the word diamond appear. It turned out the gem was moissanite.

Moissanite is often marketed as a low-priced diamond substitute but may also be fraudulently passed off, and priced, as diamond.

- One potential buyer was attracted to an ad for silver jewelry. The header said "stamped 925," indicating solid sterling silver, but in the body of the description the jewelry was called "silver plated." When asked which it was, the seller said the item was “solid sterling silver plated."

Items made of solid sterling are worth more, and they wear better, than sliver coating on base metal.

- The owner of a jewelry shop in a small town in New York recently admitted to authorities that he’d been selling fake diamonds as genuine for more than 16 years. Many of the defrauded customers were his friends. One victim said she couldn’t believe he sold fake goods, and certainly he wouldn’t do that to her.

He did.

- Even big-name retailers cannot automatically be trusted to adhere to high standards.

Macy’s was sued for selling composite rubies without disclosure.

- A couple of slick British scammers made millions by buying diamonds out of a mainstream diamond catalog and selling them as “investment” gems — at a 2,800% markup!

Buying loose gems as an investment is always a bad idea.

- Synthesized gems are being mixed in with naturals.

Labs have identified a number of synthesized gems mixed in with naturals, but it’s likely that more have slipped into the marketplace to be sold, and priced, as naturals.

- Jewelry purchases are often accompanied by lab reports from unreliable labs.

Lab reports with inflated valuations and descriptions are used as sales tools to convince the customer of the jewelry’s value.

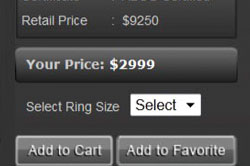

Inflated valuation |

The internet is particularly fertile ground for fraud.

- Tiffany & Co. recently won a lawsuit that resulted in the closure of 78 websites that had been selling fake goods under the Tiffany name.

“Cybersquatters” use domain names that are similar to authentic site names. Website names like salestiffany.net and shoptiffanyco.com fooled customers into believing they were on an authentic Tiffany site.

- On Cyber Monday, the day that for many shoppers kicks off the online holiday shopping season, federal authorities announced that they had seized domain names of 150 websites accused of selling counterfeit or pirated merchandise.

One anti-counterfeiting service estimates that one in six products sold online is identified as counterfeit.

- Online deception is so rampant that there are blogs acting as forums for consumers to warn each other—or simply to vent—about retailers that defrauded them.

Sometimes it’s already too late; the fraudulent site no longer exists and the consumer has no recourse.

- Jewelry auction sites usually supply too little information for a buyer to determine whether the price is fair.

They may not disclose treatments, for example, which substantially lower the value of a gem.

- Private individuals selling jewelry on eBay and similar sites may, even with no fraudulent intent, give inaccurate descriptions because they simply don’t know what they have.

That “diamond” may be CZ; that “Rolex” may be a knockoff, etc.

Fraud deterrents

So, in the face of all these potentials for fraud, you might wonder:

“Who knows what a real diamond looks like?”

Answer: a trained gemologist appraiser who has a GG or FGA+ degree and a set of GIA-certified master stones.

“All you can go on is what the salesperson tells you?”

False! --Note that the “you” in this case means the agent and insurer, as well as the consumer.

The consumer, immediately after a jewelry purchase, should have the jewelry examined by an impartial appraiser who is a GG or FGA+ to be sure it is as described by the seller. If it isn’t, the consumer may choose to return the item for a refund.

The insurer, before scheduling jewelry, should require

- a detailed appraisal, preferably on a standard JISO form

- a gem report from a respected lab, such as GIA

- warrantee papers on luxury watches

- sales receipts on recent purchases

FOR AGENTS & UNDERWRITERS

Ask for the sales receipt for jewelry purchased within the past 3 years. If there’s a huge difference between appraised value and purchase price, the purchase price is most likely a more accurate indicator of value.

Recommend that your clients get an appraisal from an independent appraiser as soon as possible after the purchase, to verify that the quality and value of the jewelry are as stated by the seller. The appraiser should be a trained gemologist (GG or FGA+), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

For colored stones, it is essential that the appraisal be written by a gemologist experienced with colored gemstones and familiar with the current pricing, treatments and frauds. Most jewelers deal primarily with diamonds, and even a trained gemologist may have little experience with colored stones.

Treatments, or enhancements, should be disclosed on the appraisal. If a gem is not treated, that should be specifically stated on the appraisal. Usually a treated stone has only a fraction of the value of an untreated gem of similar appearance.

FOR ADJUSTERS

Compare the appraised value with the sales slip. Jewelers are required to hold sales receipts for at least three years, so if the insured doesn’t have the receipt, they can contact the jeweler.

If there is a large discrepancy between valuation and selling price, the selling price is a truer indication of value.

Examine the appraisal for words such as treated, fracture-filled, enhanced, composite, hpht, synthetic, lab-grown, or other qualifying terms that suggest the stone is other than natural and untreated. Treated and synthesized gems are generally worth a fraction of the value of natural gems of similar appearance.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com