How Photos Cut Fraud

How Photos Cut Fraud

—and help the insured

A surprising number of jewelry policies are written without pictures of the jewelry. What's so bad about that?

Bogus claims, that's what. And, an honest client could be unprotected.

Picture This # 1:

A client applies for insurance on a bracelet. She has the appraisal and even the sales receipt—but they're quite a bit out of date. Why has she waited so long before getting the jewelry insured? Could it be that the jewelry is already lost, and a policy is being acquired in order to make a future bogus claim?

A photo, taken by the agent or the insured, short-circuits such a fraudulent claim. The photo is evidence that the jewelry is in the client's possession at the time the policy is written.

Picture This # 2:

A client applies for insurance on a ring, presenting an appraisal that carries a picture of the jewelry. This might seem to meet the picture requirement, but there are drawbacks. If the insurer gets a copy of the appraisal, rather than the original, the printed image will be severely deteriorated. If the document is faxed, the image will probably be useless.

Best is to have a full-color electronic image. For complex jewelry, have several views of the piece.

Picture this #3:

Along with the appraisals, a client submits pictures of the jewelry taken at home. Are such photos acceptable?

Definitely, yes. For example, some women are not comfortable removing their wedding rings but will happily have them photographed at home. People may prefer to take their own pictures for safety reasons, or simply out of pride in the jewelry. Even though not of the highest quality, such photos are valuable to have on file as they visually identify the jewelry.

Picture This # 4:

A client applies for a policy on some inherited jewelry. It's been stored in his mother's safe deposit box for years. Now it belongs to him and he wants to insure the lot of it. He presents the schedule from his mother's policy. A few months after the new policy is written, a claim is filed: one of the pieces is missing.

The question is, was that piece even in the group? Perhaps the piece had been sold, lost or given as a gift after the former policy was written. The agent did not see the jewelry. And the heir probably did not go through the schedule and compare it with the contents of the safe. Photos of all the jewelry would have verified the existence of the jewelry claimed as lost.

On the other hand, what if jewelry had been added to the safety deposit box after the original policy was written? If that were so, the added jewelry would not be covered in the new policy—which is certainly not what the heir intends. Ideally, pictures of all the jewelry are included with the schedule. Both the policyholder and the insurer benefit from this level of documentation.

Picture This # 5:

A claim is made on lost jewelry said to be unique, complex, and therefore irreplaceable. On complex jewelry items, a written description, even from a jeweler, may not be detailed enough to make a replacement.

But as the cliché has it, a picture can be worth a thousand of words. A design that appears unique to the customer may turn out to be easily duplicated by a professional jeweler who can copy it from a picture. And that would probably cost the insurer considerably less than the limit of liability.

But as the cliché has it, a picture can be worth a thousand of words. A design that appears unique to the customer may turn out to be easily duplicated by a professional jeweler who can copy it from a picture. And that would probably cost the insurer considerably less than the limit of liability.

A picture of complex jewelry also protects the client. In case of a loss, the written description may sound simple and result in a settlement that is too low. A picture shows the complexity involved and makes possible a more satisfactory payment on the claim.

Picture This # 6:

A client submits an appraisal that has a recent date, along with a photo of the jewelry. However, it turns out that the appraiser has not recently seen the jewelry—he's just updated the valuation from his appraisal of 10 years ago and has supplied the 10-year-old picture from his files. This means the picture is not useful as evidence that the jewelry is currently in the client's possession. Again, this could be a set-up for a fraudulent claim, and the appraiser could be an intended or unintended co-conspirator.

Picture This # 7:

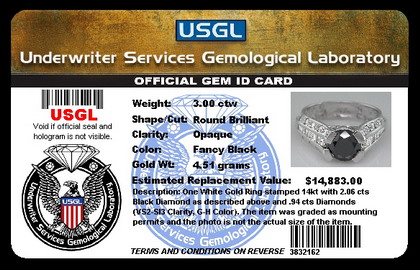

A customer submits the certificate that came with the jewelry she bought online, and the certificate has a photo on it.

Certificates, gem ID cards, and other such documents that accompany jewelry at time of sale, especially jewelry sold online, often carry a generic picture rather than a photo of the specific piece of jewelry the buyer purchased. A photo by the agent or the insured verifies the appearance of the exact jewelry being insured.

Also, such point-of-sale documents are basically sales tools, prepared in advance for display. Be wary of appraisals, certs and the like that are not specifically prepared for, and addressed to, your client. Such a document can change hands; if it becomes the basis for a policy on jewelry not owned by your client, the insurer is being set up for a subsequent bogus claim.

Picture This # 8:

There's a string of burglaries, and jewelry is what the thieves are after. Eventually the thieves are caught and police take possession of a substantial cache of goods. Most of the items are insured but, as we know, making sense of the details on an appraisal and jewelry schedule is the work of a professional jeweler. For law enforcement officials, matching stolen jewelry with its picture is much easier.

Without photos, the likelihood of recovering stolen jewelry is virtually nonexistent.

FOR AGENTS & UNDERWRITERS

An agent's or client's photo of the jewelry is the best evidence that the jewelry exists and is in the policyholder's possession.

You can make photographing the jewelry a normal part of writing the policy, as it takes only a few moments. A small setup with digital camera (turn on the macro) and lighting (turn off the flash) will suffice. Often the client in your office is wearing the jewelry, especially with engagement rings and wedding sets.

A remark of admiration for the jewelry goes a long way in customer relations. And a little time spent photographing the jewelry will impress the client with your thoroughness and attention.

FOR ADJUSTERS

Make use of the picture when pricing a replacement. It often reveals details that are not on the appraisal.

A photograph, even a poor one, may show that a lost piece of jewelry can be duplicated. This will probably be much less costly than paying the full limit of liability, especially considering the inflated nature of most appraisals.

Always take photos of a damaged item. (Photos of damaged cars are a regular part of the auto claim procedure, though a totaled car may cost the insurer less that a total-loss payout on jewelry!) A photo of the jewelry may show that the damage can be repaired at far less expense than a total-loss payout.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com