Inflated Valuations

& Questionable Certificates

Certified diamonds are all the rage in jewelry retailing. A certificate is a great selling tool for the retailer. But for consumers and insurers, the value of the cert depends on the lab that issues it.

Along with whatever movie is showing on major U.S. airlines, there’s often a film clip advertising the International Gemological Institute. “Insist on IGI before you buy” is the theme. IGI’s million-dollar ad campaign aims at building recognition of its name and promoting customer awareness of “certified diamonds.”

IGI is already a chief source for point-of-sale diamond documents. This lab turns out an estimated 200,000 to 300,000 such documents a year, supplying many of the nation’s jewelry stores. Zales — the largest jewelry outlet in the country, big-box retailers like Costco and Wal-Mart, as well as some smaller jewelry chains, all use IGI diamond documents.

How important is a diamond certificate?

Does it replace an

appraisal?

An appraisal describes (grades) the diamond, and describes the setting (metal type, mounting, etc.), and gives a valuation.

A diamond certificate (also called a diamond report) grades the stone. A certificate does not describe the setting and it does not give valuation, so it’s not a substitute for an appraisal. However, a certificate from a reliable laboratory serves as authoritative verification of the qualities of the gem, and it is a highly recommended document for insuring high-value jewelry.

So what’s the problem with certificates?

In popular usage, “certified” sounds like a stamp of approval. The current buzz over “certified diamonds” grows out of this association.

In the current market, a variety of documents are being referred to as “diamond certificates.” The document may be headed Identification Report, Appraisal Report, Certificate of Authenticity, or other such terms; it may come from an unreliable lab; and it may include a valuation (which a diamond report from a disinterested lab would not); but sellers and buyers generally call it a diamond certificate.

The retailer can point to the valuation on this document to show that the selling price is a bargain, and the “certificate” becomes a persuasive sales tool. The dangers for buyer and insurer are that 1) the grading on the document may be very liberal or inaccurate and 2) the valuation is probably inflated. In short:

A diamond certificate

is no better than the lab that issues it!

The Valuation

NBC’s Dateline recently exposed some inflated “certificate” valuations. In the Dateline report (this link takes you to their Web site, where you can view the actual video), two staffers posed as a couple looking for an engagement ring at various stores. Most of the diamonds came with documents (which Dateline refers to as “certificates”) carrying valuations.

In almost all cases, the document’s valuation was well above the selling price. The sales clerk often cited the high valuation on the official-looking paper as evidence of a bargain. For instance, a diamond ring sold at Zales for $4,000 came with an appraised value of more than $5,000.

The Dateline piece deals with fairly low-priced jewelry, but bogus valuations cover the spectrum.

The Web site for Sam’s Club, a division of Wal-Mart, advertised this ring for $260,000. To prove the price was a bargain, the site also showed an appraisal valuing the ring at $450,000 — almost twice the selling price. |

Selling Price: $260,000 “Certificate” Valuation: $450,000 |

Selling

Price: $86,999.99 “Certificate” Valuation: $183,995 |

Costco is currently selling this ring for $86,999.99, while its IGI “Summation of Appraisal” values it at $183,995 — a pretty steep overvaluation! |

Screenshots of Webpage and IGI Document for the Princess-cut ring (click for enlargement):

|

|

Costco Webpage |

IGI Document |

Here’s an extra slight-of-hand: The “Summation of Appraisal” for the Costco ring states that its contents are based on a GIA (Gemological Institute of America) Report. This suggests that no gemologist at IGI examined the stone; the information was merely copied from the GIA Diamond Report.

GIA is the premier gem grading organization, and the GIA report also comes with the purchase. However, the IGI document doesn’t even serve to corroborate information on the GIA report, since IGI’s information was taken from the GIA report. One might ask what purpose the IGI document serves, other than to publish an inflated valuation.

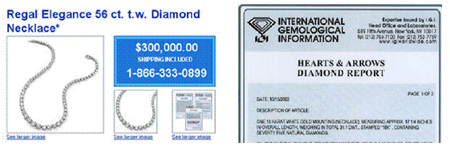

Jewelry items with 6-figure sales tags, accompanied by their inflated valuations, are indeed selling at big-box retailers. Sam’s Club closed out 2005 with a bang by selling a $250,000 necklace (marked down from $300,000). The necklace came with an IGI Diamond Report valuing it at more than $575,950. The appraised value was inflated by $325,950.

Screenshots of Webpage and IGI Document for the necklace (click for enlargement):

|

|

Sam's Club Webpage |

Diamond Report |

Documents as Imaginative Marketing

Appraisal documents often carry lines like “these values are not for investment purposes, nor are they an endorsement of the price you should pay.” Such statements may mean that the valuations have no real-world basis.

Asked by Dateline to comment on these “certified” inflated valuations, independent appraiser Don Palmieri said they seem to have come from “the market imagination…of the retailer and the laboratory.”

Buyers will, of course, submit to the insurer certificates and any other documents they received from the seller. If an inflated appraisal is the only statement of valuation, the insured may wind up paying too high a premium. In the event of a loss, they may be shocked to learn their jewelry is worth much less than they thought.

When IGI’s president, Jerry Ehrenwald, was asked about the discrepancy between selling price and valuation, he did not explain or defend it. Instead, he volunteered that customers shouldn’t rely on the certificate’s valuation when they insure the jewelry. “If the client pays less money than the appraised value, they should submit the sales receipt to the insurance company.” We think so, too!!

For more discussion of the moral hazard involved in inflated valuations, see Bogus Appraisals & Fraud in the February 2004 issue and Valued Contract for Jewelry? – Proceed with Caution! in the September 2005 issue.

The Grading

Unlike an appraisal, a certificate’s primary purpose is to grade the quality of the stone.

To check the grading accuracy for diamonds it purchased, Dateline submitted the stones to four different labs. The grades on the same stones varied significantly from lab to lab. Some diamonds, sent back to the lab that issued the original document, got different grades the second time around.

One diamond had a much lower clarity grade than reported on the document that came with the sale. The difference in grade dropped its appraised value from $1275 to $638.

Insurers and buyers should find this fluctuation worrisome, since a difference of a single grade one way or the other could mean thousands of dollars. The diamond grading system is quite precise. Its accuracy depends on the expertise — and the standards — of the lab or appraiser examining the stone.

How Reliable Is the Lab?

IGI is not the only lab that produces questionable valuations, it’s just the largest. It is a worldwide company, with lots of irons in the fire. Among its many products and services are little jewelry display boxes like those you can see in the Dateline video, with an official document neatly fitted to the size of the box.

There are many other labs providing many versions of diamond documents. They may have names like Identification Report, Appraisal Report, Appraisal summary, Certificate of Authenticity, etc., and will look official. Be especially wary if something posing as a “certificate” or “report” carries a valuation, for it’s likely to be inflated.

Reliable Labs for Certificates

Though certificates are often considered appraisals, and may even be called appraisals, they should not be. The primary purpose of a diamond certificate is to describe the diamond accurately and in detail. It is an impartial professional opinion issued by an independent lab that is a recognized authority in gemology.

A diamond certificate should not assign value — that is the appraiser’s job. IGI and other labs are taking on that role, but these are not truly independent labs. They are providing sales aids to the seller. Their valuations, and often their gem grades, are not reliable.

The most reliable diamond certificates (also called diamond reports) come from the Gemological Institute of America (GIA) and the American Gem Society (AGS). These are the most respected labs, known for their accuracy and professionalism. These reports are not appraisals and do not carry valuations. Certificates from any other sources are often questionable and should not be relied upon by insurers.

Reliable Appraisals

The most reliable and complete appraisal for insurers is one submitted on JISO 78/79 (formerly ACORD 78/79). It is prepared by a graduate gemologist who is also a Certified Insurance Appraiser™.

FOR AGENTS & UNDERWRITERS

These days, even diamond jewelry selling for less than $1,000 typically comes with a “certificate.” Do not be lulled into thinking this is a reliable diamond report unless it comes from the Gemological Institute of America (GIA) or the American Gem Society (AGS).

Do not rely upon certificates that

- carry a valuation

- are supplied by the seller in order to make a “good deal” sale

- are from a lab other than GIA or AGS

A diamond certificate (even from GIA or AGS) is not a substitute for an appraisal. Always secure an appraisal, preferably on JISO 78/79, which meets the insurance industry’s standards.

Whenever possible, also obtain for your files the sales receipt. If there is a large discrepancy between sale price and valuation, the receipt will give a more reliable indication of value.

FOR ADJUSTERS

Certificates from labs other than GIA and AGS may not be accurate. Do not rely on them.

GIA Diamond Reports are so highly regarded that they are sometimes forged. You can quickly check a report’s authenticity either online or by phone (760-603-4500 ext.7590).

Diamond certificates describe the gem but do not carry valuation. Valuations found on diamond certificates are likely to be inflated. Do not rely on them.

A valuation (whether on a certificate or an appraisal) that is well above the selling price is probably inflated. Base the settlement on the description of the jewelry, not its valuation.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com