A case in point

Lab-grown diamonds have a lower valuation than mined diamonds of similar quality. For colored diamonds, the valuation difference is HUGE.

Here is a case in point. It's an extreme example, but it also points to an important trend that insurers should be aware of.

On the left is a mined diamond, 6.21-carat fancy vivid pink. Just this month, the ring set with this diamond sold at auction for $12 million. That's close to $2,000,000 per carat.

On the right is a pair of earrings with lab-grown diamonds (LGD) from Lightbox. Lightbox upset the market for lab-made diamond in 2018 by selling its diamonds at $800 per carat. Just this month, the company slashed the price of its standard range LGDs from $800 to $500 per carat.

Between those two price points there's a lot going on.

Mined fancies of strong color are very rare and always high priced. A fancy of the size and quality of the diamond shown here is extremely rare, and such gems are becoming even more rare as mines are depleted. The price reflects the gem's rarity and quality.

LGD diamonds, on the other hand, are not at all rare. They are being produced in increasing qualities, and their pricing reflects their availability.

Some market observers believe that Lightbox sells LGDs as such low prices to increase the prestige of its main product, mined diamond. As Sandrine Conseiller, CEO of De Beers Brands, put it: "We believe that . . . lab-grown diamonds are a distinct product category, as they do not have the same enduring value as natural diamonds."

The "enduring value" strategy may not work. For consumers, lower price is a great draw. The much lower price of LGD has already pulled down prices of mined diamonds. With this new price slashing by Lightbox, other diamond growers may well follow suit. Then mined diamond retailers may adjust pricing in order to be competitive. In short, valuation of both mined and lab-grown diamond will remain in flux for the foreseeable future.

What about that $12 million diamond?

Isn't a gem at that price evidence of the "enduring value" of mined diamond?

Not exactly. That expensive gem is up there on this page as a reminder that jewelry sold at auction, with prices that may increase each time the jewelry changes hands, are unique, not typical. The vast majority of insured jewelry has gems, including mined diamonds, that are not rare and irreplaceable.

And the market is the deciding factor. Even pricey fancy colored diamonds hold their value only as long as there is a market for such gems.

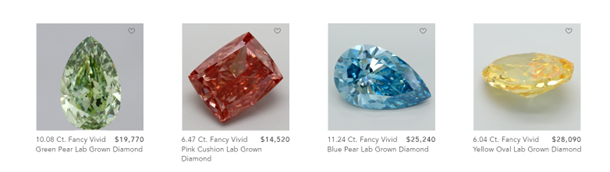

Ultimately, low price may trump rarity. Today diamond growers are producing strongly colored diamonds of good quality in increasingly larger sizes and in a variety of colors, all for much more affordable prices.

We feel safe in saying that readers of this newsletter are unlikely to see a submission for a $12,000,000 fancy mined diamond. But large diamonds of color that are lab grown—yes. They are becoming popular even in engagement rings, replacing not only mined diamonds with lab-grown, but replacing the traditional colorless round brilliant diamonds with different shapes and vibrant colors.

On website pages, a viewer can choose color, shape, setting, price range. One site even displayed the most popular engagement ring choices (so much for uniqueness!).

The take-away for insurers:

A diamond appraisal should always state whether the gem is mined or lab-made. This is especially important for fancy colored diamonds, because of the huge valuation difference.

Whether the diamond is mined or lab-made, the valuation should be up to date, as the market is much in flux these days. The price paid by the insured a couple of years ago may no longer be an appropriate value for replacement.

Lab-grown diamond can be difficult to detect without special equipment, which is usually not available to the average appraiser.

A fancy colored diamond should have a report from a reputable lab, as the valuation difference between mined and lab-made diamond is extreme.

Not all lab-grown diamonds are equal. Even Lightbox, which a few years ago did not grade its diamonds for color, clarity and cut because "they're all the same," now has a 3-tier grading and pricing system. LGDs, like mined diamonds, should have a lab report.

We recommend these trustworthy labs:

Gemological Institute of America GIA Report Check

American Gem Society Lab AGS Report Verification

Gem Certification and Assurance Lab Verify Your GCAL Certificate

Many diamond growers are upfront about what they make and sell. But fraud is always around the corner. Even a diamond with the grower's name inscribed on the girdle could be reset and sold as higher-priced mined diamond.

Always ask for the sales receipt. Valuation should be close to the price paid.

Be sure valuations are up to date. As the Lightbox price-slashing shows, a valuation from even a couple of years ago could be very out of date.

As the Lightbox price history illustrates, diamond valuation does not automatically increase over time. Prices can rise or fall depending on many factors.

If the jewelry was purchased online, check the retail site. You may be able to "build your own ring," using data from the appraisal and lab report, to see whether the appraisal's valuation is close to the current price of the jewelry.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com