Luxury Watches

Most insurers might think a $30,000 Rolex President is a pretty expensive watch. But a truly high-end watch can be ten times that price — and up.

Most insurers might think a $30,000 Rolex President is a pretty expensive watch. But a truly high-end watch can be ten times that price — and up.

What if a client wanted coverage on a $200,000 or $300,000 watch? Would you – should you – insure it?

Luxury watches can be almost any price. Their value is based on expert craftmanship, high quality materials, and the reputation earned by the manufacturer over decades.

If a timepiece involves hand workmanship, fewer are made and each takes longer to complete. If the maker comes out with a new movement, the research and development costs must be covered.

The value of the watch is justified by its quality and, ultimately, governed by the marketplace. For insurers the question is, What if there's a loss?

Here are some considerations in covering high-value watches:

- Men's watches are, in general, riskier to insure than women's jewelry. Job classifications such as contractor, mechanic, entertainer, and professional athlete present higher risk from damage/wear and tear.

- Men typically have little sentimental attachment to their jewelry and are less protective of it. A watch is likely to signal status rather than mark a personal event.

- Fakes are a serious hazard when it comes to watches. We've discussed this in detail in The Mushroom War and Frakenwatches. Use every means possible to be sure a brand name watch is indeed genuine.

- If you cover a high-value watch, be sure to get from the insured:

- Warrantee paper. This is necessary even if the watch is past its warrantee period or is previously owned. The warrantee testifies to the authenticity of the watch.

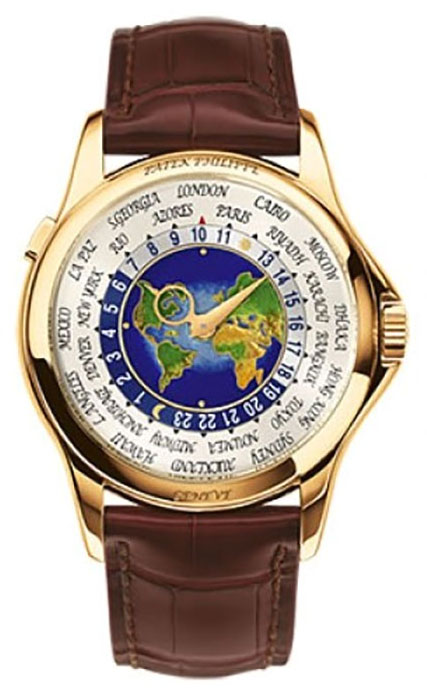

- The box it came in. Odd as it may seem, having the box provided with the sale adds to the value of the watch. Watch collectors know to hold on to the boxes and papers. (Boxes are even available on the internet—for those who want to cheat. The Patek Philippe box shown here was offered on eBay for $449.99)

- Sales receipt. Besides showing the price paid, the receipt also reveals whether the watch was purchased from an authorized dealer in that brand, an auction house, etc.

- A watch not bought from an authorized dealer is considered "used" by the manufacturer and should not be valued as a new watch. This is true even if the watch has never been worn.

- If there is no evidence that the watch came from an authorized dealer, the insured should have it authenticated by the manufacturer (preferably) or by an authorized dealer in that brand, to be sure it isn't a knock-off and contains no counterfeit parts.

- Repair of high-end watches can be difficult and expensive. Even if your jewelry store had a watchmaker capable of making the repair (and very, very few are!), most manufacturers of high-end watches will not sell the parts. The watch must be sent to the manufacturer for repair or replacement.

- Most insurance companies have an underwriting per-item limit as well as a total schedule limit, that would automatically exclude a $200,000 watch. However, if the client had significant other business with you, you might seek an accommodation.

- To a client who has no current business with you, you might say: If I come up with competitive prices on your other insurance, will you give me your other business? If the client says no, you could ask why he is not going with his current agent for watch coverage. Certainly an insurance company underwriter would ask that.

- Non-admitted markets, such as Lloyds, can charge much higher rates for high-risk items, whereas admitted carriers must adhere to lower rates. Even companies specializing in jewelry insurance, if they are admitted carriers, will not write a $200,000 exposure unless it's part of a much larger schedule because the company cannot surcharge high-end items.

- You can look to excess & surplus lines companies. Because their rates are not regulated, they can charge increased premiums for higher risk items.

Note: Watches pictured on this page were for sale online for the prices shown.

FOR AGENTS

For high-value items, be sure to get all the paperwork, such as warrantees and sales receipts. Collectors know that, even if the watch is old or was previously owned, these documents are important and should be kept.

Refer to the docs to verify that the watch is authentic. If it was not purchased from an authorized dealer in that brand, or if there is any other reason to suspect that it is not genuine, the insured should have it authenticated by the manufacturer or by an authorized dealer in that brand.

The box itself can be worth hundreds or even thousands of dollars, especially if it is kept secure and clean. Be sure to get pictures.

FOR ADJUSTERS

Counterfeit watches are big business! Use all means possible to verify that the watch is authentic. You don't want to replace a fake with the real thing.

Be on guard against fraud! The insured may have thought the watch was genuine at the time of purchase but later found out it wasn't, and he may now be trying to recoup his losses through a fraudulent claim.

Be wary of merchandise bought from an Internet seller, as watch companies do not deal with them.

- The watch may be counterfeit or contraband.

- The watch may be previously owned.

- The watch may be "gray goods" – merchandise purchased from an authorized dealer, perhaps one who is going out of business or just wants to make space for newer models. The buying merchant can sell these watches as "unworn" or "unused," but the manufacturer does not regard them as "new." Even if the papers indicate the watch is still under warrantee, the warrantee will not be valid because the insured is not the original owner.

- The insured may or may not have been informed that the watch was not "new."

- To fairly price an "unworn" or "used" watch, search auction houses and the many online sites selling such merchandise. Usually they will give both "buy" and "sell" prices.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com