Vodka, caviar . . . and diamonds?

In response to Russia's invasion of Ukraine, the U.S. and other nations have imposed various sanctions, including bans on importing certain luxury goods that are critical to the Russian economy.

One category on the banned list, along with seafood and alcoholic beverages, is non-industrial diamonds — diamonds used in jewelry.

Many people are surprised to learn that Russia is a major supplier of the world's diamond.

The world's largest diamond mining and distribution company, Alrosa, is partly owned by the Russian government and by the local Siberian province where it is headquartered. In 2021 Alrosa supplied 32.4 million carats of diamond, nearly a third of the world's diamond output.

It's not known just how much effect the sanctions will have on Russia's economy or how long the ban will remain in effect, but the situation does raise some issues for diamond importers and suppliers, and for jewelry manufacturers, retailers, customers, and insurers.

Origin of the diamond

To avoid violating the import sanctions, buyers in the U.S. must know the origin of the product they buy. But with diamonds, that's not easy. Other banned items are easier to track. Canned fish and bottled alcohol come in packaging that labels itself, its producer, its source. But diamonds could be from anywhere—Russia, Africa, under the ocean, even Arkansas.

Even a gemologist's close examination of a diamond gives no hints of the geographic locale where it was mined. Colored gems are different.

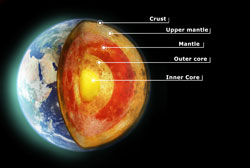

Rubies, sapphires, emeralds and most other gems are formed in the earth's crust, less than 25 miles beneath the earth's surface. During formation the gem material interacts with various minerals in the locale. The final gem retains traces of its surroundings, carrying inclusions or colorations that give the gem a distinctive appearance. This is why some regions are known for yielding gems of greater beauty, such as sapphires from Kashmir or rubies from Burma (Myanmar).

Diamonds, on the other hand, were formed deep within the earth's mantle millions of years ago, under extreme heat and pressure. Deep volcanic eruptions, probably quite early in the earth's history, brought this diamond material to the surface — or near enough to the surface to be accessed.

Having been formed so deep within the earth, millions of years before it traveled to the surface, diamond looks much the same regardless of where it was mined.

Since the diamond itself carries no evidence of where it was mined, the location of the mine can only be attested by paperwork or the word of the supplier. When money is the motivation, documents and oral reports can be modified to reflect desired outcomes.

Gem smuggling is ongoing and it adapts to avoid legal restrictions. Some years ago federal agents at a Gem Fair arrested two men for bringing illicit rough diamond into the country. In their Tucson hotel room, the two men sold undercover agents a seven-carat uncut diamond for $15,000. Agents then searched the hotel room and found 11,000 carats of uncut diamond, apparently brought into the U.S. in violation of the 2003 Clean Diamond Trade Act.

Grown diamond

It's worth noting that Russia also has a number of facilities for growing diamond, and lab-grown diamonds would also be subject to these sanctions. Lab-grown diamonds are difficult to distinguish without the appropriate technology and expertise, and they can be readily slipped into the marketplace. Even for a diamond recognized as lab-grown, identifying its country of origin would be difficult to impossible.

Transformation of the diamond

The U.S. ban prohibits importing items "of Russian Federation origin." A government FAQ page defines that phrase to mean "goods produced, manufactured, extracted, or processed in the Russian Federation, excluding any Russian Federation origin good that has been incorporated or substantially transformed into a foreign-made product" (emphasis added).

Substantially transforming a diamond might be interpreted as turning the rough material into a facetted and polished gem and mounting it in a setting — that is, turning the mineral into jewelry.

If Russian rough were sent to India, for example, where about 90% of the world's diamonds are cut, the resulting gem could be exported as a product of India. Although Russia reportedly has some 50 to 60 diamond cutting facilities, and prides itself on the quality of its cutting, having the faceting done elsewhere might be a way to sidestep the embargo.

However, U.S. businesses importing such products must be cautious, as sanctions can change. In 2008 the U.S. banned rubies imported directly from Burma, while allowing gem sellers to circumvent the ban by shipping them through Thailand. The following year the ruling was changed to ban all Burmese rubies, even those that were substantially transformed elsewhere.

Ethics & business

Besides the legal prohibitions, there are also ethical considerations and possible business consequences. Because of the widespread disapproval of Russia's actions in Ukraine, it may be that consumers here will want to avoid buying Russian diamonds.

Jewelry manufacturers and retailers may well need ways to assure customers that their jewelry does not support invasions and international violence. A similar situation arose over blood diamonds, where ethical considerations prompted some consumers to want to avoid buying diamonds that were mined using forced labor in order to finance insurgencies. Businesses began to advertise Canadian diamonds as "conflict-free," for example, and lab-grown diamonds got a boost for being free from various humanitarian and environmental abuses associated with mining.

Stamps depicting gems and jewelry in the collection of the

Russian Federation's State Diamond Fund. (Public Domain image)

Stamps depicting gems and jewelry in the collection of the

Russian Federation's State Diamond Fund. (Public Domain image) Note to Insurers

Insurers of personal jewelry are not heavily impacted by these sanctions since policies usually do not cover loose stones. However, insurers will want to exercise due diligence when buying diamond replacements, to be sure they are not violating government sanctions.

In addition to banned imports, the OFAC (Office of Foreign Assets Control) has identified and listed foreign individuals who are blocked from receiving U.S. funds. Insurers should consult this list to be sure they are not settling claims and issuing payments to those on the sanctioned list.

FOR AGENTS & UNDERWRITERS

Insurers, like consumers, have no way to verify the origin of a diamond. They must take the word of the retailer, who in turn must rely on the honesty of everyone in the supply chain.

Before offering coverage, check applicants for OFAC compliance, to be sure a potential future settlement would not violate a sanction. OFAC risks are a common exclusion.

Also check for OFAC compliance at renewal time.

For any issues related to OFAC compliance, consult SIU management.

FOR ADJUSTERS

When a claim occurs, check for OFAC compliance. OFAC risks are a common exclusion.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com