What Affects Jewelry Valuation?

More factors than you might think.

Is it global politics?

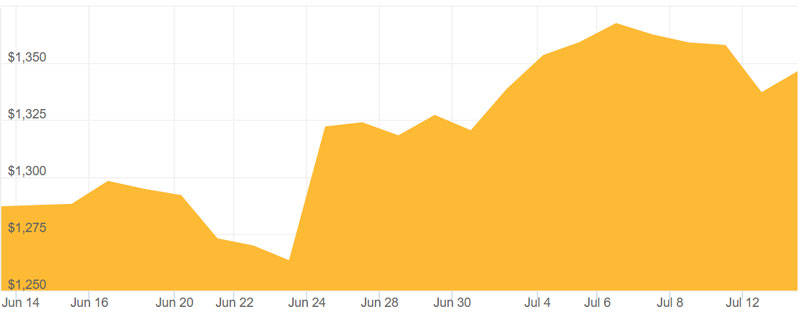

The day after Britain voted to leave the European Union, the price of gold spiked to a 2-year high, "fueled by Brexit-spooked investors," as Fortune magazine put it. Experts predict gold prices will continue to climb.

The day after Britain voted to leave the European Union, the price of gold spiked to a 2-year high, "fueled by Brexit-spooked investors," as Fortune magazine put it. Experts predict gold prices will continue to climb.

The top graph shows the effect of one dramatic political event, but this 10-year graph gives a picture of gold's volatile history.

Is it movie stars?

Is it movie stars?

The emerald earrings and matching ring that Angelina Jolie wore to the 2009 Oscars transformed the emerald market. Emerald dealers reported a surge in sales, even sales of emeralds that were not of high quality. Emeralds became "in."

There's also a huge business in jewelry that mimics pieces worn by celebrities. Online sites offer "designer inspired" CZ jewelry and "original reproductions" at a fraction of the price of jewelry with mined diamonds. The insurer should be aware that words like "designer" and "original" are marketing terms, independent of the actual value of the jewelry.

Is it jewelry auctions?

Public auctions can have a strong influence on retail jewelry, as discussed in our June issue. For example, the high premiums for such gems as Burmese rubies and Kashmir sapphires at auction brought a wide appreciation and increased demand for these gems.

Is it provenance?

This star sapphire bracelet merits high value because of the quality of the gems and workmanship, but it gains in value because of its history: it belonged to the first kidnap and extortion victims of Machine-Gun Kelly. For jewelry claiming value for provenance, insurers should be sure the piece is properly authenticated and should keep all such papers on file.

This star sapphire bracelet merits high value because of the quality of the gems and workmanship, but it gains in value because of its history: it belonged to the first kidnap and extortion victims of Machine-Gun Kelly. For jewelry claiming value for provenance, insurers should be sure the piece is properly authenticated and should keep all such papers on file.

Is it fashion?

When it comes to antique jewelry, old is not necessarily more valuable. Fashion is an important consideration. A style or setting that was once popular may no longer be considered attractive or desirable. An old stone may not be as well cut as modern methods make possible, or the shape of a stone can go out of fashion.

When it comes to antique jewelry, old is not necessarily more valuable. Fashion is an important consideration. A style or setting that was once popular may no longer be considered attractive or desirable. An old stone may not be as well cut as modern methods make possible, or the shape of a stone can go out of fashion.

Even recent purchases can become passing fads and lose their value. The "chunky" ring, with even chunkier stones, was a fad not destined to long survive.

An appraisal valuation is based on the current selling price of the jewelry. If jewelry goes out of fashion and cannot not be sold today, its value may be little more than the gems and scrap metal.

Is it where it was purchased?

Location of the purchase may not affect the jewelry's value, but it often affects its valuation.

Location of the purchase may not affect the jewelry's value, but it often affects its valuation.

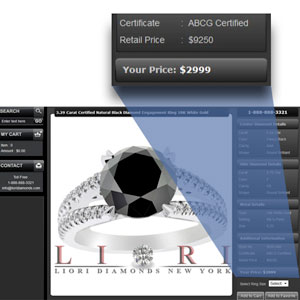

Tourist sites, internet sites and TV shopping channels often supply valuations far beyond the purchase price. This is why we strongly recommend requiring the insured to have such purchases appraised by a qualified appraiser (GG, FGA+, or equivalent) who is independent of the seller, and to get this appraisal as soon as possible after the purchase.

Is it supply & demand?

If for some reason gem material is in short supply, the price will rise. If the market is flooded, its price will fall. Gem history is full of these ups and downs.

If for some reason gem material is in short supply, the price will rise. If the market is flooded, its price will fall. Gem history is full of these ups and downs.

Tiger's eye was highly valued in the late 1800s. Then a large quantity was discovered in South Africa and the price fell to pennies per pound.

In the 1600s amethyst was said to be as valuable as diamond, but then large supplies were discovered in Brazil. Today an amethyst ring can be found on the Internet for $29.95.

In the opposite direction, some period jewelry could not be duplicated today because the best sources have been mined out and the same high quality of gem material simply cannot be found.

Or consider the recent history of tanzanite. After a large find, the price was low. Then the main mine flooded, so the price jumped. After 9/11, it was rumored that tanzanite sales were funding Al Qaeda, so the price fell. Then supply shortages again drove the price up. In early 2003, tanzanite rough was selling for $300 a gram (5 carats); by June 2004, it was going for $700 a gram. These days, tanzanite earrings are given away on cruise ships to draw customers to the jewelry counter.

Or consider the recent history of tanzanite. After a large find, the price was low. Then the main mine flooded, so the price jumped. After 9/11, it was rumored that tanzanite sales were funding Al Qaeda, so the price fell. Then supply shortages again drove the price up. In early 2003, tanzanite rough was selling for $300 a gram (5 carats); by June 2004, it was going for $700 a gram. These days, tanzanite earrings are given away on cruise ships to draw customers to the jewelry counter.

Is it technology?

Synthetic (lab-grown) gems are less expensive than mined gems, but their very existence can also lower the price of the mined stone. For example, the Chatham-created emerald can sell at a stable price. Since this is a top-quality synthetic emerald, it has had the effect of holding down the price of natural emeralds.

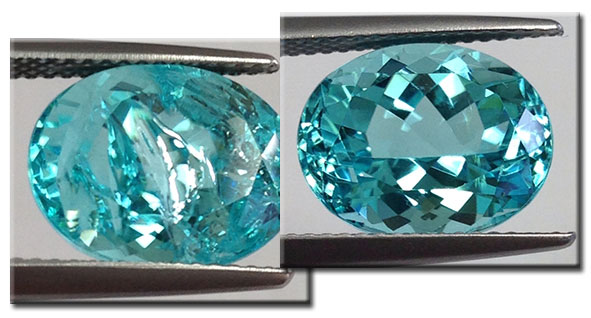

Similarly, innovative gem treatments can affect the market for untreated gems. Recent technology allows irradiating poor quality drab-colored topaz into a bright blue. The irradiated blue stones are so attractive that the price for natural blue topaz plummeted (while the price of topaz in other colors remained stable).

Is it enhancements?

Color and clarity enhancements can really skew valuations—and cheat customers and insurers—if the treatments are not disclosed and the gems are not priced accordingly.

Intensely colored diamonds used to be the preserve of only the very rich. Diamonds in vivid blues, greens, yellows, pinks, even purples, are extremely rare in nature and priced accordingly. Today there are various means for converting off-color diamonds into richly colored gems. Color-treated gems cost only a fraction of naturally colored diamond, so disclosure of the treatment is crucial to the insurer—and to the insured!

Material that formerly would not have been of high enough quality for jewelry can now be clarity enhanced. Fracture-filling is an enhancement in which fractures in the stone are filled with a non-gem material to make the stone look better to the unaided eye (but it does not remove the fracture!). A fracture-filled gem is worth significantly less than a gem of similar appearance that has not been fracture-filled. Again, disclosure is crucial.

Material that formerly would not have been of high enough quality for jewelry can now be clarity enhanced. Fracture-filling is an enhancement in which fractures in the stone are filled with a non-gem material to make the stone look better to the unaided eye (but it does not remove the fracture!). A fracture-filled gem is worth significantly less than a gem of similar appearance that has not been fracture-filled. Again, disclosure is crucial.

Is it advertising?

Alas, yes, marketing always plays its part. DeBeers' highly successful slogan "a diamond is forever" is largely responsible for diamond being held in such high regard over other gems. (In earlier times, vividly colored stones, especially red, were far more desirable.)

Other marketing campaigns also have their day. Brown diamond used to be generally shunned as off-color gem material of little value. It was used for polishing diamond. Recent advertising of "chocolate " or "cognac" diamonds has given them a whole new life, with brand names and whole websites devoted to brown diamond jewelry.

Other marketing campaigns also have their day. Brown diamond used to be generally shunned as off-color gem material of little value. It was used for polishing diamond. Recent advertising of "chocolate " or "cognac" diamonds has given them a whole new life, with brand names and whole websites devoted to brown diamond jewelry.

Is it the brand name?

As with other products, a prestige brand gets to name its price. And so there are many diamonds out there, claiming brand distinction for color, shape, cut, producer, or retailer. But with gems and jewelry, does the insurer need to replace brand with brand? Typically, just the functional equivalent is the order of the day.

A recent lawsuit by Tiffany against Costco suggests some room for debate.

Tiffany mounting |

Tiffany mounting from Tiffany |

The jewelry industry is very competitive and branding diamonds is a marketing move. While tiffany is a well-known name, there are a number of diamond brands that insurers will never have heard of. In the view of most gemologist appraisers, a diamond is valued by its qualities rather than its name. Do some research, or consult a jewelry insurance expert, before replacing a brand-name diamond.

Is it the date?

Given all the factors that affect valuation, we can also say that time itself is a factor. An appraisal for diamond jewelry, for example, is an estimation of value for a diamond of this particular cut, clarity, color, size and shape at the time of the appraisal. Similarly, a settlement is based on the jewelry's value at time of loss. That's why an appraisal should always be dated, and appraisal valuations should be regularly updated to be sure premiums are appropriate and a settlement is fair.

FOR AGENTS & UNDERWRITERS

The above discussion gives an idea of what an appraiser needs to be aware of in order to arrive at an accurate valuation.

Insurers want an appraisal with a realistic valuation, in order to set proper premiums. But the appraisal also needs to have a detailed description of each component of the piece because values change over time. In the event of a claim, the adjuster can give the description to an appraiser to determine the jewelry's value at time of loss.

The best appraisal includes the JISO 78/79 appraisal form, and is written by a qualified gemologist (GG, FGA+, or equivalent) who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

Because many factors can affect the valuation of a piece of jewelry, scheduled jewelry should have the appraisal updated every 3 years or so. A current valuation insures that the policyholder pays appropriate premiums and that items are replaceable at the scheduled amount. It also means the carrier may avoid moral hazards associated with inflated valuations, thus eliminating excessive settlements. That said, regular inspections of the jewelry are needed to avoid preventable loss, such as stone loss from a worn or damaged setting.

Some insurers offer standalone jewelry policies with coverage based on annual insurance-to-value calculations on the jewelry, so the client need never get appraisal updates.

FOR ADJUSTERS

If a claim involves brand names or any terms you don't understand, consider consulting a jewelry insurance expert working on your behalf. It could mean big savings.

In the event of a total loss, price a replacement based on the detailed appraisal description, paying close attention to the valuation issues mentioned above.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com