Conflict of Interest

A conflict between the private interests and the official or professional responsibilities of a person in a position of trust

A conflict between the private interests and the official or professional responsibilities of a person in a position of trust

That's how Merriam-Webster defines it.

When it comes to jewelry, who is open to conflicts of interest? Pretty much anyone the consumer encounters, from purchasing the jewelry to gaining insurance coverage.

Jeweler/Seller

Consumers expect to receive relevant information about jewelry they purchase, even if they themselves do not know what questions to ask.

Giving such information is the professional responsibility of the selling jeweler, and this applies also when the seller is a jewelry website, TV auction, or eBay seller.

Giving such information is the professional responsibility of the selling jeweler, and this applies also when the seller is a jewelry website, TV auction, or eBay seller.

A conflict arises when it's in the seller's interest to conceal details or give misleading information in order to make the sale.

A seller might . . .

- avoid mentioning the diamond's low color or clarity grade.

- hype carat weight, even when the diamond's weight is due to its poor cut proportions.

- fail to mention gem treatments.

- use terms that sound good but that a naïve consumer may not understand without an explanation, such as

- enhanced – for fracture-filled gems, which are worth less than untreated gems

- cultured – for lab-made gems, which sell for less than their mined counterparts.

- tell the customer the sale price is a huge reduction from the jewelry's "regular price" when it's not.

- engage in off-price selling.

- hire an appraiser but withhold from the appraiser documents that would reveal information crucial to valuation.

- give customer an appraisal that is prepared by the store's appraiser and therefore contains a description and exaggerated valuation that supports the seller's claim.

Appraiser

Appraiser

The appraiser's professional responsibility is to examine the jewelry with the appropriate gemological equipment and to write an appraisal that describes it in detail and assigns a realistic valuation.

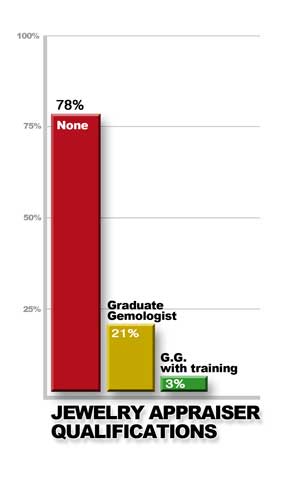

To do this, the appraiser must have the proper gemological training and experience, as well as familiarity with the market for the gems and jewelry being appraised.

The graph is based on a study of appraisals received by insurers. Although it was done some years ago, its findings remain unchanged.

A conflict of interest arises if the appraiser is not professionally up to the task, or wishes to cut corners to save time, or wants to please the client or the retailer.

An appraiser might . . .

- write an appraisal that lacks a detailed description of the jewelry and its gems.

- appraise jewelry that is outside their professional training and experience, thus producing an appraisal that may not be accurate.

- merely copy descriptive information from the customer's lab report, rather than examining the gem with proper lab equipment.

- assign an exaggerated valuation to please the customer, even though the quality of the jewelry doesn't merit it.

An appraiser who works in a jewelry store or is hired by the store might . . .

- write an appraisal that describes the jewelry as the seller wishes, omitting information the seller does not want disclosed.

- assign a highly inflated valuation in keeping with the seller's specified "true value" of the jewelry, typical of off-price selling.

Agent may

Agent may"look the other way"

Agent

The consumer trusts the agent to be knowledgeable about insurance and to actively work on the client's behalf. When an agent shortchanges the client with inadequate information or guidance, for the sake of saving the agent time or gaining income, that's conflict of interest.

An agent might ...

- "look the other way" when client fails to supply relevant facts or docs.

- take the client's word for jewelry's value because it would be too troublesome to ask for appraisal and sales receipt.

- fail to have client obtain a lab report for high valuation jewelry.

- put scheduled jewelry on HO policy but neglect to tell insured that a jewelry loss could impact their HO coverage.

- recommend the client falsely answer an application question because a true answer would cause coverage to be declined and the agent would lose the business.

Insurer

It's the jewelry insurer's professional responsibility to provide coverage at the lowest possible cost to the insured, in order to make the insured whole in the event of a claim. This requires having correct and complete information about the jewelry and its value.

An insurer might . . .

- accept appraisal that is inadequately descriptive (such as "diamond ring $8,000").

- rely on appraisal valuations for rating, even though a large majority of jewelry valuations are inflated.

- use appraised value for premiums, but use insurer's cost of replacement in cash settlements.

- fail to ask for the jewelry's sales receipt, which is a more realistic indication of market value.

- base premiums on an inflated valuation, rather than on purchase price, resulting in higher premiums for the insured.

- automatically increase valuations—and premiums—"because of inflation," even though cost of replacement does not always rise. (This is especially egregious if the valuation was inflated to begin with).

This is not to say that all participants are guilty of all—or any—of these acts, though we have knowledge or direct experience of all of them. This list is just to point out that conflict of interest is inherent in the job when financial gain may come from concealing information or relaxing principles/underwriting standards.

FOR AGENTS & UNDERWRITERS

Carefully review all items in the submission. If you are dealing with appraisals that are poorly organized, transfer the details from appraisal and lab report to ACORD/JISO 18. Then you'll have all information in an organized format and can see if any important information is lacking.

Our advice is to always ask for the sales receipt and then compare the appraised valuation with the price paid. If there is a huge discrepancy, the price paid is likely to be the truer indication of value.

Best practice is to determine ITV for rating, rather than rely on an inflated appraisal.

FOR ADJUSTERS

The submission docs should include appraisal, sales receipt, lab report, color photos of the jewelry, and warrantees for watches.

If some of these docs are lacking (all too common, alas!), check with the insured. The sales receipt and any additional appraisals are especially useful. Photos of the jewelry, even being worn, can be invaluable in settling claims, whether for replacement (preferable) or cash.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com