Diamond deflation

Inflation is a common concern in today's world, but in the jewelry realm these days, deflation is occurring. The decreasing value of diamond affects jewelry retailers, custome`rs – and insurers.

In the past jewelry was widely perceived as an investment because gems and precious metals were said to "hold their value" or even automatically increase in value. Reports of famous pieces selling at auction for increasingly high prices helped feed this belief. Some insurers contributed to this belief by automatically increasing jewelry's limit of liability from year to year.

In fact, increasing jewelry value has never been a given. Jewelry is a commodity, and valuation depends on the market: the price goes up if people want the product and it's rare, down if they don't or it isn't.

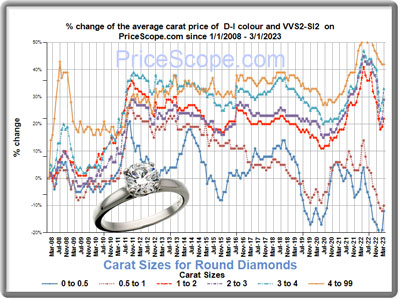

Historical charts for diamond and gold prices show the ups and downs over time. Fluctuations in value may occur because of war, weather, politics, fashion, any number of things.

The current deflation in the price of mined diamond is due to a new competitor. As one market report put it., "US buying habits [are] gravitating toward Lab-Grown Diamond."

The ultimate pull of LGD is price. Lab-grown diamond is way below mined diamond in retail price, sometimes as low as 10% of the price of mined diamond of similar quality. That low price tugs at the pricing of mined diamonds, to keep them more competitive with lab-grown diamonds, and the pricing of both is still in flux.

For insurers this means extra vigilance:

- Be sure appraisals specify whether the diamond is mined or lab-made. The valuation difference is huge. Jewelry values do not automatically increase from year to year.

- For both mined and lab-made diamonds, keep valuations up to date.

- Be cautious about relying on documents supplied by the jewelry retailer. In the past some retailers have disclosed in conversation with the consumer that the gem is lab-grown, but that disclosure was not on the receipt or other dealer-supplied documents.

- Be sure you have reliable docs. Best is to have an appraisal from a reliable gemologist appraiser (GG, FGA+, or equivalent) who is independent of the seller, and to have a lab report from a reputable gem-grading lab, such as GIA. (See links below.)

FOR AGENTS & UNDERWRITERS

The value of jewelry is subject to many variables, so valuations can change over time. An up-to-date appraisal valuation is crucial.

Not all lab-made diamonds are of uniform quality. Like mined diamonds, they should have detailed appraisals and grading reports from a reliable lab.

Be cautious regarding jewelry purchased at tourist locations or from secondary sites like eBay. These sellers may blur the valuation difference between mined and lab-made diamond, or offer poor quality diamonds (whether mined or lab-made), counting on consumers expecting bargains and being naïve about quality.

A number of retailers now supply their own appraisals and lab reports. Needless to say, such docs will mimic the claims of the retailer, and they also may omit or spin information that would negatively affect valuation. Request an appraisal from an appraiser who is independent of the seller and who has inspected the item and assigned a current valuation.

The best appraisal includes the JISO 78/79 appraisal form and is written by a qualified gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

It's always best to ask for the sales receipt, which will more likely reflect the value of the jewelry. A large discrepancy between purchase price and valuation may indicate a lab-made diamond with a mined-diamond valuation.

All diamonds of one carat or more should have a report from a nationally respected gem-grading lab.

Many retailers, emphasizing that their diamonds are certified, include a lab report with the purchase. But not all labs are reputable! Some are notorious for inflating grades, some are subsidiaries of the retailer, and some "labs" are completely bogus, existing in letterhead only.

We recommend the following labs and suggest that you use these links to verify reports you receive.

GIA Report Check

AGS Report Verification

GCAL Certificate

FOR ADJUSTERS

Be aware that appraisals and lab reports supplied by the seller are likely to have inflated valuations. Grossly inflated jewelry valuations are common—more common that you might think.

Base the settlement on descriptive information from the appraisal and lab report, not on the valuation.

Comparing purchase price to the appraisal valuation is a useful way to avoid overpayment, as the price paid is a truer indication of market value than a possibly inflated valuation.

On a damage claim, ALWAYS have the jewelry examined in a gem lab that has reasonable equipment for the job and is operated by a trained gemologist (GG, FGA+ or equivalent), preferably one who has additional insurance appraisal training, such as a Certified Insurance Appraiser™.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com