Jeweler/Appraiser Credentials

Who can call himself a jeweler?

Who can call herself an appraiser?

Yes, these are trick questions. The answer to both of them is: Anyone.

Yes, these are trick questions. The answer to both of them is: Anyone.

There is no federal or independent body setting qualifications for who may be a jeweler or a jewelry appraiser. Though these sound like impressive titles, backed by study and expertise, literally anyone can hang out a shingle as a jeweler or an appraiser.

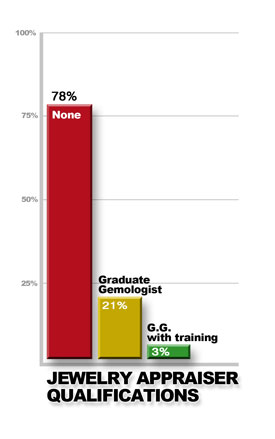

Most jewelry retailers are not even Graduate Gemologists. A JCRS study of appraisals received by insurance companies found that only 21% of them were prepared by graduate gemologists. Most appraisers had no formal training.

A GG degree insures that the jeweler has a basic knowledge of gems and jewelry evaluation and that he is able to perform the relevant lab testing.

Some retailers without a GG degree have learned their business on the job, but others are not even familiar with basic jewelry terminology or grading systems. Most jewelry retailers do not have a gem lab, with instruments to properly examine a stone and determine its quality. They must either rely on the word of their suppliers or simply guess.

This lack of knowledge shows up in many insurance "appraisals," written on fancy letterhead but with no content. If you’ve gotten an appraisal that reads, “One gold and diamond ring, value $2,000,” it’s not surprising — jewelers write thousands of appraisals like that every year. But such a description is useless for adjudicating a loss claim.

In TV exposés in London and in New York’s diamond district, jewelry retailers misidentified moissanite, a diamond simulant, as genuine diamond. The price difference between the two is immense.

Moissanite (fake diamond) Moissanite (fake diamond) |

Advances in technology have brought about a proliferation of color-treated or “enhanced” gems, synthetic gems, and outright fakes. Because all of these have a much lower value than natural, untreated gems of similar appearance, it is essential to have an appraisal by a Graduate Gemologist who has examined the jewelry in a gem lab.

FOR AGENTS & UNDERWRITERS

Recommend that policyholders obtain appraisals on the ACORD 78/79 forms. These appraisals are in a standardized format, making it is easy for underwriters to determine that all necessary information is included. ACORD 78/79 appraisals must be completed by an appraiser who is a Graduate Gemologist, preferably a Certified Insurance Appraiser™.

Explain to policyholders that a detailed appraisal benefits them because it gives realistic values and it describes their jewelry in detail so the jewelry can be replaced if it is damaged or stolen.

FOR ADJUSTERS

If you are not working with an ACORD 78/79, use JISO 18 to organize data from various documents, such as appraisals and diamond reports. If too much information is lacking and the jewelry’s valuation is substantial, consider consulting a jewelry insurance expert to avoid overpayment.

When pricing a replacement, use your JISO 18 evaluation. Do not give the replacement jeweler the appraisal valuation. Replacement quotes are generally 80-90% of the valuation, which may well be higher than retail if the valuation was inflated to begin with! You will get a more honest price if you have the jeweler submit a bid based on the jewelry’s description rather than on the appraisal valuation.

A valuation that is well above the selling price is probably inflated. Base the settlement on the description of the jewelry, not its valuation

Gather as much information as possible about the lost jewelry. Put all descriptive information on an JISO 18 form. This presents the details in an organized way and ensures that all bidding jewelers receive the same information. Send this form to the jewelers you are asking for bids. Do not include the appraised valuation or any information about the policy.

NEWSFLASH UPDATE

Fake Jewelry from a Florida Jeweler

The January Issue reported on a scam in Florida involving fake jewelry. Jeweler John Hasson was charged with fraud, obstruction of justice and money laundering. After a seven-week trial in Miami federal court, he was found guilty on six counts and faces 22-30 years in prison.

Hasson impressed and victimized numerous wealthy clients. He sold to pro golfer Greg Norman a custom-made diamond pin in the shape of his company's shark logo. When Norman had the piece independently appraised, he found that the pin he'd purchased for more than $48,000 was worth only $7,000.

In another scam, Hasson had his store manager's brother pose as a sheik and hired women to pose as a harem to impress millionaire Aben Johnson with his supposed connections to the Sultan of Brunci. A civil suit by Johnson claims he lost $60 million on purchases from Hasson.

Hasson created fantastic tales of historically prominent gems, while selling fakes, treated stones, or very poor quality gems. According to the FBI, this is the largest case of fraud involving gems and jewelry in US history.

Note that many of his victims were vacationing or conducting business in Florida and would insure their jewelry elsewhere. It would be worthwhile to check your files for appraisals written by John Hasson, his co-defendant Clifford Sloan, or his assistant Jimmy Speiser.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com