Vintage Rolexes

Just when you thought you were safe . . .

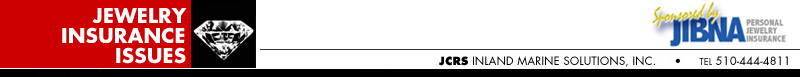

An insurer received a submission to cover three Rolexes. All were recently purchased, but they were previously owned watches manufactured years ago or even decades ago. The oldest was more than 40 years old. Is that a problem for the insurer?

When the replacement value given for a vintage watch is the price of today's model, yes, that's a problem – AND A MAJOR MORAL HAZARD!

Note to readers: Although this article is about Rolexes, the situation is equally true for many other high-end watches.

Note to readers: Although this article is about Rolexes, the situation is equally true for many other high-end watches.

Why not replace a vintage watch—that is, a used watch—with today's model?

Because, unlike other jewelry, watches are subject to depreciation.

For a diamond ring, 40 years later diamond is still diamond, gold is still gold, and the value of diamond and gold is significantly higher.

But watches are machines. A luxury watch is a quality machine with a complex mechanism, and watch parts wear out.

Also, new watches, like new cars, have improvements over last year's model. It's an apt comparison because both are machines. Other than exceptional collector's items, it's a rare watch—or car—that holds its value or gains in value over the years.

Yet appraisers regularly base the valuation of a pre-owned Rolex on the price of a new one, and insurers accept that figure. Why is that?

Jewelry (including watches) is insured based on an appraisal, while a car's coverage is based on its VIN (which contains all details). The jewelry appraisal carries a valuation, while the auto policy carries no valuation.

Both auto and jewelry are covered under ACV policies; for both, the settlement value is determined AT TIME OF LOSS. As you would not replace a 10-year-old Lexus with a new one due to moral hazard, neither should you replace a 10-year-old Rolex with a new one.

Valuing a vintage Rolex

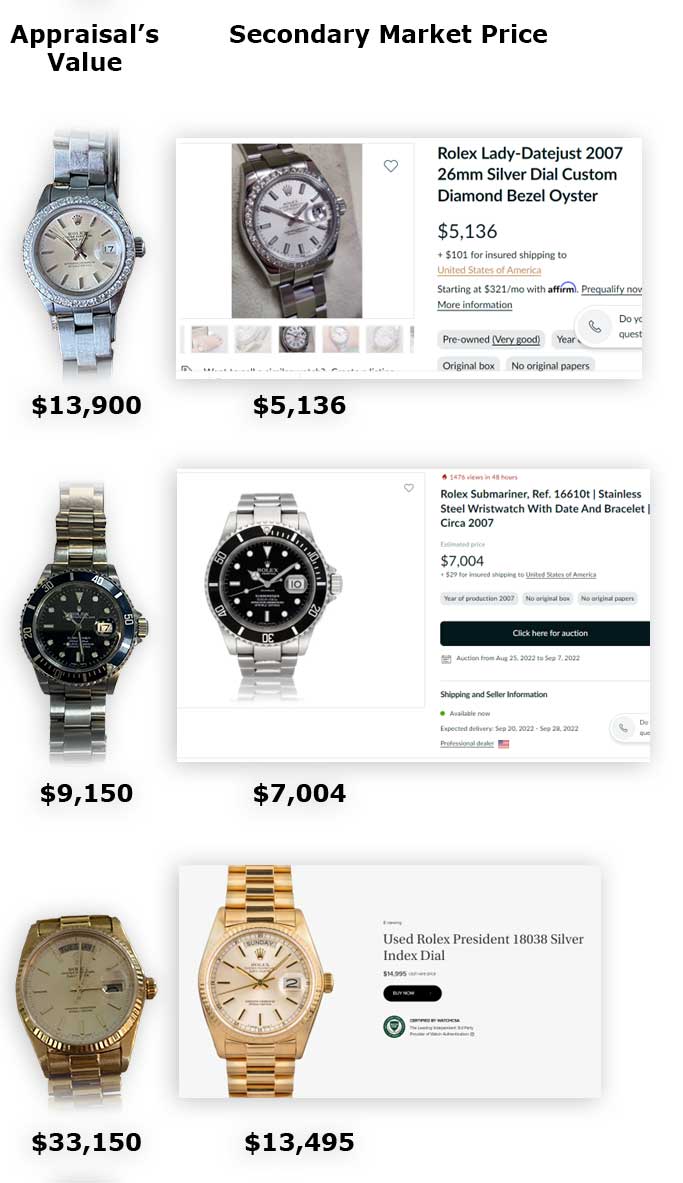

The appraisal document pictured here is for the gold watch shown above. It states that the insured purchased the watch about a year ago.

The appraisal document pictured here is for the gold watch shown above. It states that the insured purchased the watch about a year ago.

It does not state that this newly-purchased watch is a pre-owned 40-year-old piece.

The valuation given is not that of a 40-year-old watch but is the price of a new watch of the same make and model (or current replacement model). Unfortunately, this is a very common practice.

It is, of course, to a seller's advantage to have a lost watch replaced with a new one. Yet sellers are well aware of the secondary market, because that's where they can purchase pre-owned brand-name watches for well below new-watch prices. It's also a way they can purchase and sell brand name watches without being an authorized dealer.

Insurers can also access the secondary market!

Many online sites buy and sell used/vintage watches. Some carry both new and pre-owned watches. Their "buy" price is less than their "sell" price, so they can make a profit, but their sell price will usually be well below the price of a current model of the same watch.

Checking the secondary market for the watches in this submission, here is what the insurer found.

Accessing the secondary market

You must first be alert to evidence that the watch in question is, in fact, a vintage timepiece. In the case above, the appraisal document identifies the appraiser as a "Vintage and Pre-Owned Specialist." One might just overlook this as an impressive title, but it's an indication that this appraiser is aware of the price differences between old and new watches and that this watch might be a pre-owned watch.

You can find sites that sell pre-owned Rolexes by googling a phrase such as "buy used Rolex." The info you need to locate a specific watch is right on the appraisal and/or warrantee papers you received—the brand, model, serial number, etc. You should also have a good photo of the watch so you can make a visual comparison. Finding a match may take a bit of scrolling, but it could save thousands of replacement dollars.

About the appraisals

|

|

Authentication

Rolex is one of the most popular luxury watch brands and the most counterfeited. In fact, the problem of counterfeit Rolexes is staggering. A recent estimate is that the total number of fake Rolex watches produced every year is 10 times the number made in Rolex's own facilities.

Caution: Cannibalized and reconstructed watches are quite common. If any non-Rolex part is added to a Rolex or substituted during a repair, the watch is no longer considered by the company to be a Rolex, and Rolex will not service these watches.

It is important to note that the appraisal document in this submission states that the seller is an officially certified Rolex Jeweler. As such, this jeweler is authorized to sell new Rolex watches and can also order repair parts (some but not all) from the company. Even so, used Rolexes may have non-Rolex parts, such as dials and bezels.

Only an authorized Rolex dealer who is Rolex certified can reliably authenticate a Rolex.

Replacement Value

Notice that these documents are not called appraisals. Each doc describes the basic details of the watch, but it doesn't give a valuation for the pre-owned watch being purchased. Instead, it gives a "replacement value" that is the price of the current model. For insurers, that would mean replacing old with new. Again: would you do that with a twenty-year-old car?

As a dealer in used watches—a Vintage and Pre-Owned Specialist, according to the signature—the jeweler is familiar with the secondary market. The jeweler buys used watches at reduced prices, but it is in the jeweler's interest to want all insurance replacements to be new watches (new for old)—hopefully purchased from his store!

Moral Hazard

Valuing a vintage watch with the Manufacturer's Suggested Retail Price (MSRP) of a new one gives the buyer the impression that the watch's insured value is higher than its purchase price. It's not difficult to imagine the temptation to "lose" an old watch so it can be replaced with a new one. This kind of temptation does not arise with auto insurance, since auto policies usually carry no valuation and almost always replace old with old.

The danger of a fraudulent claim aside, to value a vintage watch with the MSRP price of a new one is unfair to the customer. Such a valuation sets up the consumer for higher premiums than necessary and, in case of a loss, false expectations about the settlement.

A related issue for insurers is that using the MSRP for valuation is excessive even for a new Rolex, since most authorized Rolex dealers will discount the purchase as much as 20% off the suggested retail price. Again, if the watch is scheduled at the MSRP rather than at the price the consumer paid, the insured will be overpaying premiums, while the insurer would replace with an LKQ watch at a negotiated price.

Appraiser Credentials

Documents for the two lower-value watches shown above are signed by the store's sales manager, with credentials listed as GIA AJP. GIA is a respected source for gemologist education, but don't be fooled—the letters AJP do not signify gemological study.

AJP stands for Applied Jewelry Professional™, an online course from GIA that helps students "understand the steps of the jewelry sales process" and "convey the romance, lore, and characteristics of the most popular colored gemstones." This course is for salespeople. It does not train gemologists in appraising jewelry or authenticating watches. For insurer or customer, this "credential" carries no weight. In all likelihood this person did not gemologically examine the jewelry and/or assign its value.

For a more detailed look at some other shaky appraiser "credentials," see Credential Conundrum.

FOR AGENTS & UNDERWRITERS

Insuring a vintage Rolex for the value of a new one means

- excessively high premiums for the insured;

- false expectations about a loss settlement, resulting in customer ill will;

- moral hazard, if insured believes their pre-owned watch will be replaced with a current model watch.

Considering the prevalence of counterfeit Rolexes, be on guard. You don't want to have to replace a cheap knockoff with a genuine item down the line.

The sales receipt for a luxury watch should be from an authorized dealer in that brand. If the purchase price is well below the appraised valuation, this may indicate that the purchased watch is an older, pre-owned watch, while the valuation is the price of the current (new) model.

Many consumers are not aware that luxury watches bought from sources other than an authorized dealer may be counterfeit, despite any logos or trademarks.

Any luxury brand watch from an unauthorized source should be thoroughly inspected to be sure that all its parts are genuine. It may be necessary to send a Rolex to an authorized dealer, or to the company itself, for certification. This may seem pricey to the insured, but it should be considered part of the cost of owning a luxury brand-name watch. (Rolex certification is something the seller should pay for and supply with the purchased watch, but this rarely happens with pre-owned watches.)

Always ask for warrantee papers, even if the watch is past its warrantee date. These papers attest to the authenticity of the watch and generally follow the life of the watch.

Caution: There are fraudulent warrantee documents, and such docs can even be purchased online. Scary!

Before covering a Rolex, you may want to review our four issues on 12 Reasons Not to Insure a Rolex: Reasons 1-4, 5-7, 8-10 and 11-12.

FOR ADJUSTERS

With the exception of rare collector pieces, watches begin losing value as soon as they walk out the door, just as cars decline in value the minute they drive off the lot.

Be on guard against fraud. If a policyholder discovers they have inadvertently purchased a counterfeit watch they may decide to lose it and cash in.

Check the appraisal for manufacturer, model and serial number, plus any other identifying information.

Check for manufacturer warrantees and other evidence of authenticity. Merchandise bought online (or from other unauthorized sources) may be second-hand, or may be altered with cheaper parts, or may be a complete knockoff wearing a prestigious logo.

The insurer is obligated to replace with like kind and quality. For a loss claim on a new watch, one that is still under Rolex warranty, the company would properly replace it with a like-model new watch.

Do not replace a vintage Rolex with the current model, as doing so increases moral hazard exponentially. The customer is entitled to a LKQ watch, not a newer model.

Seek a replacement of like kind and quality in the vintage watch market. If the watch does not come with verification from an authorized Rolex dealer, the insurer will have to send it to Rolex or an authorized Rolex dealer for verification.

For a cash settlement, the settlement amount would equal the insurer's cost for a replacement from the vintage market—just as is done with automobiles.

Before settling a claim on a Rolex, you may find it useful to review our series 12 Reasons Not to Insure a Rolex: Reasons 1-4, 5-7, 8-10 and 11-12 .

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com