Jeweler Ethics

Jeweler Ethics

"The lack of quality appraisals in the jewelry business is amazing.

Even more amazing is that people will sign their names to these 'appraisals.'

... Where are our ethics? Where are our values?"

The above quote is from a jeweler, in a letter sent to a jewelry trade magazine. He is accusing his own.

One industry journal reported that ethics was a "hot topic" at an annual jewelers' event, but went on to say that jewelers do not have a clear idea of what ethics are. The head of the Ethics Subcommittee for a national jewelers' organization said, "We can't dictate to our members what ethical practices they should follow. We need to first make them understand ethics.... Then we can proceed to put ethical practices (to) work."

Here are some ways lack of jeweler ethics affects the insurer:

- The valuation on the insurance appraisal is overstated. The retailer assures

the customer that the current price is a huge discount and that the real

value of the jewelry is far higher.

Crucial information is deliberately left off the appraisal. Absence of

descriptive details prevents the customer from comparison shopping. Lack

of these details also prevents the adjuster from accurately pricing a replacement.

Crucial information is deliberately left off the appraisal. Absence of

descriptive details prevents the customer from comparison shopping. Lack

of these details also prevents the adjuster from accurately pricing a replacement.

This appraisal leaves off cut proportions, mounting information and even metal type. On the basis of this appraisal, it would be impossible to determine value or order an appropriate replacement.- Flaws in gems are not disclosed, because this would lower the stated value. One appraiser admitted on camera, in a televised expose, that he would not

tell his customers their gems had flaws because then the customers would

not come back.

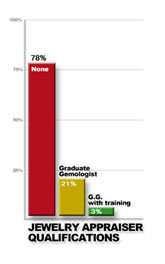

Appraisals are written by untrained personnel. A recent survey by JCRS,

examining appraisals submitted to 21 insurance companies, showed that only

21% of the appraisals were prepared by graduate gemologists and just 3%

of them had additional training in appraising.

Appraisals are written by untrained personnel. A recent survey by JCRS,

examining appraisals submitted to 21 insurance companies, showed that only

21% of the appraisals were prepared by graduate gemologists and just 3%

of them had additional training in appraising.- Retailers write appraisals without properly examining the stones. Often

retailers do not have the gem lab necessary to perform the required measurements

and evaluations. They must guess, use the information given by the gemstone

supplier, or simply leave off details crucial to determining the jewelry's

value.

Just above the appraiser's signature is a statement declaring

that the appraiser cannot be held responsible for the contents of the appraisal.

Just above the appraiser's signature is a statement declaring

that the appraiser cannot be held responsible for the contents of the appraisal.

For example, the appraisal at right says, "We assume no liability with respect to any action that may be taken on the basis of this appraisal." It may as well say: Don't base your claim settlement on this appraisal and valuation.

FOR AGENTS & UNDERWRITING

You can avoid all these pitfalls by requiring an ACORD 78/79 appraisal, prepared by a Certified Insurance Appraiser™. It contains all relevant information in an easy-to-read format, guarantees that all necessary examinations were performed in a gem lab, and warrants that the valuation reflects the current replacement price at the appraiser's store. ACORD 78/79 also identifies the insurer as first party to the appraisal, so the insurer has direct recourse against the appraiser if the appraisal has errors or omissions.

FOR CLAIMS

In settling a claim, you can rely on an ACORD 78/79 appraisal, completed by a CIA™. The information will be complete and the valuation fair.

If the insured jewelry does not have an ACORD 78/79 appraisal, there are two basic steps to follow to be sure you are not paying an inflated replacement cost.

1. Gather as much information as you can about the jewelry. Use ACORD 18, Jewelry Underwriting and Claim Evaluation, to analyze the appraisal for key descriptive content. If ACORD 18 indicates that you are lacking crucial information, ask the policyholder if there is a sales receipt (which may contain more information). Ask where the jewelry was purchased (retailers are known for the quality of their merchandise). Ask if the policyholder has a photograph of the jewelry or of herself wearing the jewelry. If there is no photo, and if the appraisal is really lacking in descriptive information, ask her to make a drawing (even a very rough drawing can be useful).

2. Use the information you have to get competitive bids for a replacement. Do not disclose the customer's name, the policy, the agent, the original valuation or sales price, or the store where the jewelry was purchased. Tell the jeweler only the information from the ACORD 18 form (do not give the jeweler the ACORD 18 form, or he will see what information is missing and may be tempted to embellish the qualities of the jewelry he offers you). Competitive bidding insures that you get the best price available. And be sure to get a written guarantee — or better yet, an ACORD 78/79 appraisal—with the replacement.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com