Handwritten Appraisals

Some insurers do not accept handwritten jewelry appraisals. Why not? Let’s explore some of the reasons by looking at a few examples.

Some insurers do not accept handwritten jewelry appraisals. Why not? Let’s explore some of the reasons by looking at a few examples.

[Note: In all examples, the insured’s information is obscured for privacy. Also, since our purpose is to bring attention to the problem and not to call out miscreants, the appraiser and store information is also obscured.]

You’ll need to enlarge each appraisal to get a good look.

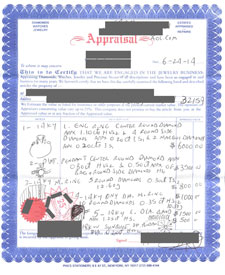

Example 1

The appraisal at the top speaks for itself. It’s a visual mess, with amateurish sketches of the jewelry, phone numbers, email addresses, and stamped seals, all higgledy-piggledy on the page. It goes on for two pages (see enlargement), covering a substantial amount of jewelry, but what underwriter — or adjuster — wants to make their way through it? As you might guess, descriptions are quite lacking. Also, no credentials are listed for the appraiser, suggesting he has no formal gemological training.

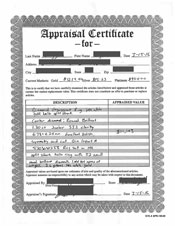

Example 2

Example 2

This “Appraisal Certificate” is much neater. It is easy to read, and the jewelry data appears to be quite detailed. One thing that’s missing is the store’s location. And since the store’s name is a common one, the store could be anywhere. The form has a very short line for the store’s name and no space for the store address or phone number, so the seller just left off that info. The consumer, as well as the insurer, should have easy access to contact info. The appraiser does not give any gemological credentials.

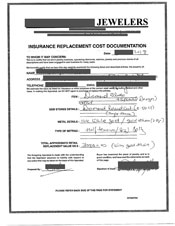

Example 3

This document is called “Insurance Replacement Cost Documentation.” The seller provided it with the jewelry purchase, and the customer gave it to the insurer in lieu of an appraisal. Oddly, it carries the signature of the buyer. We did not get the back of the page, to see what “statement” the buyer accepted by signing this paper. The signature of the preparer (notice that he/she is not identified as an appraiser) is brief and not legible. There is almost no descriptive info, and no printed name, credentials, or contact information for the appraiser.

This document is called “Insurance Replacement Cost Documentation.” The seller provided it with the jewelry purchase, and the customer gave it to the insurer in lieu of an appraisal. Oddly, it carries the signature of the buyer. We did not get the back of the page, to see what “statement” the buyer accepted by signing this paper. The signature of the preparer (notice that he/she is not identified as an appraiser) is brief and not legible. There is almost no descriptive info, and no printed name, credentials, or contact information for the appraiser.

Example 4

“To Whom It May Concern” at the top of this doc may mean you, the insurer. Or not. An appraisal for insurance should identify itself that way. (Appraisals for other purposes, such as settling an estate, have different criteria than an insurance appraisal.)

“To Whom It May Concern” at the top of this doc may mean you, the insurer. Or not. An appraisal for insurance should identify itself that way. (Appraisals for other purposes, such as settling an estate, have different criteria than an insurance appraisal.)

This appraisal, like all the others discussed here, came from a jewelry retailer. As we’ve frequently cautioned, retailer-supplied documents often inflate both the valuation and the quality of the jewelry. The stated value may well be higher than the price the consumer paid, so the buyer will feel the purchase was a bargain. What looks like a description of the jewelry’s quality may be just a restatement of claims made by the retailer.

In short, what to look at on an appraisal:

A handwritten appraisal is a red flag, an immediate sign to be cautious. Unfortunately, most of the problems discussed here are not unique to handwritten appraisals, and insurers should carefully examine all appraisals. In general, look at things in this order:

Name of firm & valuation

If the appraisal is from a store, the appraiser will not be independent of the seller. In that case, be wary of inflated values and jewelry qualities.

Appraiser identified

Appraiser’s name should be printed (not just signed), and there should be contact info for the appraiser or the store supplying the appraisal.

Appraiser credentials

Initials after the appraiser’s name indicate his credentials. If there are no initials, he’s unlikely to have formal gemological training. For jewelry valued at $25,000 or more, insurers should require an appraisal from a GG (Graduate Gemologist of GIA) or FGA (Fellow of the Gemmological Association of Great Britain).

Insured’s name

The appraisal should be prepared for the person you are about to insure.

Pictures of the jewelry

Those little sketches in the top appraisal are a joke! But good photos of jewelry are invaluable in pricing a replacement or duplicating the jewelry. Best are color photos in jpg format, rather than printed on the appraisal.

FOR AGENTS & UNDERWRITERS

Computers have been around for quite a while, not to mention typewriters. Why are appraisals still being handwritten? More to the point, why are handwritten appraisals accepted by insurers? Handwriting or hand printing is harder to read, and it makes the task of transferring data to the schedule more time-consuming.

Also, consider this: if the appraiser doesn't have the basic technology (and professional pride!) to produce a professional-looking appraisal, does he have the necessary gem lab equipment and the gemological training to accurately appraise jewelry? Can an insurer trust such an appraisal? We think not.

Rejecting handwritten appraisals should be written into the company’s underwriting and agency guidelines. If insurers stopped accepting handwritten appraisals, agents would stop accepting them.

Organization and completeness are ongoing problems with appraisals. Insurers would do well to require appraisals that follow the insurance industry standards and include ACORD/JISO 78/79/806 forms. The forms use a standard format, which assists the appraiser in presenting all necessary details.

FOR ADJUSTERS

Whenever possible, an adjuster should contact the appraiser to see if additional documentation or a more current appraisal exists.

If you are dealing with appraisals that are poorly organized, transfer the details to ACORD/JISO 18. Then you’ll have all information in an organized format for generating reports or pricing replacements.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com

If the appraisal is from a store, the appraiser will not be independent of the seller. In that case, be wary of inflated values and jewelry qualities.

Appraiser’s name should be printed (not just signed), and there should be contact info for the appraiser or the store supplying the appraisal.

Initials after the appraiser’s name indicate his credentials. If there are no initials, he’s unlikely to have formal gemological training. For jewelry valued at $25,000 or more, insurers should require an appraisal from a GG (Graduate Gemologist of GIA) or FGA (Fellow of the Gemmological Association of Great Britain).

The appraisal should be prepared for the person you are about to insure.

Those little sketches in the top appraisal are a joke! But good photos of jewelry are invaluable in pricing a replacement or duplicating the jewelry. Best are color photos in jpg format, rather than printed on the appraisal.