Appraising Jewelry—

What’s a credential worth?

Unlike the insurance industry, with its state-monitored licensing and CE requirements, jewelry appraising has no oversight by any government or independent organization. Literally anyone can hang out a shingle as a jeweler or an appraiser.

Unlike the insurance industry, with its state-monitored licensing and CE requirements, jewelry appraising has no oversight by any government or independent organization. Literally anyone can hang out a shingle as a jeweler or an appraiser.

So when a jewelry appraisal comes across your desk, how do you know it’s trustworthy?

The best way is to look at the appraiser’s education. This is indicated by the letters after the appraiser’s signature.

GG

The GIA (Gemological Institute of America) provides gemological training. GG after the signature means the appraiser is a Graduate Gemologist who has completed courses and labs in gem identification, diamond grading, and colored stone grading and has passed monitored exams on these subjects.

FGA+

FGA+ (including the + sign) indicates that the appraiser is member of the respected Fellowship of the Gemmological Association of Great Britain, having followed a course of study that includes both gemology in general and diamonds specifically.

CIA

This designation stands for Certified Insurance Appraiser. It tells you the jewelry appraiser is a GG, FGA+ or equivalent, and also has advanced training in appraising for insurance. The combination of gemological training with appraising for insurance is best because, based on instruction from world experts, the appraiser has acquired both knowledge of gemology and an understanding of jewelry appraisals from an insurance perspective.

GG, FGA+ and CIA are the credentials we recommend insurers look for.

What about other credentials?

Some are misleading, some may be bogus.

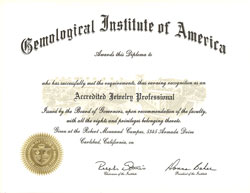

Just as there are now many questionable labs that “certify” diamonds, there are also questionable jeweler or appraiser credentials sprouting up. Even the GIA is taking advantage of its renowned name by promoting impressive-looking diplomas that are watered-down versions of gemology degrees and are of no value to insurers or consumers.

One such GIA diploma is for an Accredited Jewelry Professional. Although the name sounds impressive, the courses leading to this credential are for training sales personnel. The classes help students “become comfortable with industry terms” and teach students how to have “effective sales conversations with customers.” The AJP diploma represents only three courses, which can be taken online, and no hands-on labs. The exams are open-book, online and unproctored; that is to say, one cannot fail.

One such GIA diploma is for an Accredited Jewelry Professional. Although the name sounds impressive, the courses leading to this credential are for training sales personnel. The classes help students “become comfortable with industry terms” and teach students how to have “effective sales conversations with customers.” The AJP diploma represents only three courses, which can be taken online, and no hands-on labs. The exams are open-book, online and unproctored; that is to say, one cannot fail.

And what a deal. Classes for an AJP diploma come to $495, while tuition for the Graduate Gemologist program is $19,475.

Insurers and consumers should be aware that AJP, and many other credentials out there, do not represent gemological expertise.

The reliability of an appraisal depends on the training, expertise and honesty of the appraiser. The training is easiest for a non-professional to assess, since the appraiser will generally indicate his credentials after his signature. If you see designations you don’t recognize, ask the appraiser about them or consult a jewelry insurance professional. If there are no letters after the appraiser’s signature, she/he may have no formal gemological training; in this case you may want to request an appraisal from a GG or FGA+, preferably one that is also a Certified Insurance Appraiser.

FOR AGENTS & UNDERWRITERS

Ask for the sales receipt for recently purchased jewelry. If there’s a huge difference between appraised value and purchase price, the purchase price is a more accurate indicator of value.

Jewelers are required to hold sales receipts for at least three years, so if the insured doesn’t have the receipt, contact the jeweler.

Don’t rely on appraisals that look like lab reports but contain valuations. These are sales tools. It is likely that both the valuation and the gem’s qualities are inflated.

Recommend that your clients get an appraisal from an independent appraiser as soon as possible after the purchase, to verify that the quality and value of the jewelry are as stated by the seller. The appraiser should be a trained gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute, Oakland, CA.

Don’t be taken in by fancy appraisals that look impressive. What’s important is the detailed description. It’s best to have an appraisal on JISO 78/79, which will include all relevant information about the jewelry.

FOR ADJUSTERS

If there is a large discrepancy between valuation and selling price, the selling price is a truer indication of value.

If a claim is made for damage, always have the damaged jewelry examined in a gem lab by a trained gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute, Oakland, CA

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com