Selling Salvage Jewelry

So you have a box of salvage jewelry. Is this jewelry worth collecting and storing? If so, how do you turn those pieces into cash?

So you have a box of salvage jewelry. Is this jewelry worth collecting and storing? If so, how do you turn those pieces into cash?

How do you go about selling jewelry if you're not a jewelry store?

The same question comes up for consumers who have jewelry they no longer want to wear or keep. The New York Times recently carried an article by a woman who found herself with two inherited diamond rings that she wanted to sell. Her journey provides some useful pointers for insurers as well.

Lab report and appraisal

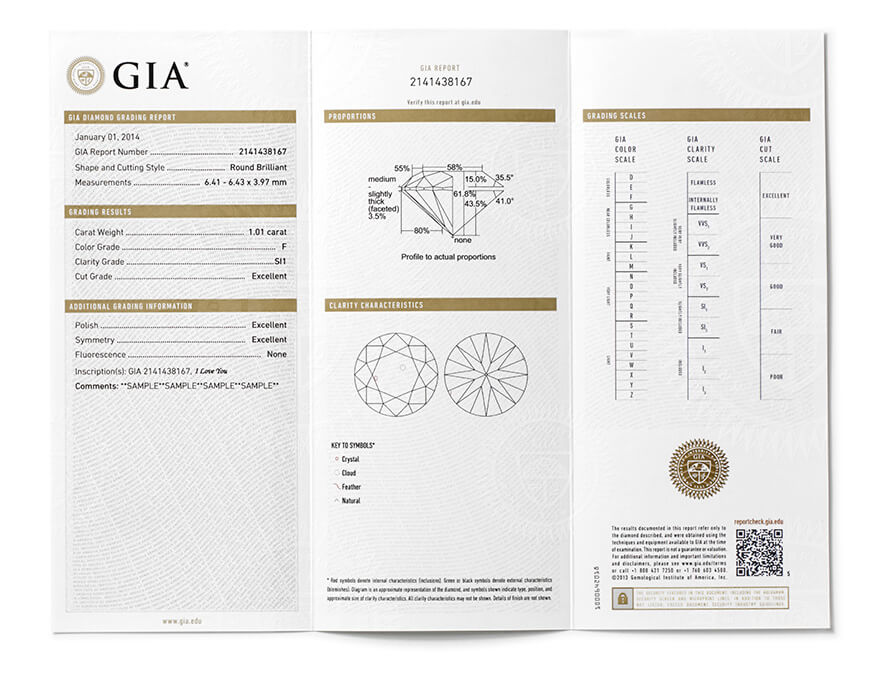

The consumer took her rings to several jewelers and all advised her to get a lab report from GIA, the most respected diamond grading lab. This is a good first step, as diamond jewelry gains its value primarily from the quality of the diamond. A GIA Grading Report has the necessary information to tell a potential buyer if the jewelry is worth considering.

An insurer with a valuable piece as salvage may already have such a report from the original submission. If not, and if the diamond jewelry was insured at a high value, it is worth the expense of getting a GIA grading report.

NOTE: Be sure it is GIA's Grading report! GIA's Origin report does not specify the qualities of the diamond.

Even if you have on file the appraisal for insurance, you may also want to get an appraisal that states the resale valuation of the jewelry. Expect the resale valuation to be considerably lower than the replacement valuation on the insurance appraisal.

The next step is finding a buyer.

Selling to a jeweler

In buying used diamond jewelry, jewelers consider only larger diamonds (more than one carat). The ring itself and smaller stones often used to offset a large center diamond are regarded as scrap and irrelevant to the purchase.

Besides the quality of the diamond—its Color, Clarity, Carat weight, and Cut proportions—a jeweler will take into account his clientele, the quality of merchandise he carries, how he may present the stone in a new setting, whether he'll want to have it recut to a shape that's currently more popular, or even whether he'll buy the jewelry in order to resell the loose diamond.

All these decisions affect the price the jeweler will offer, or whether he'll decline the purchase altogether. Therefore, it's wise to get quotes from at least three jewelers.

Auction houses

An auction house will usually sell the piece as jewelry (rather than considering just the diamond). Besides evaluating the stone itself, the house will take into account such factors as brand name, design, workmanship, provenance and, perhaps most importantly, the price for which similar pieces have sold at auction.

Auction houses may provide free estimates of what the piece will sell for — though there's no price guarantee. They deal not only in the superstar jewelry we read or hear about in the media, but also with less pricy items. However, a representative of Sotheby's said it is impractical for them to auction anything expected to sell for less than $5,000 because the house takes a commission and the seller has to cover other expenses, such as the cost of catalog photography. Commissions vary depending on the auction house, but they can be as high as 35% of the selling price.

Internet sales and auctions

There are online consignment and auction sites such as eBay that facilitate peer-to-peer selling. Since you're selling to an individual rather than to a business, you'll likely get a higher price than by selling to a jeweler. If you go this route, check out what similar jewelry is selling for and price your piece accordingly.

There are also sites that will make you a purchase offer, then they will offer it to the public. Some sites have unsavory reputations. The Better Business Bureau receives many complaints about online buying sites that give lowball offers, fail to return jewelry if you reject their offer, or don't send payment. It can take time to explore these sites and to use them smoothly and safely. An insurer must determine whether the potential profit outweighs this investment of time.

Using a broker

Another option for an insurer with jewelry salvage is working with an appraiser who will act as a broker or who can recommend one. A broker can determine the resale value of the jewelry, assess its finest features, and find out where you can get the best price.

Look for someone with strong gemological training, such a GG or FGA+, as well as years of experience in this field and deep connections. Some brokers charge a flat fee, others may charge a percentage of the sale price.

Tips for Selling Salvage

Get a GIA Grading Report on diamonds of 1 carat or more.

Get a GIA Grading Report on diamonds of 1 carat or more.- You can look on eBay or other online sites for comparable pieces to see what your jewelry might sell for.

- Shop around. If selling to a jeweler, get at least 3 firm quotes in writing. There may be large differences between them.

- Most jewelers deal primarily with diamonds. For salvage with colored gems, go to reputable jewelers who regularly deal in colored gem jewelry.

- Don't expect the quotes to match the insured valuation. A jeweler who buys used jewelry will expect to make a profit. The diamond in the story above was valued at $17,724; the consumer sold it for $11,000.

- If selling online, be sure to read the fine print, especially regarding turnaround time. Some online buyers stipulate that if you don't reject an offer within a certain time period, they consider the offer accepted.

- Gold jewelry without gems will usually be valued by weight based on current gold prices. This is the melt value. Unless it is highly unusual in some way, gold jewelry is considered scrap and will just be melted down. Here, too, get at least 3 quotes. Consider selling directly to refiners or coin dealers to get 95-98% of melt value.

- If getting an offer entails mailing the jewelry, use a method that verifies the jewelry was received, such as Certified mail.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com