Price, value, valuation . . . and limit of liability

In the drama of jewelry insurance, price, value, valuation and limit of liability are major characters. Let's look at how these characters are seen by their audience — jewelry purchaser, appraiser, insurance agent and jewelry insurer.

In the drama of jewelry insurance, price, value, valuation and limit of liability are major characters. Let's look at how these characters are seen by their audience — jewelry purchaser, appraiser, insurance agent and jewelry insurer.

Jewelry Purchaser

The purchased jewelry has a sales receipt with the price paid. The purchaser could take the price to be the value of the jewelry. Sometimes the purchase also comes with an appraisal (which may be called a Value Card, Certificate of Valuation, Summary of Appraisal, etc.) showing that the "true value" of the piece is much greater than the price paid, supporting the retailer's claim.

This bloating of valuations is endemic in online sales, as we've covered many times, and also occurs in brick-and-mortar jewelry stores and mall jewelers. Do customers really believe retailers can survive by offering 50% discounts?

The customer, happy with their bargain and the dealer-supplied "verification" of the jewelry's much higher value, may use this expanded valuation when applying for insurance. Insurance contracts are in fine print, and rarely do consumers understand, or ask about, the definition of limit of liability. The insured typically expects that, in the event of a loss, the settlement will be the exaggerated valuation. In cash.

Jewelry Appraiser

An appraiser may want to please the customer by assigning a valuation higher than the price paid. The appraiser may imply, or even say directly, that after all "it's only for insurance."

An appraiser may want to please the customer by assigning a valuation higher than the price paid. The appraiser may imply, or even say directly, that after all "it's only for insurance."

If the appraiser is working for a jewelry retailer, writing appraisals that accompany a purchase, the appraisal valuation will match whatever the retailer decides is the "true value" of the piece.

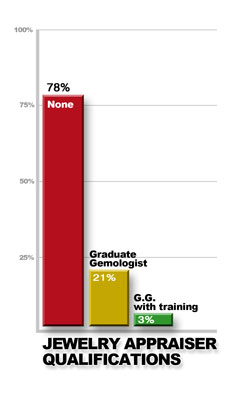

Insurance records show that the vast majority of jewelry appraisals for insurance are done by appraisers with no formal training in gemology or appraising. This means that the description of the jewelry may be unreliable, and therefore the valuation would also be unreliable.

An appraiser knows, or should know, that the insurer's limit of liability may not match a grossly inflated valuation. Yet appraisers, like consumers, are likely to believe that a higher valuation is a service to the jewelry owner.

Insurance Agent

Agents looking at an appraisal tend to check only that a date and valuation are given. They probably assume that the jewelry's valuation was determined by a trained expert, but this is often not the case. Literally anyone can call themself a jewelry appraiser.

A responsible agent would ask for the jewelry's sales receipt and compare purchase price with appraisal valuation. A realistic valuation should be close to the retail selling price. A huge discrepancy between the two figures is likely a sign of an inflated, "feel good" valuation.

An agent knows, or should know, that the limit of liability is not equivalent to the jewelry's valuation. It is the upper limit of what the insurer would pay on a claim.

A responsible agent protects the client by explaining that a settlement is based on the insurer's cost to repair or replace the jewelry, not on the valuation. An inflated valuation just means inflated premiums, which is no advantage to the insured!

Insurer

So what happens when an insurer is faced with this not uncommon situation: a grossly inflated jewelry valuation (often based on a woefully incomplete appraisal from an unreliable source)? Many insurers simply accept that inflated valuation!

The insured then pays premiums in excess of what an accurate valuation would warrant. That is to say: the insurer receives larger premiums because the valuation is inflated!

The insurer knows that their limit of liability may be far below this insured valuation.

Some insurers don't even offer cash settlements. They have relationships in place with retailers allowing them to acquire replacements at greatly reduced cost. So here, too, the excessive premiums are concealed from the insured.

Do customers really believe they can insure their jewelry for twice what they paid, and simply get that double amount in a settlement? Misled by advertising, they probably believe the inflated value on the appraisal is true.

Many insureds who have had a prior jewelry loss know valuations are often the policy's limit of liability. For insurers such a settlement is an economic choice, as it is less expensive to pay the limit of liability than spend time researching the actual replacement cost.

Do appraisers really believe that inflating value fools the insurance company and is a win for the customer?

There are too few ethical appraisers who take pride in their work and use their expertise to arrive at appropriate valuations. Understanding how insurance works would enable them to educate their clients about why an inflated appraisal for insurance does the insured no favor, since it results in excessive premiums.

Do agents not care about the possibility of moral hazard and fraud? Do they even know to check the appraised valuation against the sales receipt? Perhaps they just regard that as the insurer's job.

Conscientious agents will check the sales receipt for new jewelry and compare the purchase price to the appraisal valuation. If there's a large discrepancy, agents can explain to their clients that an inflated valuation just means higher premiums.

Rather than comparing insurers' rates (which are regulated by the state), agents will best serve their clients by shopping for the lowest premiums.

Do insurance companies deliberately ignore inflated appraisals because higher valuations earn them higher premiums? Many do.

Some insurers do not offer cash settlements. Because they have prior replacement agreements with jewelers (whom they also insure), they know they can get a replacement for far below the inflated valuation. Jewelers in these agreements go along with lower replacement prices because they gain increased business from the insurance company.

FOR AGENTS & UNDERWRITERS

Inflated valuations do not serve the insured. They just mean higher premiums.

Agents and underwriters can easily compare the sales receipt with the appraisal valuation. A large discrepancy between purchase price and valuation indicates an inflated valuation.

An inflated valuation may also signal an unreliable jewelry description. The quality of the gems and metal may be exaggerated in order to support the higher valuation.

Pro-active agents can provide a valuable service by helping their clients understand how insurance works, including the definition of limit of liability and the impact of an inflated valuation.

When the appraisal has an inflated valuation, advise the client that getting an appraisal with a more accurate valuation can mean lower premiums. Giving information and saving the client money go far in winning a client's trust—and the rest of their business!

Agents and CSRs could benefit from a zoom class on the Ethical Approach to Jewelry Insurance, currently being offered by JCRS for Ethics CE credit.

A growing number of jewelry retailers supply their own appraisals and lab reports. Needless to say, such docs will necessarily support the claims of the retailer, and they also may omit or spin information that would negatively affect valuation. Request an appraisal from a gemologist appraiser who is independent of the seller.

The best appraisal includes the JISO 78/79 form, and is written by a qualified gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

FOR ADJUSTERS

Review all documents on file—appraisals, sales receipts, gem lab reports. If some of these documents are lacking, ask the insured for them.

Comparing purchase price to the appraisal valuation is a useful way to avoid overpayment, as the price is generally a truer indication of market value than a possibly inflated valuation.

Reject lab reports that carry valuations. Reliable labs describe the quality of the gem, they do not include valuation.

Keep in mind that often appraisals supplied by the seller are sales tools meant to impress the buyer. Their valuations may have little real-world basis. If the appraisal shows a valuation considerably higher than the sales receipt, suspect an inflated valuation.

Inflated valuation on an appraisal can signal inflated descriptive information as well. If such a doubt arises, it can be useful to check other jewelry on the schedule to determine whether the quality of that jewelry matches its appraisal description. Then make some assumptions about the lost item.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com