Fraud catcher: the sales receipt

Of course any piece of scheduled jewelry should have an appraisal. But what about that appraisal's valuation?

Of course any piece of scheduled jewelry should have an appraisal. But what about that appraisal's valuation?

It's no secret: Many jewelry valuations are grossly inflated. Accepting such a valuation could lead to a grossly excessive settlement down the line.

Having the sales receipt lets you compare the appraisal's valuation with the price actually paid — and price is likely to be a truer indication of the jewelry's market value.

A large difference between purchase price and valuation suggests something is amiss. Here are a few situations you may encounter, where the sales receipt could prove very useful.

- The sign said 60% off and, sure enough, the valuation on the appraisal that came with the purchase carries the store's much higher "regular selling price."

Ask for the sales receipt!

It's likely that the store has this "sale" almost all year long. The unfortunate truth is that many jewelry retailers advertise artificially inflated prices so they can lure customers with the promise of spectacular discounts. The sales receipt can be very revealing.

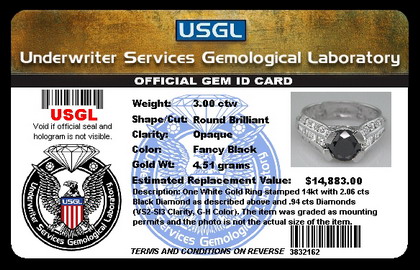

Online retailers can presumably sell things at a steep discount because they don't have to support a brick-and-mortar store. The valuation on the certificate from the seller must show what the jewelry is really worth.

Online retailers can presumably sell things at a steep discount because they don't have to support a brick-and-mortar store. The valuation on the certificate from the seller must show what the jewelry is really worth.

Ask for the sales receipt!

Many online jewelry sellers supply cards or certs to prove the value is far higher than the price paid. Retailers can purchase in quantity gem cards that carry descriptions, pictures and valuations for jewelry never examined by a gemologist appraiser. Customers just think they got a real bargain.

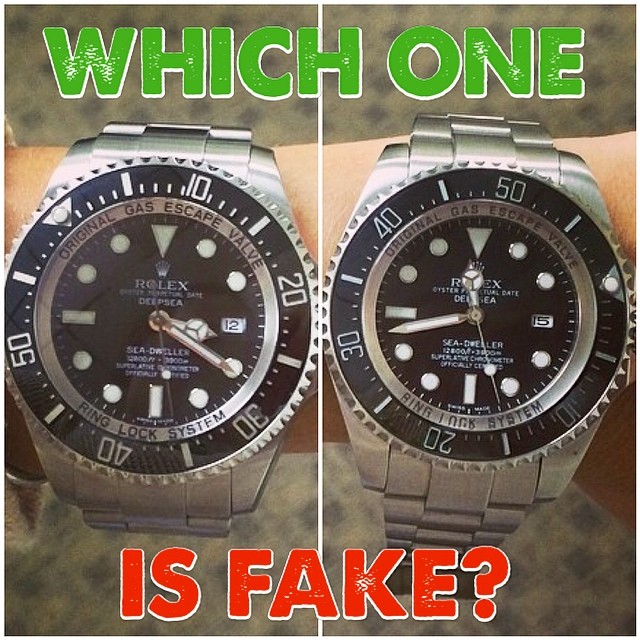

The internet is awash with sites selling imitation brand-name merchandise (Rolex watches, Tiffany jewelry, etc.), complete with packaging that mimics that of the genuine product. Such purchases may include appraisal-like documents from bogus labs attesting to the jewelry's high value. A sales receipt will show whether the jewelry came from a reputable authorized dealer as well as how much the customer actually paid.

Counterfeit watches are big business, so be extremely cautious about evidence of authenticity. For luxury watches, always ask for the warrantee paper, even when the watch is second-hand. You don't want to have to replace a knock-off with the real thing!

- Big box retailers sell such large quantities of merchandise that even their jewelry is half what it would cost at jewelry store. Or so consumers may believe, because they have a certificate from the store proving the jewelry's high value.

Ask for the sales receipt!

Certs from big-box sellers often come from unreliable labs. The customer probably got the jewelry they paid for—a lower-quality piece for a lower price—along with a feel-good certificate or appraisal. The low price and high valuation attract the customer but may defraud the insurer.

I bought this on vacation, where the gem is actually mined, so got a much better deal than I could ever get here. The owner of the business gave me this appraisal himself.

I bought this on vacation, where the gem is actually mined, so got a much better deal than I could ever get here. The owner of the business gave me this appraisal himself.

Ask for the sales receipt!

Retailers in tourist areas notoriously overprice jewelry or lie about its quality. They may even misrepresent the gem itself, knowing that travelers tend to spend freely and do not comparison shop. If later there's a problem, they will have no recourse once they've left the country.

The TV jewelry channel had a special low price for a limited time and I was lucky enough to catch this really good value.

The TV jewelry channel had a special low price for a limited time and I was lucky enough to catch this really good value.

Ask for the sales receipt!

It's a poor setup for purchasing jewelry: Buyers are prompted to buy quickly. The ring is displayed at the size of the TV screen, not seen in real life, not tried on. The buyer typically does no prior comparison shopping. The jewelry's description (perhaps called an appraisal) may emphasize carat weight, which makes the purchase sound like a bargain, but it may leave off other crucial details, like treatments or enhancements that would greatly decrease the gem's value.

- I bought this from a good friend of a friend, and it came with this appraisal.

Ask for the sales receipt!

Oh, dear . . . there was no sales receipt. . . . Private sales from friends, flea markets, Craig's list, etc. should make insurers very cautious. Jewelry appraisals can be copied and altered, gem lab reports can be purchased online. Both are used to "verify" stolen or cheap imitation jewelry, to defraud both jewelry customers and insurers.

Conclusion

Always ask for the sales receipt.

- If the appraised valuation is far higher than the purchase price, that points to an inflated valuation.

- A severely inflated valuation often means the jewelry's descriptive info is also not reliable. It may exaggerate the gem's qualities or may leave out information that, if revealed, would lower the valuation. Or it may indicate that a lab-made gem has been given the valuation of its mined counterpart.

- If there is any suspicion that the docs are unreliable, ask for an appraisal from a disinterested appraiser. We suggest a qualified gemologist appraiser (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

FOR AGENTS & UNDERWRITERS

Make it a practice to always ask for a sales receipt. If there is a great difference between purchase price and valuation, the price paid is a better indication of the jewelry's value in the marketplace.

Some jewelry retailers artificially inflate their "regular prices" in order to then advertise dramatic discounts. This is especially true around the holidays, when consumers are very much in a spending mode. The sales receipt can be very revealing.

If there is a large discrepancy between selling price and appraisal valuation, it is best to ask for an appraisal from a reliable appraiser who is independent of the seller.

The best appraisals include the JISO 78/79 appraisal form, written by a trained gemologist (GG, FGA+, or equivalent) who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ course

FOR ADJUSTERS

Sales receipts and proof-of-payment docs are often helpful in establishing whether a diamond is mined or lab-made. Read the fine print!

Mined diamond has a substantially higher valuation than lab-made diamond. If the appraisal or lab report does not explicitly state whether the gem is mined or lab-grown, use every means possible to determine which it is. If possible, interview the seller.

Deliberate non-disclosure is always possible. Deceit can happen anywhere along the selling chain.

Suppose you are settling a claim and you suspect the valuation is inflated. Try using ACORD/JISO 18, Jewelry Underwriting and Claim Evaluation. This form helps adjusters analyze jewelry appraisals for key descriptive content. You can easily see what details are needed for valuation and whether the appraisal you have is sufficient.

On a damage claim, ALWAYS have the jewelry examined in a gem lab that has reasonable equipment for the job and is operated by a trained gemologist (GG, FGA+ or equivalent), preferably one who has additional insurance appraisal training, such as a Certified Insurance Appraiser™.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com