What’s So Great about JISO Appraisal Forms & Standards?

There was a time when people thought valuation was the only necessary thing on a jewelry appraisal. There was a time when insurers couldn’t do much about bad appraisals so they just accepted whatever was submitted.

To quote Bob Dylan, the times they are a-changing.

JISO has played a major role in making this happen.

JISO is a non-profit organization established to serve the insurance industry by maintaining the integrity of jewelry insurance standards. Here’s a look at those standards and how they’ve improved the quality and ease of insuring jewelry.

Insurers know that valuation is not the most important thing on the appraisal. Valuations can be inflated (as we’ve discussed in a number of newsletters), and valuations change over time.

What’s necessary is a detailed description of the jewelry, prepared by a trained professional. This detailed information and proper training have been woefully lacking in jewelry appraisals submitted to insurers, as these charts from an insurance survey show.

|

|

|

|

Information Given on Insurance Appraisals |

|

JISO standards hold that a crucial part of a jewelry appraisal for insurance is a detailed description of the jewelry.

The purpose of the appraisal is to describe the jewelry item in such detail as to adequately distinguish it from other similar types of jewelry, verify its condition, and assign it a reasonable value as of the date appraised.

This kind of appraisal is useful to an adjuster. A complete description of the jewelry enables any competent and experienced jeweler/appraiser to determine the jewelry’s value at time of loss.

Can you trust the jeweler/appraiser?

Even a very slight difference in a gem’s quality can mean a huge difference in value, so the skill (and honesty) of the appraiser makes a big difference at settlement time.

Many jewelry retailers are untrained in gemology. Many do not examine the gems they sell but base their appraisals on the gem supplier’s word. Even in New York’s Diamond District there were jewelers who mistook a diamond simulant (imitation diamond) for the real thing. The startling fact is that literally anyone can hang up a shingle as a jeweler or appraiser.

The vast majority of appraisals submitted to insurers come from jewelers with no gemological training. It’s not surprising that such appraisals are incomplete and lacking in descriptive detail.

JISO standards hold that the most reliable jewelry appraisals come from Graduate Gemologists who have additional training as Certified Insurance Appraisers™ (CIA).

A Graduate Gemologist is a graduate from the Gemological Institute of America. Jewelers who have this degree usually write GG after their names.

A Certified Insurance Appraiser™ is a GG who has had additional training in appraising jewelry for insurance purposes. This course focuses on how jewelry is insured and what information insurers need on an appraisal.

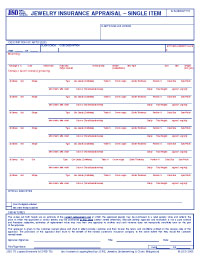

JISO publishes appraisal forms in a standardized, easy-to-follow format.

JISO facilitates detailed appraisals by publishing forms that prompt the appraiser for all necessary descriptive information, so nothing is left out. The information is presented in an easy-to-read format, so agents and underwriters can easily see that the details have been filled in.

Insurers need not understand jewelry terms or judge whether the information is accurate. Accurate information is the jeweler/appraiser’s domain; insurers need only look at the standardized format to see that the information is given.

| JISO 78 |

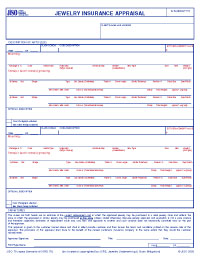

JISO 79 |

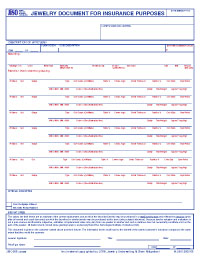

JISO 806 |

With an appraisal on a JISO 78/79 form, insurers and their clients know that

- The appraiser is a Graduate Gemologist and a Certified Insurance Appraiser™ (CIA).

- The appraiser examined the jewelry in a gem lab, using appropriate equipment.

- All stones and mountings are described in precise, widely accepted gemological language.

An additional benefit to consumers is that at least one major national jewelry insurer (JIBNA) offers significant discounts for appraisals written on JISO forms.

If there is no CIA in the area, JISO 806, Jewelry Document for Insurance Purposes, can be filled out by any jeweler. This form also guides the jeweler/appraiser in providing essential descriptive content useful for insuring jewelry.

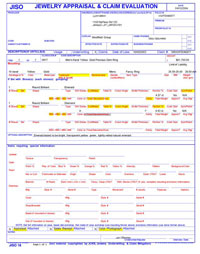

JISO 18 is an Appraisal and Claim Evaluation form uniquely useful to insurers who are dealing with a non-JISO appraisal. An insurer can transfer details from the non-JISO appraisal onto JISO 18’s standardized format and easily see whether all necessary information is present.

A typical appraisal |

Information from that appraisal entered onto JISO 18 |

In this example, the yellow highlighting shows what information essential to accurate valuation is missing from the appraisal.

The highlighted form provides a graphic representation of an appraisal’s completeness. An agent or underwriter can use JISO 18 to show clients what information is lacking on their appraisal. If too many details are missing, this is a persuasive argument for getting a more complete appraisal (preferably on JISO 78/79).

An adjuster can put onto JISO 18 descriptive information from various documents, such as appraisals, sales receipt, diamond certificates, colored gem reports, etc., to create one reference document with the fullest description of the jewelry possible. Detailed information recorded here can be used to price a replacement.

All JISO forms are available free of charge to jewelers, insurers and consumers at www.jiso.org.

The JISO forms make it easier for agents to ask for, and jewelers to write, the kind of appraisals insurers find useful. JISO forms make the adjuster’s job easier. Agents can use the JISO forms as a vehicle to make jewelry insurance more comprehensible to consumers. And policyholders have a record of the exact qualities of the jewelry they have insured.

FOR AGENTS & UNDERWRITERS

JISO 78/79 appraisals give the most detailed and reliable information.

JSIO 78/79 can be used only by a jeweler/appraiser who is a Graduate Gemologist and also trained as a Certified Insurance Appraiser™ (CIA). Consumers can go to the JCRS website to find a CIA in their area.

If there is no CIA in the area, suggest that clients take JISO 806 to any jeweler/appraiser. This form also prompts the appraiser for all details needed to properly insure jewelry.

Use JISO 18 to evaluate non-JISO appraisals for completeness.

All forms can be found at www.jiso.org.

FOR ADJUSTERS

Use JISO 18 to organize data from various documents, such as appraisals and diamond reports. If too much information is lacking and the valuation is substantial, consider consulting a jewelry insurance expert for help to avoid overpayment.

When pricing a replacement, use your JISO 18 evaluation. Do not give the replacement jeweler the appraisal valuation. Replacement quotes are generally 80-90% of the valuation, which may well be higher than retail if the valuation was inflated to begin with! You will get a more honest price if you have the jeweler submit a bid based on the jewelry’s description rather than on the appraisal valuation.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com