Insuring a Rolex - steps to take, things to consider

Insuring a Rolex - steps to take, things to consider

Appropriate coverage for a watch sometimes requires investigation. Here's an example.

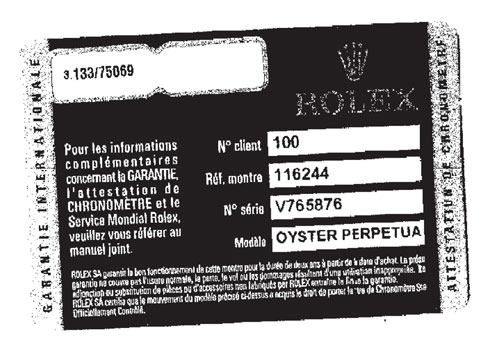

- The client wanted to insure his new Rolex and brought in the warrantee card.

The card is in French and names a European distributor as the authorized Rolex dealer. But it does not name the purchaser, as it should. A Rolex warrantee only holds for the original purchaser, which is why the purchaser's name should be here. The insurer wondered why a date of sale was filled in, but not the purchaser's name. - The client said he bought the watch from a store in California, not in Europe. He said he knew the store was not an authorized Rolex dealer. In further conversation with the underwriter, the client mentioned that the retailer said the watch was new and had only recently arrived from New York.

What we have so far: This watch, presented to the customer as new, had passed from an authorized Rolex dealer in Europe to a New York entity (probably not an authorized Rolex dealer) and then to the California retailer (definitely not an authorized Rolex dealer)—and perhaps through others along the way—before it reached the customer. - Rolex considers any watch not acquired directly from an authorized dealer to be second-hand—not new—regardless of whether or not it has been worn.

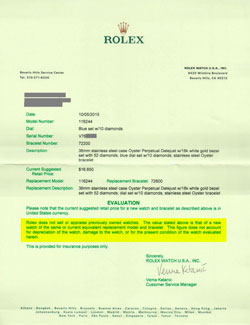

The watch was sent to Rolex for an appraisal. What came back was not an appraisal of this watch, but a description of that model watch and the suggested retail price for a new watch of the same model.

Rolex's response authenticated the watch, substantiating the seller's claim that this was a genuine Rolex and not a fake. This is important verification, since Rolex is the #1 faked watch, as we've discussed in an earlier issue on counterfeiting Rolexes.

- The insurer had an expert look into the details of the watch. It turned out that the model of the watch, Oyster Perpetual, is still made, but the serial number indicates that this particular watch was made prior to 2009.

So we can guess a little of the watch's history. The authorized dealer in Europe had this watch and probably others sitting in inventory for several years and decided to move them along. He sold them at a reduced price to another retailer, who also moved them along, and eventually they wound up at the California store. Such activity is not uncommon, but is it ethical? Was the age of the watch disclosed? Probably not.  This watch is no longer new, as the retailer claimed. If it was priced as a new watch, the customer overpaid, and he was probably not told that the watch is no longer under warrantee by Rolex but by the dealer. Whether or not the watch has been worn, Rolex doesn't consider it new, and neither should the insurer.

This watch is no longer new, as the retailer claimed. If it was priced as a new watch, the customer overpaid, and he was probably not told that the watch is no longer under warrantee by Rolex but by the dealer. Whether or not the watch has been worn, Rolex doesn't consider it new, and neither should the insurer.

Insurer's problem: Valuation

The document from Rolex states, under "EVALUATION":

Rolex does not sell or appraise previously owned watches. The value stated above is that of a new watch of the same or current equivalent replacement model and bracelet. This figure does not account for depreciation of the watch, damage to the watch, or for the present condition of the watch evaluated herein.

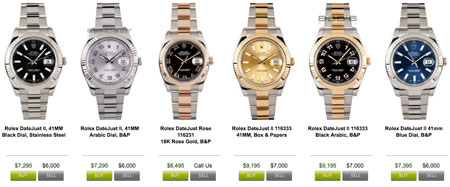

Rolex gives as replacement value the MSRP (manufacturer's suggested retail price) of a newly made Oyster Perpetual. And this is what many appraisers would do for watches—look up the price of the current model and list that on the appraisal. Is such a valuation reasonable?

For all jewelry, the settlement is determined by the value of the piece at time of loss. Unlike other jewelry, watches are subject to depreciation.

While other jewelry may increase in value based on market fluctuations for gems and metals, watches (except in the rare case of a collector's item) decrease in value over time. They are mechanical in nature and parts can wear out. The manufacturer generally makes improvements on any given model, so even if the watch hasn't been worn, an older one most likely is not like the newest model.

As you would not replace a 7-year-old Lexus with a new one, neither should you replace a 7-year-old Rolex with a new one.

Another important point about valuation: Most authorized Rolex dealers offer discounts of 15-20% on new watches. So, even for a new Rolex, the MSRP is inappropriate because it doesn't reflect the usual retail price. To value a vintage watch with the MSRP of a new one is especially unfair and misleading to the customer. Such a valuation sets up the consumer for higher premiums than necessary and, in case of a loss, false expectations about the settlement.

Check out our more detailed discussion of excessive valuations of Rolexes.

New for new, vintage for vintage

The insurer is obligated to replace with like kind and quality. For a loss claim on a new watch, one that is still under Rolex warranty, the company would properly replace it with a like-model new watch.

For an older watch, the insurer would go to the huge secondary market for vintage watches (that is, the used watch market) and find a model comparable to the one lost. The ever-growing online vintage Rolex market has been described as "bursting at the seams."

For a cash settlement, the settlement amount would equal the insurer's cost for a replacement from the vintage market—just as is done with automobiles!

FOR AGENTS & UNDERWRITERS

Customers may be surprised to learn that a Rolex from an unauthorized dealer is not covered by Rolex's warrantee, even though the customer has the warrantee card and the watch has never been worn. Many consumers are not aware that luxury watches bought from sources other than an authorized dealer may be counterfeit, despite any logos or trademarks.

Ask for the sales receipt. If the seller was not an authorized Rolex dealer, the watch is regarded by Rolex as previously owned. And there's also the possibility that it is counterfeit.

Insuring a vintage Rolex for the value of a new one means

- excessively high premiums for the insured;

- false expectations about a loss settlement, resulting in customer ill will;

- moral hazard, if insured realizes his vintage watch will be replaced with a new one.

Insisting on complete information about the watch protects both the policyholder and the insurer.

Not all jewelers or appraisers are competent to appraise luxury watches—to open the watch and inspect it, to judge the authenticity of the watch and all its parts, and to recognize non-authorized aftermarket add-ons or even out-and-out fakes.

It may be necessary to send a Rolex to an authorized dealer, or to the company itself, for an appraisal. This may seem pricey to the insured, but it should be considered part of the price of owning a luxury brand-name watch. Rolex can verify that the watch is genuine Rolex in all its parts.

FOR ADJUSTERS

With the exception of rare collector pieces, watches begin losing value as soon as they walk out the door, just as cars decline in value the minute they drive off the lot.

Do not replace a vintage Rolex with the current model. The customer is not entitled to betterment with a new model. Seek a replacement of like kind and quality in the vintage watch market.

Be on guard against fraud. If a policyholder discovers he has inadvertently purchased a counterfeit watch he may decide to lose it and cash in.

Losses on men's Rolexes can be expensive. If you suspect a watch is counterfeit, consider consulting a jewelry insurance expert to help resolve the issue.

Before settling a claim on a Rolex, you may find it useful to review our series on Reasons Not to Insure a Rolex.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com