Bogus Diamond Certificates and Appraisals

How can you tell a reliable diamond certificate from just another advertising tool?

How can you tell a reliable diamond certificate from just another advertising tool?

“Certified diamonds” have a remarkable draw in jewelry sales. Consumers realize they have little expertise in judging diamonds, so they rely on paperwork to prove the value of what they are buying.

Retailers are offering this proof. Zales, a major jewelry chain, started certifying large diamonds five years ago. Because customers have come to expect certificates, many stores, including online retailers, now supply them even for low-cost fashion items.

However, not all diamond certificates are reliable.

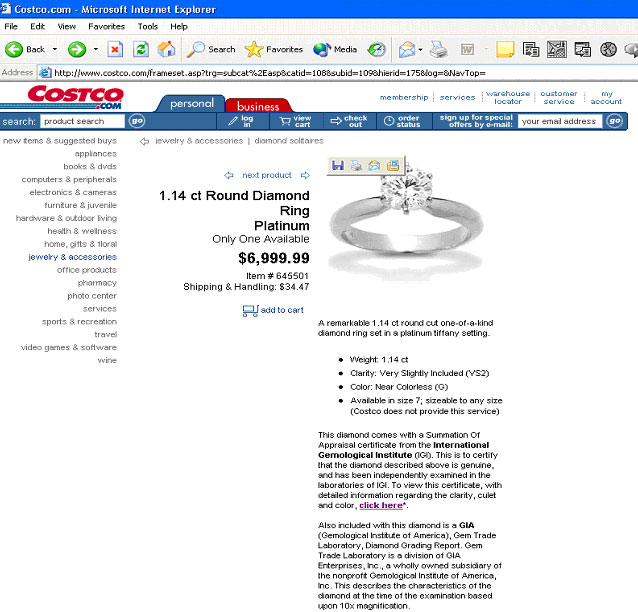

Example 1:

The new trend among large retailers is to supply documents that carry valuation. For example, Costco offers on its web site a 1.14-carat diamond ring that retails for $6,999.99. It comes with a “Summation of Appraisal” certificate placing its value at $12,955.

How can a buyer pass up such a bargain? The ring is worth twice its price -- and here’s a certificate to prove it!

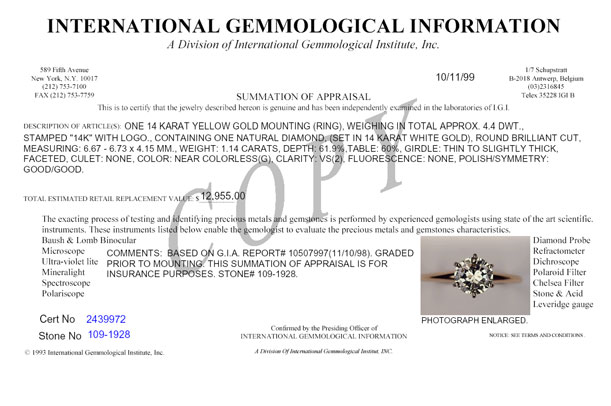

Example 2

Another item for sale through Costco is a 3.06 carat diamond ring selling for $31,699.99. The certificate that accompanies the purchase puts the value at $61,480.

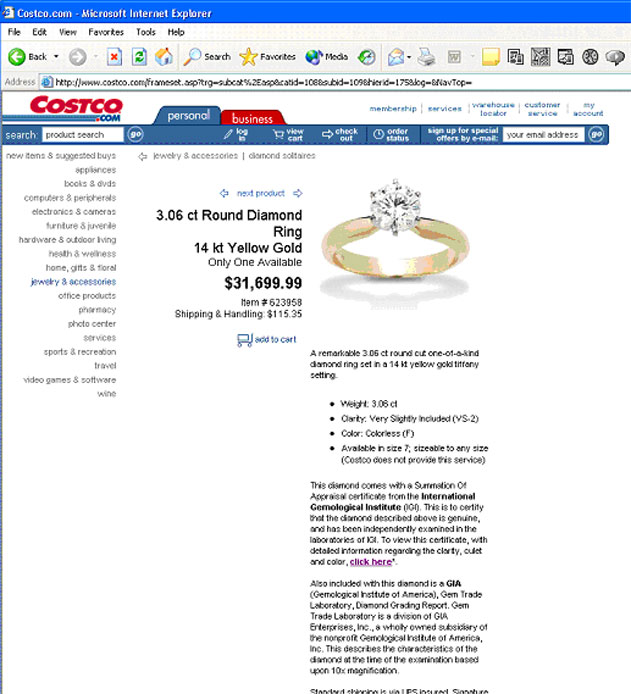

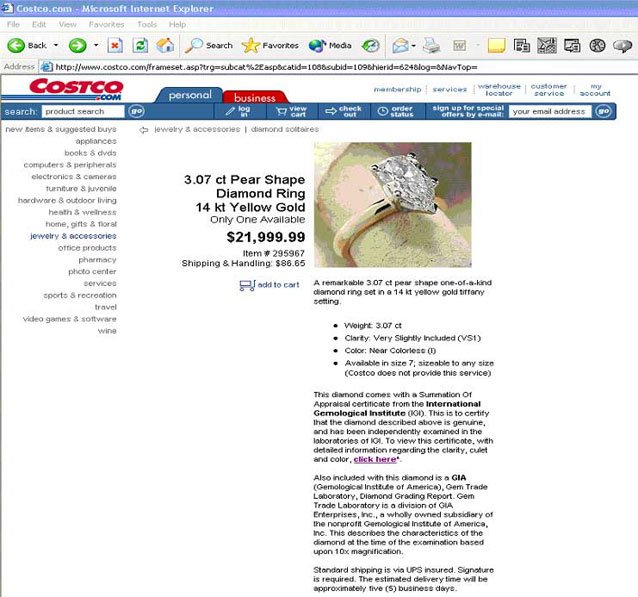

Example 3

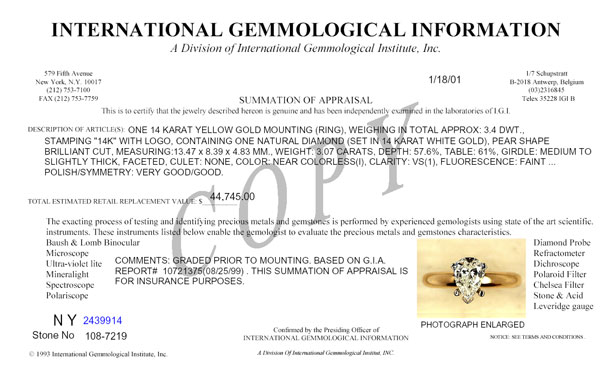

Costco offered this 3.07 carat diamond ring for $21,999.99, but its certificate gave it a valuation of $44,745.

These examples are typical of the discrepancies between selling price and valuation.

What’s going on here?

Can Costco afford to sell its jewelry at half the price of other retailers, simply because of its high volume? The answer is: No.

If you were to buy that $22,000 ring in a retail store in a small town in the Midwest, would you have to pay $44,745? Highly doubtful. It is often argued that jewelry prices in, say, New York City are lower because there is more competition. However, in the Midwest rents and salaries are lower, so things pretty much balance out. And everyone is in competition with the web. Jewelry is ultimately a national market, not a local one.

What’s going on here is a subtle scheme. Costco’s jewelry is, in fact, fairly priced. The valuations, however, are totally unrealistic.

Independent analyses of the stones’ qualities (as described on the website) show that the selling prices are quite competitive. These rings, if the quality is as described, are good deals.

The purpose of offering a certificate that places valuation at double the selling price is to lure consumers into making the purchase. The “Summation of Appraisal” comes from a lab with an official sounding name. It has a certificate number, a stone number, a photograph of the jewelry. Internet shoppers, especially, expect bargains, and this certificate acts as evidence they are getting a bargain.

Insurers, take note:

The customer gets what he pays for, but here’s the danger for insurers. The document states: “This summation of appraisal is for insurance purposes.” If the insurer sees only this document and not the sales slip or an independent appraisal, the policy will be based on the inflated value rather than a realistic one.

A reliable certificate

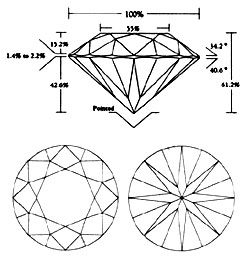

A reliable diamond certificate is a detailed description of the stone prepared by a respected independent laboratory, such as the GIA or AGS. Its purpose is to verify the quality of the diamond. A certificate from an independent lab does not carry valuation, since valuation isn’t the domain of the lab.

FOR AGENTS & UNDERWRITING

Do not rely on diamond certificates that carry valuation, as these valuations are often inflated and the description may not be accurate. Ask to see the sales receipt.

Ask for a descriptive appraisal and valuation by a graduate gemologist, preferably a Certified Insurance Appraiser™, who has examined the stone.

Be attentive with jewelry from large retailers, especially when the purchase price is significantly below the certified valuation.

For large retailers, certificates and other appraisal documents are sales tools. You have no way of knowing whether a certificate supplied by a retailer represents the jewelry actually purchased. The same is true for online purchases.

Even certificates from respected authorities such as GIA and AGS leave out information crucial to valuation, such as mounting data. For quality jewelry, always ask for a descriptive appraisal, preferably on JISO 78/79.

FOR CLAIMS

If the insured item has only a certificate by a suspect lab, the valuation is probably inflated.

If the valuation on a certificate is much higher than the purchase price, the valuation is probably inflated.

In pricing a replacement, use descriptive information from the certificate or appraisal to get competitive bids. Don’t automatically turn to the seller for replacement.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com