Agents: Do you know who you're doing business with?

When a client comes to you for jewelry insurance, your first thought may be to just put it on their Homeowners policy. In some cases this is a fine choice, as long as the HO policy covers the client. Check these caveats if you're not sure.

When a client comes to you for jewelry insurance, your first thought may be to just put it on their Homeowners policy. In some cases this is a fine choice, as long as the HO policy covers the client. Check these caveats if you're not sure.

But if coverage on the HO policy is not appropriate, where do you go?

Do you comparison shop to get the best deal for your client? And to avoid shooting yourself in the foot?

Maybe an agent would call various insurers for quotes.

The agent may get someone on the line, tell them what the item is and its appraised value, and get a quote. Some insurers even have websites where agents (or consumers) can do-it themselves, type in that simple info and get a quote on the spot.

Based on the information the agent gave, it may turn out that several quotes are the same. The agent may decide to just pick one of the companies and be done.

But did the agent really get the best quote?

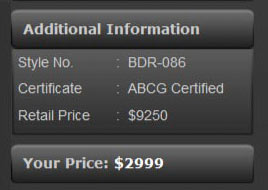

Listing shows a "retail price" over

Listing shows a "retail price" over 3 times the selling price

Here's a crucial consideration:

Is the insurer's quote based on an inflated valuation? Usually they are.

Any insurer who closely examines submission docs will see that the majority of jewelry valuations are inflated. And "inflated" can mean double or even triple the purchase price!

Valuations can be inflated for a number of reasons:

- The seller supplies an inflated valuation as "evidence" that the jewelry's true value is much higher than what the customer is paying; or

- The appraiser works for the jewelry store and so must support the seller's claims as to value and quality; or

- An appraiser doesn't want to alienate a client by saying the jewelry is worth less than the seller claims; or

- The appraiser is unfamiliar with jewelry insurance; or

- The appraiser is untrained or incompetent; or

- The auction site seller knows customers expect online purchases to be bargains, so increases the "regular retail price;" or

- Seller on a cruise ship or at a tourist site knows the customer is buying on impulse and can't get an independent appraisal until returning home.

- In short, an inflated valuation makes the customer receptive. It's a sales gimmick that works.

.jpg) Luxury jewelry for sale aboard cruise ship

Luxury jewelry for sale aboard cruise shipWe've discussed the prevalence of this deceit in several JII issues, including Inflated appraisals—Alive and well and Is the appraisal good enough?

The underlying attitude is that the inflated valuation is "only for insurance." The customer goes away happy and no one is harmed by the deception.

Well, that's just not true. If premiums are based on an inflated valuation, the insured is paying excessive premiums -- every year!

Many insurance companies ignore this issue, or are not aware of it, and simply base their quote on the valuation given on the appraisal. The insured pays higher premiums than necessary but doesn't know it.

But how does a non-gemologist (like an agent or an underwriter) even know a valuation is inflated?

Some insurers use proprietary software to determine the appropriate retail value based on the jewelry's description. This is the best approach, as it keeps valuations (and premiums) appropriate from year to year. It also saves the insured the cost and inconvenience of having to get updated appraisals.

Lacking such software, an insurer or agent can ask for the sales receipt, knowing that the price actually paid will reflect market value more accurately than an inflated valuation.

If an agent sees a huge discrepancy between purchase price and valuation, it's worth taking the time to explain to the insured that an inflated valuation does them no service, it just means higher premiums.

What about cash settlements?

Consumers often assume that, in the event of a claim, they will get the insured value in cash—and if that value is inflated, they'll even come out ahead.

Take a moment to explain that this is not the case! In a cash settlement, they would receive the amount that it would cost the insurer to replace the jewelry at time of loss, and that cost is based on the jewelry itself, as described in the appraisal, not on the possibly inflated valuation.

It's important to know whether the company even offers cash settlements. Cash is an option most insureds expect, but may not think to ask about until a loss occurs. Typical insurers will only repair or replace the jewelry, and that repair/replace business will likely go to a jeweler who has previously agreed to recommend this insurer to the store's customers.

Very Important Question: Does the insurer cross-sell?

This answer may surprise you!

Many agents who don't have a market for personal jewelry insurance, or who simply don't want to deal with what they consider small potatoes, will just refer clients to an insurer that specializes in jewelry insurance. If you're like these agents, be careful!

One prominent insurance company that advertises its focus on jewelry insurance has a wholly-owned affiliate agency that provides all kinds of insurance services – both Personal & Commercial. Agents who send their insureds – or send away potential insureds – to that company are also supplying leads to a large full-service insurance agency.

A client you refer for jewelry insurance soon becomes a policyholder with that company and receives unsolicited information from the company's affiliated agency. If you have other insurance with that client – auto, homeowners, business policy, you name it – all that business is at risk for cross-selling.

The jewelry website of that company does not link to, or even mention, its full-service affiliate, but its insureds do receive links to the affiliate agency site. Every client sent to this company for jewelry insurance could be cross-sold for all their insurance.

FOR AGENTS & UNDERWRITERS

It's good practice for an agent or underwriter to always ask for the sales receipt and include it with the submission documents. As most agents and underwriters do not have the necessary training and tools to determine the ACV of jewelry, the sales receipt is your best indication of inflated valuation.

If there is a huge discrepancy between purchase price and appraisal valuation, the actual price paid is likely to be a reasonable indication of market value.

If the valuation is extremely inflated, it's possible that the jewelry's qualities are also not to be trusted.

Basing premiums on an inflated valuation constitutes moral hazard. If the insured later discovers they've been paying excessive premiums, they may decide to "lose" the jewelry and file a claim.

Be especially cautious about vacation jewelry. Jewelry sellers on cruise ships, group excursions, and in popular tourist areas are notorious for inflating value (and quality) because their customers are tourists. Vacationers are generally in a receptive mood, they tend to buy on impulse rather than comparison shop, and they will have no recourse if the quality turns out to be not what they were promised.

FOR ADJUSTERS

Compare appraised value with the sales receipt. If the appraisal valuation is significantly higher, the actual purchase price is a better indication of value. If there is no sales receipt on file, ask the insured for it.

On a damage claim, ALWAYS have the jewelry examined in a gem lab that has reasonable equipment for the job and is operated by a trained gemologist (GG, FGA+ or equivalent), preferably one who has additional insurance appraisal training, such as a Certified Insurance Appraiser™. Such an exam can verify that information on the appraisal is true, and that the condition of the gem is not due to inherent vice. It may also provide missing appraisal information.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com