Insuring Bling

Insuring Bling

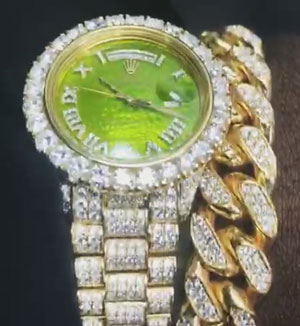

If that picture caught your eye, that's exactly what bling is meant to do.

Bling is showy. Flashy. Ostentatious. If sparkle made a sound, it would be Bling!

Well, what's wrong with eye-catching jewelry? Let's take an insurer's look at bling.

Bling bling—or its shortened form, bling—draws attention. An important role of bling jewelry is to display the wealth and success of the wearer. Though cheap bling (heaped with CZ, for example) may just be showy, bling encrusted with diamond can be expensive.

Aside from the usual attention required for insuring high-value jewelry, bling is a special case requiring additional caution.

The insurer experience

Underwriters received an application for insurance on six jewelry items, including necklaces, a pendant, a bracelet and a Rolex. A photo of the jewelry was included with the application. The total value of the jewelry was given as $176,899.

The insurer took one look at the application and decided to decline coverage. The jewelry was bling.

Photo from submission

Photo from submissionHere's the fuller story:

The submission included a single photo, showing parts of all 6 pieces. It was a poor-quality photo, a rather casual shot.

Accompanying the submission was a 10-second video clip of a pendant, presumably like the one in the photo. The screen carried the seller's name, in a format suggesting the clip had been lifted from Instagram. The applicant gave that seller as the source for other pieces as well.

What's wrong here? A video on Instagram is done to catch the eye, not to show jewelry details. An online video from a seller is no proof that the applicant owned the jewelry. A video, even a decent one, is a clumsy thing for showing jewelry details and it's difficult, if not impossible, for insurers to store and use.

Image from submission video

Image from submission videoAnother serious problem: who is the seller? The seller named on the video and on the application for insurance has no Internet site nor any apparent brick-and-mortal location.

Also submitted was a 30-second cell phone video clip of the gem-laden watch being displayed on the owner's wrist. The darkness of the video, and the dance music playing in the background!, suggested the filming occurred at a nightclub.

The jewelry was bling, and it was out on the town!

As we've pointed out before, bling attracts attention, and bling on a Rolex attracts even more. It's often entertainers, athletes, celebrities — and those who aspire to hobnob in that crowd — who go in for extravagant jewelry. Surrounded by enthusiastic fans or crowds in high spirits, they may become less cautious about the safety of their jewelry. Nightclubbing, walking the streets in the small hours, can be risky business, and flashy jewelry is an easy target for thieves.

Watch iced out in CZ selling for $150 on Internet

Watch iced out in CZ selling for $150 on InternetA lifestyle that puts the jewelry at increased risk is reason enough for an insurer to be wary, and there was more justification for declining coverage in this case. The client represented this jewelry as expensive, but how do we know? All that glitters is not gold. Or diamond. Or valuable. Iced-out bling is available on the internet for under $100.

This submission had no appraisals to describe the jewelry's quality and verify its value. There was no evidence at all that the stones being passed off as diamonds were not some cheap imitation, such as cubic zirconia.

If the sale originated in response to an Instagram post, the seller may well have given the buyer inflated valuations for the jewelry, and may also have exaggerated the jewelry's quality.

It is frequently the case, especially with internet purchases, that the seller inflates the valuation of jewelry to far beyond the purchase price. Our earlier issues, Valuation inflation keeps on keeping on and Moral hazard – alive and well, give examples of this practice and discuss the problems it creates for insurers.

In this case, the insurer had only the client's word even for the purchase price. The client stated that the jewelry had not been previously insured. Yet if this was all new jewelry, why were there no sales receipts? Since the seller seemed dubious, it's possible that the jewelry was a gift or payment in kind, and there are no docs. And that would make the stated values even more suspect.

There was also no warrantee paper for the Rolex. Counterfeit watches are big business! All name-brand watches sold by authorized dealers come with a warrantee, and an insurer would be foolish to cover an expensive luxury watch without this evidence of authenticity.

The name of the seller of this watch had no internet presence, so it's more than likely the watch had after-market additions or fake parts, or it may well have been a complete knock-off. See Frankenwatches for a real Halloween scare story!

FOR AGENTS & UNDERWRITERS

Bling is showy. It signals status and is typically worn in venues where it will be widely seen. That means increased risk of theft.

Some insurers choose not to cover jewelry worn by entertainers, athletes and others whose lifestyle makes their jewelry an easy target for thieves. Other insurers will cover such jewelry but are able to charge a higher premium to offset the increased exposure.

Never insure high-value jewelry without an appraisal from a trained gemologist who is independent of the seller. The best appraisal includes the JISO 78/79 appraisal form and is written by a qualified gemologist (GG, FGA+, or equivalent) who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

10:1 Annual production of |

Any gems on the watch, and the metal of each watch part, should be described in the same detail as for any other piece of gem jewelry. As you can imagine, detailed reporting on a watch encrusted with gems is extremely important to insurers.

The loss ratio for men's jewelry is much worse than for women's. And a watch, usually a Rolex, is the most frequently scheduled item of men's jewelry.

Ten times more fake Rolexes than genuine ones are put into circulation each year. These are the odds you face when insuring a Rolex.

ALWAYS ask for Rolex warrantee papers and a sales receipt. A new Rolex must come from an authorized dealer in that brand; otherwise it will not be considered "new" by Rolex, and it may even be a complete counterfeit.

Check out 12 Reasons not to insure a Rolex, to be sure you are acquainted with the issues around insuring this popular brand.

FOR ADJUSTERS

Be mindful of the moral hazard of excessively high valuations, which can cause the insured to try to come out ahead by "losing" the jewelry.

Though claims on luxury watches are relatively infrequent, they can be expensive. To guard against fraud:

- Check the appraisal for manufacturer, model and serial number, plus any other identifying information.

- Check for manufacturer warrantees and other evidence of authenticity. Some manufacturers sell only through authorized dealers. Merchandise bought online (or from other unauthorized sources) may be second-hand, or may be altered with cheaper parts, or may be a complete knockoff wearing a prestigious logo.

- The sales receipt is important evidence. If the seller is not an authorized dealer in that brand, the watch may be counterfeit.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com