Rapaport's New Year Message

Diamond and aquamarine pendant

Diamond and aquamarine pendantCourtesy of Brilliant Earth

Rapaport said that lab-made diamonds do not hold their value, and that their sellers are operating unethically because of lack of disclosure. These are strong accusations from an industry authority, pointing to issues relevant to insurers and to consumers.

We ask: Is he right?

Who and what is Rapaport?

Rapaport Price List, first published in 1978 and updated weekly, is the diamond industry's leading price list for mined diamonds. The Rap List is based on the "high" asking price, from which jewelers often discount as much as 40%. Jewelers may use the Rap List to show consumers the "good deal price" they are receiving.

So there was quite a stir in the industry when Martin Rapaport, publisher of the price list for mined diamonds, opened the new year with a message inveighing against lab-grown diamonds.

From Rapaport's message:

Our trade is willfully destroying the underlying value of diamonds as a store of value through the marketing, promotion and sale of synthetic diamonds as a replacement for natural [mined] diamonds.

Many—if not most—in our trade are operating dishonestly and unethically by failing to make a full disclosure about the value retention of synthetic diamonds compared to natural diamonds.

Despite their lack of natural scarcity, [lab-made diamonds] are sold as comparable to natural diamonds without full disclosure as to their inability to retain value.

Is Rapaport right?

Value retention

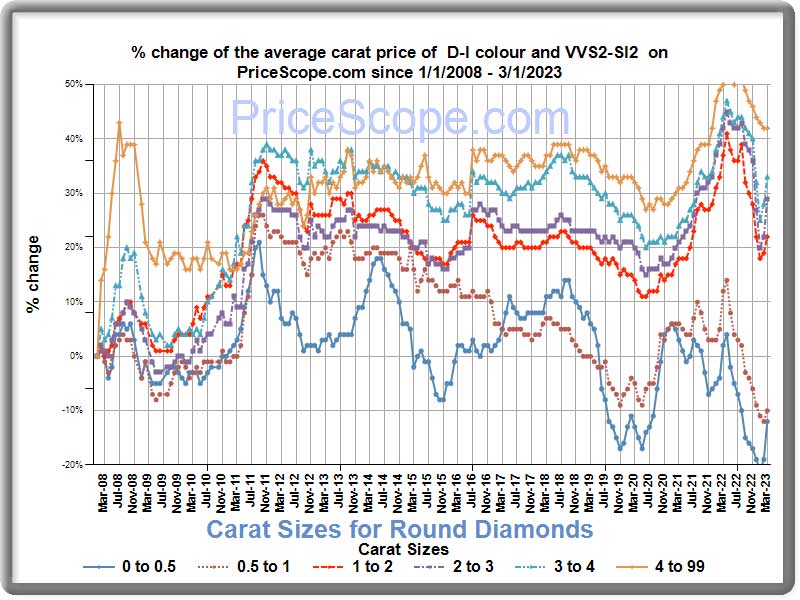

We may read about famous diamonds of exceptional size, color and clarity, like the 3,106-carat Cullinan, which eventually wound up in the Crown Jewels. Or we hear of diamond jewelry bought by a celebrity for some astronomical price, with a value that increases each time the piece is sold. But such gems are truly exceptional. The vast majority of diamonds, whether mined or lab-made, are not in this league. Their values do not automatically increase over time—as shown in the graph.

Lab-made diamonds do retail for substantially less than mined diamonds of similar quality, but marketplace competition may wind up lowering the prices of mined diamonds as well. As gem-making technology advances, we can expect even more price flux.

In any case, it is unwise to buy gems as an investment. Consumers would have a hard time selling them for their original price (if at all!), as the retail price will always be significantly higher than what a jeweler would pay for similar gems.

Bridal Ring, white and rose gold with diamonds

Bridal Ring, white and rose gold with diamondsCourtesy of Chatham Created Diamonds

Oddly, surveys suggest that value-retention is rarely on a consumer's list of important concerns. Most purchasers are looking at price, size, beauty, and perhaps the ecological impact of gem mining or manufacturing. They may have a foggy sense that diamonds have enduring economic (as well as romantic) value, but they're not thinking about selling that engagement ring sometime down the line.

Disclosure

The FTC Guidelines, which are interpretations of laws against false advertising, are very clear about the importance of disclosure in marketing. Advertising for lab-made diamonds should clearly state their origin in a lab, so buyers know what's being offered and can do appropriate comparison shopping.

And if "value retention" is an issue for disclosure, mined as well as lab-made diamonds would require explanations of how market value works.

"Synthetic" v "Natural"

It comes off as openly hostile to persist in using the term synthetic, when even the FTC no longer recommends this term because it is often misunderstood to mean imitation. GIA grading reports now use the term laboratory-grown, rather than synthetic. Other common terms are lab-made, man-made, lab-grown, created or lab-created. In the trade, a widely used descriptor is LGD, for lab-grown diamond.

Ring with lab-made yellow diamond

Ring with lab-made yellow diamondUsing synthetic conveys the sense that lab-made diamonds not real diamond. Calling mined diamond natural is also provocative, and this term is no longer part of the FTC's definition of diamond. In fact, lab-made diamond is identical to mined diamond chemically, physically, visually, and in durability and beauty.

Scarcity

It's true that lab-made diamonds are not scarce — in fact they are increasingly less scarce. But is scarcity a primary foundation of diamond's value?

De Beers made diamonds scarce deliberately to increase their market value. The truth is that gem-quality mined diamonds are quite plentiful, while a number of less expensive gems, such as alexandrite or tanzanite, are much rarer. Today it is safe to say that it's the romantic heritage (and marketing) that makes diamond the popular choice for engagement rings, not the gem's scarcity.

Tilting at Windmills

Addressing others in the trade, Rapaport said:

Consumers who have spent thousands of dollars on diamond engagement rings only to find that their value has shrunk to hundreds, or even tens of dollars will remember the names of the companies that sold them the synthetics. Is your long-term reputation worth the short-term synthetic profits?

In an industry magazine, jewelry retailer Cliff Yankovich responded by asking his readers: Do you get mad "that your favorite electronic device is actually cheaper than it used to be? Do you hold the salesperson responsible because you can now get a bigger TV with better definition or a more powerful computer for less money?"

Lightbox earrings with pink diamonds

Lightbox earrings with pink diamondsAn increasing number of jewelers and online sites are selling lab-made diamonds. Quality and size are improving. Consumers are becoming more knowledgeable about gems and jewelry, and they appreciate having more choices. Prices are in flux, and the market is accommodating increased variety and changing tastes. Lab-grown diamonds are here to stay.

FOR AGENTS & UNDERWRITERS

Lab-made, man-made, laboratory-grown, created, cultured and synthetic are some terms describing real (not imitation) diamond made in a lab.

For insurers, the distinction between mined and lab-grown diamond is important because of the valuation difference and because of the need to replace with like kind and quality.

If lab-grown diamond is passed and priced as mined diamond, the appraisal valuation may be grossly inflated.

Don't assume a diamond is mined just because the appraisal doesn't say it's lab-grown. The appraisal should specifically state whether the stone is mined or lab-made. Be sure to read all the fine print on the appraisal.

It's always best to ask for the sales receipt, which will likely reflect the value of the jewelry. A large discrepancy between purchase price and valuation may indicate a lab-made diamond with mined-diamond valuation; or it may point to an inflated valuation on a "feel good" appraisal used as a selling tool.

As production of lab-grown diamonds increases, their price will go down. To be competitive, mined diamond prices may also decline. On the other hand, since the supply of diamonds from the earth is limited, values of mined diamonds may go up. The situation highlights the importance of keeping valuations up to date. This goes for policies already in place as well as for new coverage.

A diamond of one carat or more may have a grading report from a reliable lab. We recommend the following labs, and you can use these links to verify reports you receive. The lab reports distinctly state whether the diamond is mined or lab-made.

GIA Report Check

AGS Report Verification

GCAL Certificate Search

Note that grading labs may offer several reports, with higher-priced reports giving more information. (See GIA's reports on lab-grown diamonds.) Be sure the report you get has all the necessary information.

The best appraisal includes the JISO 78/79 appraisal form and is written by a qualified gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

FOR ADJUSTERS

Lab-made, man-made, laboratory-grown, created, cultured and synthetic are terms describing real (not imitation) diamond made in a lab.

Mined diamond has a substantially higher valuation than lab-made diamond. If the appraisal or lab report does not explicitly state whether the gem is mined or lab-grown, use every means possible to determine which it is. If possible, interview the seller!

Deliberate non-disclosure is always possible.

Be especially diligent with colored diamonds, which are very expensive for mined diamond but easily produced in the lab. For example, Lightbox (owned by De Beers), sells its pink and blue diamonds at the same price as its colorless diamonds.

Sales receipts and proof-of-payment docs are often helpful in establishing whether a diamond is mined or lab-made. Read the fine print!

Take note of brand names on the docs, as some names may indicate producers or retailers of lab-made stones.

On a damage claim, ALWAYS have the jewelry examined in a gem lab that has reasonable equipment for the job and is operated by a trained gemologist (GG, FGA+or equivalent), preferably one who has additional insurance appraisal training, such as a Certified Insurance Appraiser™.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com