Love Is in the Air

The big commercial push starts on Black Friday. With jewelry, that push continues right up to Valentine's Day, and the jewelry that gets the biggest flourish of advertising is the engagement ring.

The big commercial push starts on Black Friday. With jewelry, that push continues right up to Valentine's Day, and the jewelry that gets the biggest flourish of advertising is the engagement ring.

An engagement ring is, of course, special to the giver and to the recipient. Engagements rings are also the bread and butter of jewelry retailers.

For insurers, the engagement ring is a jewelry item requiring special attention.

The pesky valuation issue

The pesky valuation issue

An engagement ring is an emotionally weighted gift. The beauty of the jewelry as well as its value represent the love and commitment of the suitor. Typically, he shops for the ring alone, in advance of his proposal, to surprise his beloved.

Once he makes his choice, the retailer obligingly presents him with an appraisal showing a valuation substantially higher than the purchase price. The jeweler assures the customer this valuation shows what the ring is "really worth," and that the customer has received a special discount. Indeed, the store's ads may have promised just that.

An insurer then receives an application for coverage of this engagement ring. The submission includes the jeweler's appraisal. The insurer asks for the sales receipt, and the woman says the ring was a gift so she has no receipt. Perhaps she can't supply the receipt because the groom-to-be "lost" it.

This scenario is quite common. (It would be even more common if more insurers made a point of asking for the sales receipt.)

This scenario is quite common. (It would be even more common if more insurers made a point of asking for the sales receipt.)

The groom's motivation for concealing the sales receipt is that the man wants his beloved to think he spent more than he did. The store's motivation in supplying the customer with an inflated appraisal is to cement the customer's good will: the purchase was a bargain, this is a good place to shop. Even independent appraisers may inflate valuations to please, and to keep, their clients.

The insurer's motivation in asking for the receipt is that the price paid is usually the best indication of the jewelry's market value. If there is a huge difference between purchase price and valuation, it's likely that the valuation is inflated and/or that the item's quality is inflated.

The insurer's motivation in asking for the receipt is that the price paid is usually the best indication of the jewelry's market value. If there is a huge difference between purchase price and valuation, it's likely that the valuation is inflated and/or that the item's quality is inflated.

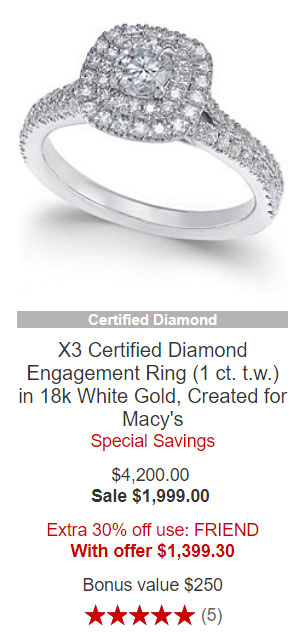

Many jewelry retailers artificially inflate "regular" prices so they can lure customers with spectacular discounts.

The promotion shown here advertises 70% off, "plus an extra 10% off." Is a discount of 80% realistic?

In Deceptive Pricing, we discussed a lawsuit brought against J.C. Penny Co. for hiking up prices in advance of a sale so they could advertise price reductions. The court's decision was disheartening, but reading the story will give you an idea of just how widespread this practice is.

Jewelry appraisals supplied by the seller basically function as sales tools and often have inflated valuations. To verify their quality and prices, retailers may write appraisals on their own merchandise, or supply appraisals from anonymous appraisers, or accompany purchases with "certificates" from bogus labs. Appraisal Inflation – It Keeps On Keeping On gives a view of this ongoing problem.

Moral hazard

As one insurer put it, "Engagement rings are packed with moral hazard." Suppose the couple break up before the wedding. Who gets the ring? He, because he paid for it? Or she, because it was a gift? Whose name is on the policy? In Who Owns the Ring? we discussed a court case on this very subject and raised some questions for insurers to consider.

When a couple break up, maybe they'll decide she should keep the ring and he will claim a loss. That way they both win. Many insureds expect a cash settlement, and he may even expect the (inflated) appraisal valuation of the ring as settlement – which would be a real win. The last thing he wants is a replacement!

FOR AGENTS & UNDERWRITERS

For insuring jewelry, it is best to have both parties with an "insurable interest" named on the policy. This is especially advisable for all couples, whether married, engaged (or about to be engaged!), or partnered.

For insuring jewelry, it is best to have both parties with an "insurable interest" named on the policy. This is especially advisable for all couples, whether married, engaged (or about to be engaged!), or partnered.

There's nothing so convincing to consumers as a piece of paper that says: What you are buying is really worth more than we're charging you! Because they serve as sales tools, to impress consumers, appraisals and certificates supplied by the seller are likely to be inflated.

Ask for the sales receipt for recently purchased jewelry. If there's a huge difference between appraised value and purchase price, the purchase price is a more accurate indicator of value.

If there is a large discrepancy between the sale price and appraised value, urge the policyholder to get an appraisal on JISO 78/79, the insurance industry's standard.

Recommend that your clients get an appraisal from an appraiser independent of the seller as soon as possible after the purchase, to verify that the quality and value of the jewelry are as stated by the seller. The appraiser should be a trained gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

FOR ADJUSTERS

Compare the appraised value with the sales slip, if available. Jewelers are required to hold sales receipts for at least three years, so if the insured doesn't have the receipt, contact the jeweler.

If there is a large discrepancy between valuation and selling price, the selling price is a truer indication of value.

If a claim is made for damage, always have the damaged jewelry examined in a gem lab by a trained gemologist (GG, FGA+, or equivalent), preferably one who has additional insurance appraisal training. One course offering such additional training is the Certified Insurance Appraiser™ (CIA) course of the Jewelry Insurance Appraisal Institute.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com