Non-Disclosure:

Following a Trail of Deception

The jewelry to be insured was a lady’s diamond wedding set, with a valuation of $18,900. A Certificate of Authenticity, including a picture, arrived with the policy application. Most insurers would regard this as a pretty straightforward matter and simply insure the rings for $18,900.

The insurer who received this particular application declined coverage. To discover why, follow along as we check the docs to see what they reveal.

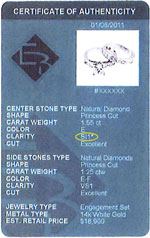

Certificate of Authenticity

This is a wallet-size card with basic descriptive information about the jewelry. The word “Excellent” occurs a couple of times, and the estimated retail price is given as $18,900.

This is a wallet-size card with basic descriptive information about the jewelry. The word “Excellent” occurs a couple of times, and the estimated retail price is given as $18,900.

Suspicious: Although specific gem grades may not have much meaning for an agent or underwriter, what should arouse suspicion is that little asterisk after the Clarity grade SI1* — because there is no explanation for the asterisk.

Suspicious: Who issued this card, who declares these details are true? Who is EB? We’ll find out.

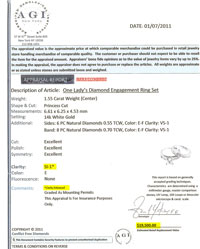

Appraisal Report

The insurer requested an independent appraisal, and this Appraisal Report was submitted.

The insurer requested an independent appraisal, and this Appraisal Report was submitted.

Suspicious: An appraisal should be addressed to the person requesting it, but this report is not addressed to anyone. The industry is thick with “canned” appraisals, prepared in quantity, to accompany a type of jewelry. It is possible (likely?) that this particular piece was never examined in a gem lab.

Suspicious: Who is AGI? This looks something like a lab report, but it is not from a well-known lab recognized as reputable. Also, an independent lab only describes quality, not market value.

Suspicious: This report is dated one day after the invoice/sale date, so presumably it was sent by the seller. The question arises: is AGI owned by the seller? What is their business relationship?

The Appraisal Report has a little more information than the Authenticity card; for example it describes the small diamonds. AND it explains the asterisk next to the Clarity grade: the center gem is clarity enhanced.

Suspicious: This disclosure of a clarity treatment, given in very tiny type, should be LOUD AND BOLD because it greatly affects valuation. (More about valuation below.)

Suspicious: Disclosing the clarity treatment only here is very misleading. Was the buyer told at time of sale that the stone was treated, and was he told what that means? The document originally submitted to the insurer did not contain this important valuation information.

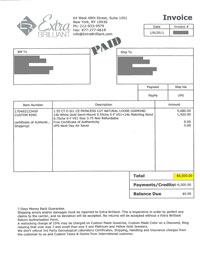

Invoice/Sales Receipt

Insurers who don’t require sales receipts on new purchases miss some important clues to problematic issues.

Insurers who don’t require sales receipts on new purchases miss some important clues to problematic issues.

Suspicious: Because the buyer lived a great distance from the seller (client’s privacy protected in these illustrations), the insurer suspected this was an internet purchase. Indeed, it turned out the purchase was through eBay. Please check out our earlier issue, where we discussed cautions about eBay purchases in some detail.

Suspicious: After the item’s description is the phrase “Non-Refundable.” Printed text at the bottom says “7 Days Money Back Guarantee.” Aside from the obvious contradiction, even 7 days is not a sufficient time to receive the jewelry by mail, get it appraised by an independent Graduate Gemologist, and then return it if it’s not of the stated quality. A miserly return policy is a red flag, and a no-refund policy for expensive unseen merchandise is inexcusable.

Suspicious: ExtraBrilliant, the seller, is also EB, the issuer on the Certificate of Authenticity (with its unexplained asterisk), so the Cert is not a supporting document from a separate source.

A link from ExtraBrilliant’s eBay website allows a buyer to purchase for $60 “a third-party certificate,” – which is the Appraisal Report above. So this document also came through the seller.

As we have cautioned many times, do not take at face value reports and similar documents provided by the seller. Always ask for an appraisal by an independent Graduate Gemologist who examines the piece in a gem lab.

Suspicious:The Appraisal Report carried a valuation of $19,500 – higher even than the seller’s Certificate of Authenticity. But looking at the invoice, we find that the buyer paid only $6,500. It is hardly credible that a retailer would sell an article for one-third its retail value.

This immense value discrepancy suggests either that the qualities of the piece are exaggerated or that the valuation is grossly inflated.

About clarity enhancement

So we turn again to that asterisk next to the Clarity grade, denoting that the diamond is clarity enhanced. The seller discusses clarity enhancement on its website, inventing the term “feather filling” instead of using the common term, fracture filling.

The seller’s discussion says that this treatment makes the diamond “more visually appealing, which also increase[s] the value of the stone.” Not true! It would be more accurate to say the treatment makes a low-quality stone more marketable, but not more valuable.

So what is it really worth?

The insurer’s ITV (insurance to value) calculation for a natural untreated diamond of the stated qualities came to $17,935, which is very close to the seller’s declared valuation. However, a similar diamond that is clarity enhanced probably is actually of I2 or I3 clarity. It turns out that a diamond of that clarity is worth about the $6,500 the buyer paid.

So the buyer got what he paid for.

What about the valuation discrepancy?

Was the buyer deceived? The clarity enhancement wasn’t mentioned on the sales receipt or the Cert of Authenticity. It’s possible the buyer wasn’t told at all. The fact that this important disclosure was very tiny on the Appraisal Report suggests some degree of collusion between the seller and the provider of the Appraisal Report.

What if an insurer had simply accepted the $18,900 valuation? Insuring jewelry for three times its value creates a moral hazard, and it opens the insurer to adverse claim costs.

Some important points to come away with:

This is not a unique case. This kind of deception is rampant.

- Deception like this is easy for internet sellers — because buyers believe they’re getting bargains when they shop online, and auction sites like eBay reinforce that expectation; because consumers are impressed by “certificates” and don’t consider the source; and because buyers don’t get independent appraisals, or even know that they should. And the same goes for insurers who rely on such seller-provided lab reports and appraisal documents.

- The two issuers of “third-party” appraisal reports for this seller make the point that their documents “are accepted by major insurers.” No doubt this is true. But just because they “are accepted” does not mean they are trustworthy.

- A document that inflates valuation may also be inflating the quality of the stones; it should not be trusted at all.

- Perhaps another insurance company will issue coverage based on this inflated valuation. If a claim arises, they will overpay the settlement. Or, if an astute adjuster investigates that asterisk and gets a true valuation, the settlement will be much lower and the policyholder will be dissatisfied. Both the agent and the insurance company could lose all that customer’s business.

FOR AGENTS & UNDERWRITERS

All scheduled jewelry should have an appraisal from a Graduate Gemologist (GG) preferably a Certified Insurance Appraiser™.

An appraisal should be addressed to the owner/buyer of the jewelry. One that does not name the recipient is probably a “canned” document supplied by the seller.

The reliability of a lab report depends on who issues it. We recommend relying on reports only from these reputable labs:

GIA (Gemological Institute of America)

AGS Lab (American Gem Society Lab)

GCAL (Gem Certification & Assurance Lab)

Be especially wary of purchases made online. Be sure documents include an appraisal from an independent GG (not just documents obtained through the seller).

Please review our earlier issue of JII, where we discussed cautions about eBay purchases in some detail. You may also want to recommend that newsletter to your policyholders.

For new purchases, ask for the sales receipt. Compare selling price with valuation; a large discrepancy suggests an inflated appraisal.

FOR ADJUSTERS

Though enhancement sounds like a good thing, it may signal deception. Enhancements are treatments that improve the appearance of a gem, not its quality or value.

Check all documents for terms like enhancement, treatment, color-treated, clarity-treated, fracture-filled, feather-filled, laser drilled, irradiated, etc.

If the appraisal or other documents contain any terms you don’t understand, consider consulting a Jewelry Insurance Agent before settling a large claim.

If the sales receipt is available, be sure to compare the purchase price with the valuation; the purchase price is likely to be closer to true valuation. Compare all documents for qualities.

©2000-2025, JCRS Inland Marine Solutions, Inc. All Rights Reserved. www.jcrs.com